Is finance a good career path is a recurring question that has always been asked by our group, and we chose to use this article to answer it and other related questions.

Treasury is a comprehensive career path that includes both fund management and financing processes. Finance is generally divided into three aspects: individual, business, and finance.

Each of these aspects requires different skillsand thinking. The principles remain the same, and each role requires knowledge and experience in certain aspects of accounting. Procurement is required to manage funds. Financing is usually done directly through bank or corporate funding, but this also depends on the funding being processed.

Therefore, a financial career needs to not only understand accounting principles, but also a clear understanding of the best tactics for raising and investing.

High salary financial jobs are some of the most popular jobs for business school graduates because of their high salaries, bonuses and promotion opportunities

Financial Salary

A financial profession is related to significant compensation. In the United States, Finance judges can earn over$, and account administrators, finance administrators, and regard administrators can earn between$ and$, in line with Glassdoor data. For commercial enterprise academy graduates, the fee can be certainly advanced. According to GMAC, the common price for brand spanking new MBA graduates within side the economic region is$. For the pinnacle 25 of earners, this par$.

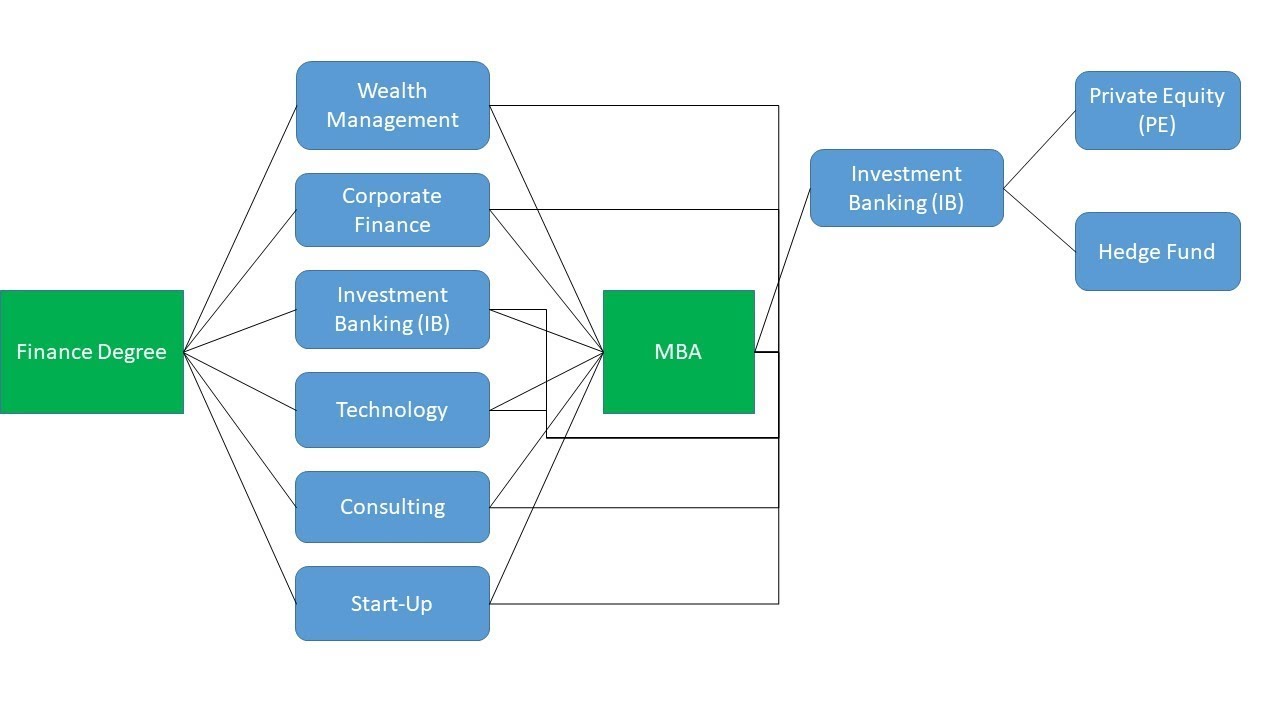

MBA Finance Jobs

Finance jobs vary, however the 3 fundamental regions that graduates start with are funding banking, business finance, and fairness or debt research.

When investigating banks and shares or debt securities, MBAs commonly percentage as associates, however the sharing of business finances is extra diverse.

“Commercial Finance can be employed as an account assistant, as a director, or immediately to a finance organization for explanation,” says David. The employers with an MBA in Finance from Cornell University encompass Bank of America, Credit Suisse, Citibank and JP Morgan. But huge banks are not the most effective employers to consider. Sustainable funding and the upward thrust of FinTech innovations have additionally created numerous new possibilities for financing. Graduates inquisitive about new technology including block chain and synthetic intelligence will gamble in regions inclusive of FinTech, Neo. banks, cryptocurrencies and crowdfunding. That’s perfect. The Sustainability-Focused Fund raised a record $ 45.7 billion in useful resource with inside the first region of 2020. This shift to sustainable funding gives graduates of green enterprise seminars an opportunity.

Financial Career Advancement

No remember what vicinity of the enterprise you enter, there are numerous possibilities for long-time period economic progress.

“Many human beings need to be portfolio managers someday, each in funding banking and fairness or debt research,” says David.

Careers in those regions normally observe a well-described structure, from friends to vice presidents to handling directors.

However, there’s no “typical” course to company finance. The maximum formidable graduate may also someday emerge as the CFO, however this is now no longer the most effective option.

“We every so often see company finance employees getting into commercial enterprise development, and inner mergers and acquisitions are a famous path,” says David.

“I’ve even visible humans step into the commercial enterprise and manage of a company. Once in, there may be a door that may be opened, and there may be now no longer continually a clean path.”

Corporate Finance Even destiny enterprise leaders, way to the extensive variety of analytical and verbal exchange abilities they develop. “Many CEOs are former CFOs,” says Catherine

Key Skills for a Financial Career

A financial career can be very rewarding, but it’s miles an area of infamous competition and can be difficult to stand out in interest seekers and interviews.

To maximize your chances of getting an economic pastime, David recommends an amazing aggregate of technical and mild abilities.

“You need at least a slight knowledge of accounting, and you need to take some courses to teach you the manner to navigate and understand monetary statements,” he advises.

“Analytical skills are also required. Treasury specialists often need to draw conclusions from big portions of data, so it’s far important that lets in you to manipulate and observe them.”

Communicating insights with stakeholders. Is an in addition important expertise and will become more and more crucial as your career progresses. “To be successful, you have were given a great manner to hold your mind and convince others that what you’re supplying makes sense,” David concludes.

When using for employment funds, it is also important to thoroughly investigate the organisation using. Employers need to realize why you want to art work in particular for them, and now no longer unusual place questions and answers aren’t feasible to keep you away within side the software program manner.

Success within side the financial region requires hard artwork and specific skills, from an exquisite expertise of bookkeeping and economic statements to analytical and verbal exchange talents.

Nevertheless, finance is a fulfilling and diverse career path, and innovation brings new opportunities for business business enterprise school graduates. A strong knowledge of FinTech and sustainability over the subsequent few years is crucial to long-term economic success.

Whether you pick out to stay within side the organization for a long time or gather capabilities to analyze elsewhere, finance is one of the top three most well-known career paths after graduation. There are many reasons.

If you want to start your career within side the economic employer, an MBA or master’s degree (MiF) gives you get entry to to the company network and expert advice whilst gaining the big sort of capabilities you need to succeed. You can join it. Ease after graduation on your method search.

Overview of the Financial Career Guide

Finance covers several regions and consists of now no longer best the operation of finances, however additionally the backing process.

Generally, falls into 3 subcategories

Particular Finance

Commercial Finance

Public Finance

Each of those orders calls for unique chops and thinking. Still, the standards stay the same, and every component calls for expertise and enjoy in positive elements of account.

To manipulate your finances, you want to elevate them. This may be finished at once or via financial institution or industrial backing, relying at the backing. Thus, careers withinside the financial assiduity want to now no longer most effective recognize counting ideas, however additionally a clean knowledge of the fashionable techniques for elevating and investing.

This financial associate is meant to provide a short assessment of

Possible Careers in Finance,

Reasons to Choose a Career in Finance,

Top Career Paths in Finance and

Jobs to Get.

This associate additionally offers heritage facts on instructional programs literacy, and expert qualifications

Finance Career Pros and Cons

| S # | PROS | CONS |

|---|---|---|

| 01 | Excellent salary. It is a well-known fact that people who deal with finance make a lot of money. | Lots of stress. As mentioned earlier, this job requires tight deadlines and high pressures. |

| 02 | Various possibilities. When many people think of financial work, they first think of accounting. Other carriers include banks, hedge funds, financial analyses, and registered agents. Each has its own educational niche and benefits you can enjoy | Meet the delegation. Part of the source of this stress is related to the allocations that companies continue to allocate by the deadline. As a financial analyst, you are also a partial seller as you are always looking for new customers. |

| 03 | Use your critical thinking skills. Critical thinking is essential to any job in the financial industry. However, this innate ability is incredibly rewarding. | Continuous training. When you get a CFA, you haven’t done it yet. In a changing market, you need to constantly acquire new knowledge. This can be positive for some and negative for others. |

Why choose a fiscal career?

Careers within side the financial assiduity provide excessive hires and rapid-hearthplace profession relinquishment after scale. For illustration, the United States Bureau of Labor Statistics estimates that the range of jobs for monetary judges will growth via way of means of in addition than 12 through 2024, nicely above maximum Orders.

For person tax accountants, ■■■■ over the equal duration is near 30, so there’s no scarcity of positions for everyone interested by a profession as a tax accountant, specially withinside the United States. Financial operations are developing similarly or hastily withinside the European and Asian corridors, exceeding maximum due diligence requirements. And jobs are in particular appropriate for human beings with strong backgrounds and expert qualifications. Financial popularity is an crucial organizational function, now no longer most effective an investor on Wall Street, however additionally an inner income center. List of Financial Services Providers Investment banks are aggressive and feature numerous subsidies, so maximum humans have heard approximately funding banks, however they could assist banks or provide emotional charge packages. Apart from doing. Not all and sundry is aware of that there are a extensive variety of economic offerings providers. Some tax profession paths have the identical capabilities as an accountant, however the secretary is absolutely a part of the activity, however with a focal point on funding and funding in preference to spending money. ■■■■. It is apparent that it become placed. The preferred history of the monetary funding banking enterprise is as follows.

Financial critic

Financial adviser

Portfolio director

Investment banker

Financial adviser

Threat director

Credit critic

Many others Finance: But growing older typically receives a task It takes greater than two times as long, so long-time period sweating is needed for crucial profession development. Treasury Judge All Treasury Judges examine tax records. Nevertheless, this role relies upon significantly at the affiliation and enthusiasm. The Internal Tax Judge will do the following: • Analyze the tax statistics of the organization and its funding.

Look for tax issues.

Run the brand new layout range.

Perform advert hoc reviews and analyzes. The quantity of tax judges in an funding employer

View tax statistics for outside agencies making plans to invest, buy, or sell. This calls for a entire knowledge of the specific kinds of organizations within side the enterprise and the way and why investments are made

Financial Advisors or Advisors

Financial advisors or advisors typically cooperate with you regarding the financial position of a company or individual. Most counselors or advisors focus on specific offers to differentiate them from others. We can provide possible advice on topics such as tax, investment, and insurance decisions.

Personal Financial Advisors or advisors, can work closely with clients to provide personalized financial advice and guide them in buying and selling stocks and bonds on their behalf. Some financial advisers work for large banks, but many work for smaller organizations.

When financial advisers work for a consulting firm, they often focus on the financial needs of a particular company or industry, such as a hospital.

Start your career in finance

Get the right degree

You might think that you don’t need a degree to get a job in finance, but you’re wrong. A bachelor’s degree is currently a minimum requirement for almost every financial company. Choose your degree and university carefully, as some companies and banks limit recruitment to specific universities.

Make sure that the university you choose has a solid reputation in the financial industry as a business school. When moving, make sure you have a strong presence at a recognized university in your area.

Science and Engineering programs are popular outside the United States, but undergraduate degrees must be accompanied by additional financial education. Obtaining a Master of Business Administration (MBA) is the most common and direct method.

MBA

is also a requirement for finding a job on Wall Street.

Exercise

As you could see, the monetary region is a numerous enterprise and there are numerous possibilities to research on this enterprise area. Graduates can discover jobs in accounting, finance, education, sales, banking, and monetary advisory. The listing of profession possibilities is endless.

Most corporations want a person with an analytical thoughts who can study and interpret monetary records and bring outcomes and recommendations. During your apprenticeship, it could take years to make a decision, however make certain to analyze which kind of labor you discover maximum interesting. Ultimately, one factor of finance wishes to be targeted on, as

specialization is the excellent method for a protracted and a success profession. Obtaining one or greater expert qualifications which include Chartered Financial Analyst® (CFA), CharterMarketTechnician® (CMT), Financial Risk Manager (FRM) will assist you emphasize and improve your profession.

Build a profession in finance

After completing secondary education, it is time to discover a task. Remember, it is now no longer simply what you know, it is the character you know. Therefore, attend meetings, task fairs, education seminars and different networking occasions to set up and use private connections.

Try to benefit your first expert enjoy thru an internship to similarly differentiate yourself. You might imagine it is too early to get began out however getting a expert qualification may be a dramatic assist on your first process after graduation.

You appear to have completed reading at school, however you’re simply getting commenced. Successful humans in no way prevent learning.

Financial Certifications and Licenses

Employers are presently seeking out candidates with extra qualifications to show that they have got the important abilities and know-how to focus on finance. Professional qualifications are taken into consideration an extraordinary manner to enhance the area and make sure that applicants have the fundamentals to get the task carried out proper from the start, as coaching techniques and substances range from college to college.

Why to Choose Finance as Career?

Considering pursuing finance as a profession? Here are 10 motives so one can show that finance can be the appropriate desire for you.

A Broad Field of roles and Specializations

The economic area is huge and so are the numerous alternatives with regards to selecting a profession in finance. Financial jobs and careers cowl to encompass the entirety from counting and cash control and economic control, to make investments chance control, banking or even tax.

High Earning Potential

Careers in finance offerings pay a great deal greater than different fields, with a number of the most paying access degree positions. If you figure tough early on, you could swiftly make substantial strides ahead on your profession and revel in a sizable ■■■■ in pay.

Narrow Focus

If you’re interested by a commercial enterprise profession you then definitely have a big variety of university diploma alternatives together with control, accounting, or commercial enterprise. One great item to emerge as a finance main is because of its miles the greater slender cognizance, however it nonetheless allows you to discover a area that is lots of task opportunities. A finance diploma offers you to paintings with selection makers of outer groups together with authorities’ agencies, provider agencies, stakeholder suppliers, financial institution and greater. Being cap in a position to distinguish yourself with a finance diploma will help you while attempting to find jobs, specifically from a big of commercial enterprise majors. As a finance diploma is more difficult to reap, it’s miles confident to set you apart.

Personality-Driven

Anybody can achieve a commercial enterprise diploma or do accounting, however which will be in a finance profession, you ought to be intrusive. However, you’ll require being properly at mathematics, you furthermore might ought to be properly and speak to me with humans and making pleasant dialogue on a variety of subject. Hence schooling, personality, and intelligence are all taken into taken into consideration for finance jobs. You ought to be discreet & assume via your corporation`s goal, alternatives, and sources while speaking with their alternatives for economic growth.

Lots of profession alternatives

The economic zone is numerous and complete of numerous profession alternatives for specialists. There is a huge form of specializations you may reap to cognizance in on one segment of the economic zone. It affords numerous profession opportunities. With a finance diploma you could paintings in:

- Investment offerings

- Corporate control

- Insurance corporations

- Credit unions and personal banks

- Financial making plans offerings

- International economic control

- Brokerage companies

- Credit unions and personal banks

Finance is complicated area a person without the right expertise and revel in to navigate. For example, running as a economic advisor you’ll have the possibility to paintings with humans and still have an possibility to assist them to make the proper funding and economic choices.

Job protection

Job protection could be very essential in any profession. Finance is an in-call for occupation. Positions on this area are typically secure. For the cause that finance is essential to life, there are numerous task alternatives are available. This permits you greater freedom to interchange cities, corporations, etc. in case you are feeling such as you need a brand-new challenge.

Challenging profession

A task in finance isn’t always precisely simple. It takes brainpower, tough paintings, and schooling to be successful. Because it’s miles an intellectually stimulating area, it is able to be very profitable with inside the lengthy term. If one works tough and placed on themselves early of their profession it does now no longer take lengthy to transport up with inside the ranks, so a selected can earn greater and face new obstacles. So, whether or not making a decision you need to transport right into a distinctive corporation circulate laterally with inside the finance industry.

Your abilities are treasured and Transferable

The expertise, abilities, and revel in you benefit in a single economic area can help you now no longer simplest on your private finance and economic making plans. A qualification in accountancy, for instance, can will let you specialize within side the area and additionally opens up doorways in different economic fields like economic control, cost, and control accounting, inner auditing and credit score manipulate etc.

A variety of corporations and commercial enterprise to paintings for

Finance is part of each corporation, commercial enterprise, and organization. This is a superb possibility to for economic specialists and people pursuing a profession in finance as there are few limits located at the kind of commercial enterprise or organization you could paintings for. While you could paintings at a organization that specifies handling the price range of different businesses, you could additionally locate paintings withinside the inner finance departments of groups and corporations. Nowadays, opposition for jobs can be very excessive however as soon as to procure settled in economic zone it is able to offer you a profitable profession. As the economic zone is a huge and spanning zone as numerous as actuarial, banking, insurance, and regulation. In every of those sectors, there are a huge form of divisions that scholars can adopt. These are a few motives that would do not forget you to pick out finance as a profession.

Summary

**

When it comes to careers in the financial industry, there are countless opportunities to increase as you gain more education and work experience. Finance has three major industry categories: public, corporate, and individual. From financial planning to investment banking to insurance, those seeking a career in the financial industry will invigorate the world. A Bachelor of Science in Finance is the first step in unleashing the potential of a financial career. The article describes distinctive varieties of finance degrees, finance careers, corresponding salaries, and finance diploma skills.

**

Frequently Ask Questions

Q1. What is the best career in finance?

Here are the highest paying finance jobs:

- Investment banker. National average salary: $61,929 per year. …

- Information technology auditor. National average salary: $63,412 per year. …

- Compliance analyst. …

- Financial advisor. …

- Insurance advisor. …

- Financial analyst. …

- Senior accountant. …

- Hedge fund manager.

Q2. Is finance still a good long-term career?

Over the past few years, the short-term prospects of finance jobs have improved, but the long-term outlook has worsened. … By “short-term,” I mean roughly 3-5 years. In other words, enough time to work in an entry-level role such as an IB Analyst and then get promoted or move to a buy-side job.

Q3. Does finance have a future?

According to the International Monetary Fund, rapid shifts in the workplace and the financial industry necessitate life-long learning: … The future of finance is rich with possibilities for those willing to seek and create new opportunities to thrive.

Q4. Is a finance career worth it?

It’s not always easy and may take time. But for the right position, it is definitely worth looking into! Not only is working abroad an advantage for finance majors, but so is starting your own business. If you have the entrepreneurial drive in you, a finance degree can be an advantage.

Q5. Is finance a growing career?

According to the U.S. Bureau of Labor Statistics, financial analysts are on track to grow by 5% between 2019 and 2029, which is faster than average for all occupations. People in this job analyze financial statements and histories to help determine whether a line of credit should be extended.

Q6. Do finance jobs pay well?

Finance can be a fiercely competitive field to break into. After all, it’s a famously high-paying industry known to pay six or seven figures in salaries and bonuses for those at the top. Even those on the bottom rung can expect to start at a good wage compared to other fields.

Q7. Why finance is the best career?

A finance job always keeps you on your toes to consistently expand your knowledge and reach heights in the career. … Financial firms put more emphasis on accomplishments than seniority. Opportunities for faster career growth indicates why finance is preferred by young professionals.

Q8. Is a career in finance stressful?

In India, some of the most stressful jobs include that in the banking, finance, IT, construction and medicine sector. If you’re at the cusp of making a career decision then think twice about the field of work you want to get into.

Q9. Are finance jobs in demand?

According to the Bureau of Labor Statistics, employment for financial occupations is expected to grow 10 percent by 2026, introducing more than 773,800 new jobs to the marketplace.

Q10. Are finance jobs hard to find?

Landing a finance job with just a bachelor’s degree isn’t impossible but is highly competitive. When the stock market is booming, finance jobs ■■■■ as well. But when returns dwindle, so do the listings and openings. Of course, even when the market is flush with jobs, they’re not all jobs that you would want.

Conclusion

**

Treasury is a commonly used term to describe two activities. The first activity involves learning how to manage finances and money. The second part contains the process used to raise funds. Finance defines the money, credits, investments, liabilities, asset management, research, and research of those financial instruments that make up the financial system. An area with great revenue potential and rewarding career opportunities in a variety of industries. Careers in the financial industry are also one of the best ways to work in foreign markets. Compared to other industries, the financial industry has a lower priority in assessing employee motivation for promotion.

**

Is finance a good career path? You need to first acknowledge that there’s no straightforward answer to it. As for career choices - it’s always about what works for people individually.

A career in Finance does merely depends upon your interest in it. Are you well aware of the paths that it may lead to? or do you know it well adequately to pursue a whole career with it? There should be no space left out for such questions, as you may not want to regret holding a degree with what you want to do absolutely nothing!

If you want to see whether finance fulfil all such blanks for you, then keep on reading below;

1.1 What should you know about Finance?

The very basic concept of Finance revolves around the acquisition and management of money. If I give you a task “to think about starting a business”, what do you think would be your first need? Yes, money for sure.

No business or day-to-day affairs can be settled down without it. Finance is the fixed need for the society.

There are numerous career paths in Finance, but before turning towards them, we must take up the direct-route to understand its main structure and how financial job-posts come into existence.

What are the main components of Finance?

Finance is covered by three areas and components. These areas facilitate different public and private organizations. They are as follows;

- Public Finance.

- Corporate Finance, also known as “Investment Finance.”

- Business Finance, also known as “Sales and trading.”

1.2 What is Public Finance?

Public Finance is a government activity. It involves financial processes that build Finance for government entities. Anyone who chooses it as a major subject of the degree or planning to craft a career-path across it should know, that it involves financial management of governmental institutions — they are those public sectors, agencies, organizations and projections that run through the state itself.

These can extend to the fund’s management of cities, towns, public sectors with having the following examples as a practical part;

-

Roads projects and infrastructure (Construction works, Bridges and tunnel management, Public transit systems, municipal water systems, garbage controlling system, parks and other mega projects)

-

Defence, purchasing weapons, conducting law and order

-

Social sectors like education, health care, pensions and housing.

Financial funding & management in Public Finance:

Financial funding & management in Public Finance:

You’ve already learnt the concept of public finance above - now further you’d need to be enlightened with the procedure of money acquisition and management. How is Finance funded and managed in public Finance? Let’s learn it in detail.

How finance is funded in Public finance?

Tax collection: As Public Finance includes, collection of funds to fulfil the needs of government — The practice is usually done through imposing taxes, I.e., Income tax, Sales tax, Property tax and Freight taxes (Import and export). Financial managers look-after this system.

Exempted securities: Government with the help of Investment banks, issue federal tax-exempted securities such as municipal bonds. Public invest in government securities and get “interest” every year over their investment. These exempted securities raise the fund.

Investment banking: Investment bankers help government sectors and corporations to raise fund by issuing corporate bonds and stocks. The citizens buy such stock & bonds, through which capital is raised.

How finance is managed in Public finance?

For the departments mentioned above, there need to be people who handle the money or capital once it’s raised - to help the government work well. There is a whole team of financial managers, accountants, financial controllers, risk manager who help the public financial management cycle to complete. Every fiscal year the budgets, accounts and controlling factors are managed through human-capital.

What career can you choose with a major in public Finance?

-

Chartered public finance accountant (CIPFA)

-

Municipal Investment banker

-

Other small roles relating to financial management. Please read Point 1.6 - to know more about these roles in detail.

1.3 What is Corporate Finance?

Corporate Finance is an organizational activity. It refers to the management of the organization’s finance in a long-term manner — keeping its interest foremost. Here it would help, if you keep in mind that big organizations’ focus remains intact on their brand equity. They want to increase the shareholders’ wealth.

Corporate Finance deals with the financial management of large national and multinational organizations. It’s not easy to do the task. Despite that, are you aware of how Finance is raised and managed in Corporate Finance? Read the next point.

How finance is funded in Corporate finance?

There are two main sources through which Finance is funded in the organization.

Internal factors: Owner’s Equity is the way of raising money in the organization, i.e. Initial public offering (IPO), Shares, Sale of stock (Goods that the organization manufacture), return on investment and retained earnings (the amount left after profit distribution)

External factors: Debt or borrowing is another way of raising funds in the organization, i.e., bank loans etc.

How financial is managed in Corporate finance?

Once Finance is raised in the organization, it is then invested to increase shareholder’s wealth. Corporate Finance is supported in the current asset (other big ventures etc) and fixed assets of the company (buying plant, machinery and mandatory fixtures).

Careers that you can choose with a degree in Corporate Finance:

What career prospects do you have with a major in Corporate Finance?

There are many smaller and bigger roles that you can opt for with a major in Corporate Finance see point 1.6, but the most prominent one is that of a Financial manager.

Summary: An organization raise finance through borrowing money or selling its shares and stocks. It does add in money by receiving a return on investment and the amount left after profit distribution to all the shareholders. At the same time, it manages its Finance through investment.

Interesting topics:

What is Finance?

What is Debt financing?

1.4 What is Business Finance?

Business finance is a smaller business activity. Sole proprietorship or partnership is an example of small businesses. Here the financial funding and management are different and easier than that of bigger organizations, i.e. It is easier than that of Corporate Finance.

So, does it all done? Follow up

How finance is funded in Business Finance?

In Business finance, money can be funded through the sources of the owner itself. The owner(s) of the business bring forward with a set amount of Finance and start the business. Besides a second option is considered as well — debt borrowing.

Finance can be added by borrowing it from institutional and non-institutional sources. Institutional sources refer to banks, investment companies, specialized credit institutions, and non-institutional authorities include friends or relatives.

How finance is managed in Business finance?

After the required Finance has gathered, it then is invested to buy fixed assets (Plant, machinery, building) and Working capital (Raw material, advertising, expenses and repairs). Once the business is structured and start selling goods, the finance managers keep managing the working capital; it pushes the company to run forward. Financial reports such as income statements, cash flow statements, profit or loss statements and balance sheets are managed.

What careers can you choose with a major in business finance?

There are whole a lot of careers that you can choose with a business finance degree such as business planner, research officer, cost estimator, financial analyst and many other. Read point 1.6 for all the details.

Summary: Business finance refers to the Finance that helps smaller businesses or organizations run. It is funded in by owners themselves or borrowed by lending organizations. Money is managed in business finance through employees; who keep checking the financial reports and sell off the stock.

1.5 Details about the Career paths for finance majors:

1. Actuary:

Actuaries are those professionals who evaluate the livelihood and severity of the risk through their historical, mathematical, statistical, economic and financial knowledge. Business needs such people to prevent upcoming risks. A person who has a degree with a major in finance can apply for actuarial jobs - though the field itself is called Actuarial sciences.

Actuaries are best suited for careers in corporate finance. Besides, the candidate needs to give actuarial exams and earn an internship certificate to have the edge over other candidates.

2. Financial Analyst:

Keep it public or private corporation; Financial analysts are the supreme need. They use their research tactics and all the possible knowledge of securities altogether to advise the relative organization regarding their investment decisions. They sense the prospect risk and approve or excuse to invest in stock, bonds and other investment securities.

They also foresee the companies’ ability to repay their debts with the inclusion of bonds. A person with a finance degree can apply for the position of a financial analyst. They are also called research analyst, investment analyst and rating analyst.

3. Financial Accountant:

Financial accountants mainly deal with the company’s financial statement such as balance sheets, profit or loss accounts, income statements, cash flow statements etc. They keep a check on the organization’s reports. They do all the transactions-recording and accounts-ending process. How a certain amount of cash flowed into a business? How much has the company invested on certain projects? What’s the overall profit? All such inquiries are made and recorded by financial accountants.

They are best suited for all three major financial areas: Public finance, Corporate finance, Business finance. Besides, they also compare corporate practices with legal and economic standards. A finance degree holder can opt for this field.

4. Financial Advisor:

All the governments and corporate institutes need people who give consultations about their financial decisions. Financial advisors provide special advice regarding how their clients can manage the organization’s cash flow efficiently and what corporations, sectors and products will be best suited for them to invest in. People with a finance degree can apply for this job.

5. Investment Banker:

They help the Government and Private sectors to issue debt and securities. Investment bankers also advise about transaction decisions relating to mergers and acquisitions. This is a high paying job which initiates with a six-salary figure. Being a lucrative and fancy job, it is highly well-versed and demanding. A person who has studied finance as a major subject can opt for this career.

6. Audit Manager:

These managers verify the financial accountant’s work by conducting an internal audit. The audit is done by following the company’s policy and plans. The system of conducting an audit is different for various companies. Audit manager’s main duty summaries to check the financial and operational balance. They ensure that the company is not following any illegal practices mistakenly or the finance has not been misplaced due to dishonesty.

A finance degree-holder can apply for this job, but without certificates or chartered accountancy as a major – it becomes difficult for larger companies to hire fresh degree holders. Mostly, common financial accountants get to this position with experience.

7. Tax manager:

Tax managers are responsible for creating plans relating to tax management. They implement and review the agenda so that the organization remain good in terms with its operation. They do it by creating and analyzing the necessary tax related documents, rechecking its accuracy and recommending certain amendments or practice to the organization.

Tax managers verify and handle the tax reporting system of the organization. A person with a major in finance can apply for the post. The hiring is made based on previous experience most prominently as a tax manager or a financial accountant. Mostly, people after working as accountants - gain optimal Knowledge of accounting, tax management and finance. They then apply for the role of tax managers.

Interesting topics:

What is Financial analysis?

What is a Financial system?

8. Security Trader:

Security traders work as a bridge between the security buyer and purchaser. They help to sell securities like share or bonds to the potential buyer in a financial market. For each deal, they earn a little amount of money. Sometimes the amount earned is in pennies, but if constant effort is made and activity is resumed then through bigger deals, the higher amount can be attained. People who have a financial background can opt for the profession.

9. Sales Manager:

Sales managers are mainly managers who are in charge of predicting total sales and making plans to improve the sales volume of the company. They also implement those plans and create sales budgets within which all selling processes —such as marketing and advertisements — need to face the edge.

Sales managers are the need of all the profit-making companies. This career path can be chosen with a degree in finance. The sales manager can start with an internship or from the basic career lines within sales management, such as customer relationships builder.

10. Customer Relationship Builder:

Customer Relationship builders are responsible for helping a corporation generate sales. They bring in customers through their interactive services. They are highly persuasive and possess professional communication skills. Relationships builders at the lower hierarchy level are a part of sales management. A degree in finance can also make a person eligible to go for the field.

11. Operation manager:

Through, it is a field of management, yet people who have studied finance can choose to be an operation manager. An operation manager makes operational strategies about the production of goods. All the processes that take place in it are covered by an active manager. They manage the process of manufacturing, finalizing goods and hiring employees; such as workers, daily wage labour. They also are in charge of budget controlling activities.

12. Market research analyst:

Market research analysts are those, who conduct research and gather qualitative and quantitative data about the customers’ needs and wants. They help you with launching your new product-line or improve the sale volume of the existing one. People who study finance can choose to be a market research analyst.

1.5 Why finance is a good career choice?

Pros: There are four main reasons for finance being one of the optimal career choices one can make. Let’s read why is it that so?

1. It is a lucrative profession:

Although, most of the career paths in finance demand to work as a low paying internee or even at times — an unpaid one. Gradually, once you attain a necessary skill-set and learn to evolve in the field’s environment — promotions can uplift your position as an employee. People who work in the the finance field are enjoying 6 figure salary after good years of hard-working. It depends what’s your experience level and who you’re working with. If you’re looking to have an ingrained lifestyle, thdn finance is the one good option for you.

| Job Benefits | |

|---|---|

| Increments | |

| Bonuses | |

| Incentives | |

| Job Security |

2. There is no edge to it:

People who studied finance and chose it as a career, sooner or later gather enough expertise to take charge of themselves. In case of not wanting to resume their jobs, they can set up a small business of their own. Finance does not restrict a person to take up 9 —5 jobs throughout their lifetime; it encourages and wipes off the way for its mates to take individual steps and ride the horse themselves.

| Diversity | |

|---|---|

| Profession | |

| Business | |

| Services |

3. it has an ■■■■■■■■■ of different fields:

It is not necessary to work as a banker. When we hear the word ‘finance’ many misconceptions aim to hinder our way to the truth. People often relate finance with banking — which is true in a sense— but that’s not the whole truth. People who want to study finance can also work in other related fields.

| Financial Jobs | |

|---|---|

| Financial Advisors | |

| Financial Managers | |

| Financial Analyst | |

| Financial Accountant |

Though finance is the study of money management but a student - along with it - learn a variety of different subjects such as Accounting, management, economics and Insurance. People can turn the routes and drive to any other field that they had studied during university times. Besides, finance gives the whole a lot of options within its grounds.

All of the fields, as mentioned above are inclusive of specific career-lines such as, for Financial managers there are finance executives, finance deputy managers and finance deputy directors. The hierarchical system goes well with all the fields. Besides, other related areas are as follows;

| Non-financial Jobs | |

|---|---|

| HR manager | |

| Operational manager | |

| Tax manager | |

| Sales manager | |

| Insurance sales manager |

4. It’s a promising field:

It can be observed that how financial managers serve benefit to all of the organizations and how without them, nothing can reconcile. With the outrage of new technology and management, many systems and professions vanished. Youngsters and teenagers are highly confused with their career choices, as what they’ve chosen now, would be replaced tomorrow by a computer system or a robot. Finance is truly a profession, which will never be outdated. No matter how accurate and faster a computer system work, still it needs validation from a human at the end of the day. Stock markets are highly activity places; businesses are running, corporates are busy managing their brand-equity and profits and trade is normally happening there. Could that ever stop? It’s not yet predicted.

Related Topics:

What are Financial assets?

What are Financial sectors?

1.6 Why finance is not a good career choice?

Cons: There are four main reasons for it to be not suitable as a career path. let’s learn them one by one.

1. Finance is a life drenching career.

One who chooses this field must compromise with all the non-materialistic activities and bonds. There are these beauties of life that need proper time and attention but gets traded off under the anxiety of financial profit or loss, i.e., Family time, passions, worship, volunteering charity work etc. If you choose it as a career, there’s a high possibility that you won’t get time for yourself or to do other important stuff.

2. It makes you an obedient cog.

If you like it that way then it may be good for you - however, it’s unhealthy for general human growth. A man is not made to work like a machine throughout life and say ‘goodbye’ when he must leave the world. Instead, he must explore himself, connect with the purpose of life and find an objective that benefits him and ultimately, the whole humankind. There are other fields which serve the purpose i.e, History, Philosophy, Astronomy, Science etc.

3. It works against your interest.

Once you get the job, all of your interest gets replaced by the company’s interests - That’s all how you’d be working like! It’s a highly demanding field. After reaching a certain milestone, you’ll not find your responsibilities getting easy on you. In most of the companies, senior employees make their office’s “their homes”. When in 2004 google opened its Initial public offering (IPO) it demanded 20% extra time of its employee sparing with the normal job schedule. Although, it was a special case yet that’s the common story of the industry.

4. It’s a dry subject!

If you don’t enjoy mathematics, statistics and other analytic activities, then it’s better if you look for alternatives. In finance, you’ll be dealing with accounts, financial reports, financial analysis, Swot analysis etc.

1.7 What should be your stance?

The world is evolving. There are a thousand new fields that are being born in this modern age, so are a thousand areas that are going outdated. Choosing a career is not same as picking up a favourite dress, rather it’s about choosing a whole lifestyle. Someone said it right that “Choose a job and a wife wisely, for they are those who you’ll be spending the rest of your life with.” If you’re comfortable and love doing what you’ll be doing in a specific field, go for it only then.

We’ve defined finance well enough for you to make a choice. Indeed, in the end, you’re the one who has to make a decision. Everyone struggles once they step into a job-market, the stress should not instruct you for running towards the things that seem like glitters - “for all the glitters are not gold”.

FAQs:

1. Is it hard to get a job in finance?

Honestly, it’s a tough task. Financial markets are highly competitive industries, but that does not limit the hiring process. Thousands of commercial jobs are offered every year relating to finance, but it’s always the skilled people who get the job. People with good credibility are accepted for a financial position. It is better to build a strong cv and gain some experience along with studying finance.

2. Is finance ■■■■■■ than accounting?

No, it’s not ■■■■■■ than accounting. In fact, accounting is not ■■■■■■ too. Finance is about money management, whereas Accounting is about book-keeping and interpretation of the financial data.

Both come with different perspectives. If you’re a person, who enjoy analytics, then accounting may seem a bit tough, besides that, if you enjoy mathematics and calculations, then accounting can prove to be best for you.

3. Is a career in finance stressful?

Yes, it is stressful, but those who enjoy their work in the field develop different viewpoint for it. It solely depends upon the nature and level of your job within the walls of finance as each milestone hit differently with all its responsibilities and workload.

4. What is the best career path for a finance major?

The students with a finance major can choose different career paths. They may fit in any organization for a variety of roles, but they are suggested to begin the career hunt in the following directions;

- Bank Jobs

- Corporate Jobs

- Teaching Jobs

The Final Word

This article is rather a detailed discussion to help you make a decision relating to your career choices. A few brainstorming techniques have been used. Is finance a good career path? Is it really good for you? We’ve explained all the prospects, advantages and disadvantages. Now, the table has turned to your way. Evaluate your abilities, contemplate upon your interests, explore other fields and then come to a conclusion. A very best of luck to you.

Related Articles:

- What is Financial Accounting Software - Things you Need to know

- Financial Accounting in Business: Resonsibility and Necessity in Society

- What is Finance? How does it work?