Investment banking is a section of a bank or commercial institution that gives subscription assistance to states, corporations, and organizations.

Investment Banking:

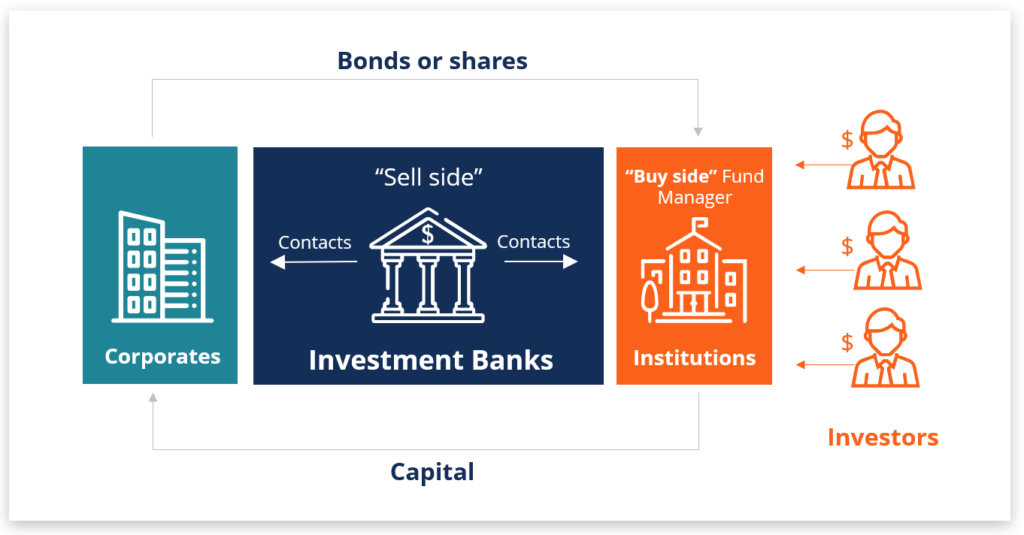

Investment banking could be a department of a bank or establishment offers that gives that has} consulting services to governments, companies, and establishments that provide consulting services relating to underwriting (capital raising) and mergers and acquisitions (M&A). Investment banks mediate between investors (who have the cash to invest) and corporations (who want capital to develop and manage the business). This guide explains what investment banking is and what the particular business of investment bankers is. An investment bank could be a monetary services company or business unit that may advise individuals, firms, and governments on financial transactions. These banks historically related to company finance can facilitate register financial capital by registering customers with investment banks or acting as investment banks agents. you’ll be able to conjointly assist companies concerned in mergers and acquisitions (M&A) and supply different services appreciate market creation and stock mercantilism. monetary derivatives trading and FICC services (fixed financial gain instruments, exchange transactions, and most investment banks have extremely proficient brokers. As an industry, the wealth management department and investment analysis of its traders are divided into Bulge Bracket (top), Mid Market, (intermediate), and boutique markets (unlike commercial and retail banks, investment banks do not accept deposits. The Glass-Steagall Act came into effect in 1933 and was repealed in 1999. Including G7, Wo Volckers “Dodd-Frank-Wall Street Reform and Protection Act of 2010” (Dodd-Frank Act of 2010) has not supported the institutional isolation between banking services and commercial banks, “F” or " “Buyer”. “Seller” includes the use of cash or other securities (such as income) for securities transaction correction, market creation) or securities promotion (such as B. underwriting, research, etc.). Purchase includes providing advice to companies that purchase investment services. Private equity funds, mutual funds, insurance firms, mutual funds, and hedge funds are the foremost common shopping for institutions. Separate screens can even be accustomed divide investment banking into public and personal functions. personal details can not be publically disclosed, whereas public domains appreciate securities analysis modify publicly accessible information. The u. s. should be an authorized agent and controlled by the United States of America Securities and Exchange Commission.

What does investment banking do?

Seldom, there may be interference within an investment bank and the bank’s investment banking (IBD) field. A full-service investment bank provides a wide range of services including underwriting, mergers and acquisitions, sales, and transactions. As well as wealth analysis, wealth management, retail banking, and retail banking. Investment banking specializes in underwriting and consulting services in the field of mergers and acquisitions. It assists the central market or “new capital”. Note 3: Purchase and retail, join the customers and dealers of protection on the secondary business.

Investment bank underwriting services:

Underwriting is that the method of raising funds by commercialism stocks or bonds (such as initial public offerings or initial public offerings) to investors on behalf of an organization or different organization. they have the capital to work and develop their business. Bankers facilitate them get the cash by selling the corporate to investors. There are typically 3 sorts of subscriptions: Firm commitment: The subscriber agrees to repurchase all shares and assume full money responsibility for the unsold shares. you’ll issue several shares as attainable at the in agreement issue price, however, you can come back the unsold shares to the institution with no money responsibility. All or all: If all publications can’t be oversubscribed at the asking price, the group action are off and also the exhibiting company can get nothing.

M&A advisory services:

M&A advisory services (M&A) help companies and institutions find, evaluate and complete the process of business acquisitions. This is the basic function of online banking. The bank uses its vast network and connections to find opportunities and negotiate on behalf of customers. The banker recommends that both parties to the M&A transaction represent the “buy” or “sell” of the transaction.

Bank customers:

Investment bankers provide financing and M&A consulting for a wide range of customers. These customers are all over the world. The clients of investment banks include:

1: Government-Investment banks cooperate with the government to raise funds, trade, and buy and sell Crown Corporation.

2: Company-bankers work with public companies and private companies to help them go public (IPO), raise more funds, develop businesses, make acquisitions, sell business units, and conduct research on their own and in general.

3: Institutions-Banks cooperate with institutional investors. Institutional investors manage the funds of others to help them trade stocks and conduct research. They also work with private equity companies to acquire and exit portfolio companies through sales to buyers or through IPOs. sentence.

Investment banking abilities:

operating in automated trading needs a lot of economic modeling and evaluation. Whether it is underwriting or mergers and acquisitions, bank analysts and partners spend a lot of time building financial models in Excel and using various evaluation techniques to provide customers with recommendations. The investment banking business requires the following skills:

1: Financial modeling-to conducts comprehensive financial modeling activities, such as the establishment of a three-statement model, discounted cash flow (DCF) model, LBO model, and other types of financial models.

2: Company evaluation-using various evaluation techniques, such as comparable business analysis, case studies, and DCF analysis.

3: Presentations and presentations-create PPT presentations and presentations from scratch to introduce ideas to potential customers and attract new business (see CFI technical manual course).

4: Transaction documents-prepare documents such as Confidential Information Memorandum (CIM), investment advance payment, payroll, confidentiality agreement, data room creation, etc. (please refer to the free CFI transaction template library).

5: Contact management-complete strong activities with being consumers and assure that clients are contented with the help they give.

6: Sales and business development-keep meeting with potential customers to come up with ideas, provide support in their work, and provide value-will eventually lead to new business recommendations.

7: Negotiation: It has become an important factor in the negotiation strategy between buyers and sellers in the transaction, and helps customers maximize their value.

Vocations in Investment Banking:

It is very difficult for investment banking to enter electronic banking. There are many more applicants on Wall Street than there are vacancies, sometimes as many as 100:

You also want to see a sample of our real-life investment bank interview questions. It is also helpful to take financial modeling and assessment courses to prepare for the interview. (From elementary to advanced) Internet banking:

- Analyst

- Assistant

- Vice President

- Director

- CEO, Vice President or other special functions

What are the major investment banks?

The major banks, also known as major investment bank-backed banks, are:

- Bank of America Merrill ■■■■■

- Barclays Capital

- Citi

- Credit Suisse

- Deutsche Bank

- Goldman Sachs

- J. Morgan 8: Morgan Stanley

History Of Investment Banking:

Early history:

The Dutch East India Company was the first company to issue bonds and stocks to the public. It is also the first company listed on the stock exchange and the first company listed on the official stock exchange. Lay the foundation for modern investment banking.

Additional development:

Over the years, investment banking has evolved from a partnership company focusing on securities subscription, initial public offering (IPO) and secondary market issuance, brokerage services, and mergers and acquisitions to a full-service company. This includes securities analysis, real estate transactions, and investment management. In the 21st century, leading independent investment banks such as Goldman Sachs and Morgan Stanley filed documents with the SEC reflecting three product categories: investment banking (mergers and acquisitions, securities underwriting and advisory services), assets Management (sponsoring mutual funds), and core business and investment. (Mediation). -Brokerage activities, including proprietary account transactions (“broker” business) and brokerage transactions (“broker” business). In the United States, commercial banking and investment banking were separated by the Glass-Steagall Act, which was repealed in 1999. The termination has directed to the development of more extra “universal banks”. Therefore, through acquisitions and recruitment, many large commercial banks have created investment banking divisions. Major well-known banks that have invested heavily include JPMorgan Chase, Bank of America, Citigroup, Credit Suisse, Deutsche Bank, UBS, and Barclays.After the 2007/08 financial crisis. With the passage of the Dodd-Frank Act in 2010, the regulations restrict certain investment banking operations, especially the Volcker Rules restrictions on self-pay transactions. Percentage of revenue. As early as 1960, Merrill ■■■■■ generated 70% of its revenue through transaction fees, while traditional investment banking accounted for 5%. However, Merrill ■■■■■ is a relatively “retail company” with a larger network.

Organizational formation:

The main activities of investment banking:

Investment banking is divided into front-end, mid-range, and back-end. Large investment banks that provide services provide all business areas for buyers and sellers, while small investment companies focus on sellers, and small investment banks and small stockbrokers focus on investment banking and sales. Trade/research. Investment banks provide services to companies that issue stocks and investors who purchase stocks. For companies, investment bankers provide information about when, where, and how to buy securities on the open market, which is very important to the reputation of the investment. bank. Therefore, investment bankers play a very important role in allocating new securities.

Headquarters:

Headquarters are often referred to as revenue-generating functions. The main office has two main areas: investment banking and marketing.

1: Investment banking services include advising on organizing mergers and acquisitions and a wide range of fund-raising activities.

2: The market is divided into “sales and negotiation” (including “structured”) and “research”.

Corporate financing:

Corporate financing is an aspect of investment banking, which includes helping clients raise funds in the capital market and advising on mergers and acquisitions. This may include investor subscriptions for security issues, coordination with bidders, or merger negotiations. A financial account book will be created to make potential M&A customers aware of the bank. If the release is successful, the bank will arrange the transaction for the customer. See Financial Analyst#Investment Banking. The Investment Banking Department (IBD) is usually divided into industry and product coverage groups. Industry coverage is concentrated in specific industries, such as healthcare, public finance (government), FIG (Financial Institution Group), industry, TMT (technology, media, and telecommunications), P&E (energy and energy), consumer/retail, food, and beverage, Defence and corporate governance, and maintain relationships with companies in the industry to create business for the bank. The product coverage group focuses on financial products, such as mergers and acquisitions, loan financing, public financing, asset financing and leasing, structured financing, restructuring, stock, and bond issuance.

Trading:

Large investment banks represent banks and their customers, whose main function is to buy and sell products. When creating a market, the purpose of traders buying and selling financial products is to make money in each transaction. For investment banking business departments whose main job is to attract high-net-worth individuals and institutional investors, make business recommendations (according to the buyer’s warning) and place orders. Who can list and ■■■■■■■ transactions or construct new products to meet specific requirements? When derivatives come into play, structuring is a relatively new development. Highly skilled personnel and several employees are dedicated to developing products with complex structures that usually provide profit. In 2010, investment banks were under pressure to sell complex derivatives contracts to local communities in Eastern Europe. American strategists advised external and internal customers on strategies that can be applied to various markets. From derivatives to specific industries, strategists fully consider the macroeconomic situation and conduct quantitative assessments of companies and industries. This usually affects the company’s marketing approach, what direction it takes in terms of ownership and streaming location, what products the salesperson offers to customers, and how the architect develops new products. Banks also take risks through their transactions and “primary risks” carried out by a group of specific merchants who do not interact with customers, that is, “primary risks”: the risks that merchants bear after buying or selling products to customers. And this does not cover your overall exposure. Banks strive to maximize profitability when there are certain risks on the balance sheet. Please note that FRTB emphasizes the difference between “transaction book” and “bank book”, which are assets held for active transactions, not assets that are expected to be held to maturity. And the capital requirement has market risk. Will be different. The demand for digital skills in sales and trade creates employment opportunities for Ph.D. students engaged in quantitative analysis in physics, computer science, mathematics, and engineering.

Research:

The securities research department reviews companies and reports on their prospects. These companies are usually designated as buying, holding, or selling. Investment banks usually have sales analysts covering various industries. The office will also investigate purchases. The research also includes internal and external credit risk, fixed income, macroeconomics, and quantitative analysis used to advise clients. These together with the “capital” can be a separate “group”. Research teams usually provide important services in terms of recommendations and strategies. Although the research department may or may not generate revenue (depending on the policies of individual banks), its resources can be used to help traders with transactions, salesmen, ideas for customers, and investment bankers to ensure their Customer safety. The research also provides investment advice to external customers (such as institutional investors and high net worth individuals), hoping that these customers will implement the proposed business ideas through the bank’s sales and trading departments, thereby generating revenue for the company. The MiFID II research team must charge banks for research fees, and the research business model has become increasingly profitable. The external ratings of researchers have become more and more important, and banks have begun to profit from research publications and customer interaction time. , Meeting with customers, etc. There is a potential conflict of interest between the investment bank and its analysis, because the published analysis may affect the performance of the securities (in the secondary market or IPO) or the relationship between the bank and corporate customers. Impact on bank profitability. [citation needed] See China Wall# Finance.

Intermediate Office:

The scope of activities of the bank includes fund management, internal control (such as risk), and internal company strategy. The company’s treasury is responsible for financing investment banks, managing the capital structure, and monitoring liquidity risks. He (company) is responsible for the FTP (bank transfer pricing) framework. Internal control monitors and analyzes the company’s capital flow. In important areas such as controlling the company’s global risks, finance is the main advisor to senior management. With the help of a dedicated product monitoring team in the commercial sector, assess the risks, profitability, and structure of various companies. In the United States and the United Kingdom, the Comptroller (or Comptroller) is a senior position and frequently reports to the CFO.

Risk management:

Risk management includes the analysis of credit and market risks of transactions or balance sheet transactions conducted by investment banks or their clients. The Intermediate Credit Risk Department specializes in capital market activities, such as syndicated loans, bond issuance and restructuring, and loan financing. They are not regarded as “customer service offices” because they are usually not customer-centric but oversee bank functions so as not to take too much risk. And business activities based on the VaR model. Other types of inter-departmental risk include country risk, operational risk, and counterparty risk, which may or may not exist between banks. Take actions against clients such as companies, governments, and hedge funds, such as B. Structure, restructuring, syndicated loans, and securitization. Here, “credit risk solutions” are an indispensable part of the capital market business, including debt structure design, exit financing, loan modification, project financing, leveraged buyouts, and sometimes portfolio coverage. Portfolio management, advice, and risk assessment. JP Morgan Chase, Morgan Stanley, Goldman Sachs, and Barclays J found well-known risk pools. Although the Financial and Operational Risk Department acts as an intermediate office, including the internal control of loss-making operational risks, Morgan IB Risk cooperates with investment banks to complete transactions and provide investors with advice. The Credit Risk Group of Barclays Investment Bank and the Risk and Finance Group of Sachs Securities Alliance are all franchises specializing in customer service. As well as registering risk analysis and setting limits for group actions that are not related to needs. These groups can also be responsible for approving transactions that have a direct impact on capital market activities. In contrast to the business strategy group that advises clients, this strategy group focuses on corporate governance and profitability strategies. It does not generate revenue, but it does play a vital role in investment banking.

SUMMARY:

This is not a complete overview of all the functions of the investment bank headquarters. This allows the support and customer service departments to participate in internal functions.

Background:

The background checks the correctness of group action knowledge and executes necessary transactions. several banks conduct business on one side. However, this can be a very important part of the bank.

Technology:

Investment banks have an outsized quantity of internal software packages created by technical teams, that also are accountable for technical support. within the past few years, technology has undergone major changes like additional and more sales and retail departments use e-commerce. advanced security algorithm.

Other activities:

Global Transaction Bank is a department that provides fund management, custody, credit, and securities brokerage services for organizations. The bank said that brokering first-class hedge funds is a particularly profitable and risky business. Cooperated with Bear Stearns in February 2008: Investment management is the professional management of various stocks (stocks, bonds, etc.) and other assets (such as real estate) to achieve specific investment goals, thereby enabling investors to Benefit. (Insurance companies, pension funds, companies, etc.) or private investors (directly through investment contracts, more commonly through mutual funds (such as mutual funds)). Investment bank investments are usually divided into different groups, commonly referred to as private wealth management and private customer service.3: Commercial banking can be called “personal banking”. Commercial banks provide stocks instead of holding stocks instead of loans and provide management advice and strategies. Commercial banking is also a name describing the private equity portion of a company. The current example is Foennier & Cie. JPMorgan is chasing One Equity Partners. J. Morgan & Co., Rothschilds, Barings, and Warburg were originally commercial banks. “Handelsbank” was originally the term for an investment bank in British English.

Industry Overview:

As AN industry, it’s divided into Bulge Bracket (top-level), medium-sized (medium-sized company), and store (professional company) markets. There are many industry associations around the world lobbying the industry. modify industry standards and publish applied mathematics information. The Council of International Securities Associations (ICSA) may be a world industry association organization. within the United States, the Securities and monetary Markets trade Association (SIFMA) is also the foremost important. However, some giant investment banks are members of the Yankee Securities Bank Association (ABASA), whereas tiny investment banks are members of the National Investment Bank Association (NIBA). In Europe, varied European securities associations established the ECU Securities Association Forum in 2007. many European trade associations (mainly the London Investment Banking Association and SIFMAs European subsidiaries) integrated in Gregorian calendar month 2009 to create the Association of European monetary Markets (AFME).

The combination of global scale and financial returns:

In 2007, global investment banking revenue grew for the fifth consecutive year, reaching a record of 84 billion U.S. dollars, a year-on-year increase of 22%, twice the 2003 level. The revenue of the world’s largest investment bank in 2012 was estimated at 240 billion U.S. dollars, a small decrease compared with 2009. The reason is that the company has been looking for less business and less negotiation. This should include other methods of classifying investment banking operations. For example, income: B. Reduce the income of one’s own business. In terms of total revenue, the documents submitted by major independent US investment banks to the US Securities and Exchange Commission show that between 1996 and 2006, investment banking business (defined as M&A advisory services). Acquisitions) account for only 15-20% of the total revenue of these banks. Most of the income comes from “transactions”, which include brokerage fees and transaction fees. At your own expense; your own business is considered an important part of your income. In 2009, the United States accounted for 46% of the world’s income, compared with 56% in 1999. Europe (including the Middle East and Africa) accounts for about one-third, and Asia accounts for the remaining 21%. Eight. The transaction targets some major currency centers as well as New York, London, Frankfurt, Hong Kong, Singapore, and Tokyo. Investment banks and their investment managers are located in New York and play important roles in various financial centers. London has traditionally been the center of European mergers and acquisitions and has generally facilitated the process of most companies and capital restructuring in the region. International Monetary Services estimates that the proportion of mergers and acquisitions in Asian cities is increasing. In the decade before the 2008 financial crisis, mergers and acquisitions were the largest sources of financial returns for investment banking. In London, ten years before the 2008 financial crisis, mergers and acquisitions were the main sources of income for investment banking. Sometimes they accounted for 40% of income, but they regressed during and after the financial crisis. crisis. Interest income and stagnant income constitute the remaining income. Sales are full of new product releases that are more profitable. However, these innovations are usually quickly copied by competing banks, thereby reducing trading profit margins.

SUMMARY:

Mercantilism bonds and stocks are a commodity business, but structured and commercial derivatives produce higher returns because each unlisted contract must have a unique structure and can include income analysis and configuration files. One area of growth is private equity (PIPE, also known as Regulation D or Regulation S). These transactions are conducted privately between the company and authorized investors. This could lead to investment banks becoming lenders. Since the end of the Glass-Steagall Act in 1999, it has been legal in the United States.

Conclusion:

Investment banking is a specialized banking department that is related to raising funds for other companies and companies. Investment banking activities to assist the issuer in the allotment of shares. Investment banks can also carry out the following activities:

- Financial expansion

- Project financing

- Authorized financiers in the capital market

- Brokerage services that do not provide deposits

- Portfolio management-discretionary and non-discretionary

- Recommendations, including finance Professional analysis of restructuring, merger, securities, and financial investors, including debt and equity distribution, etc.

7: Issuing guarantees and counter-guarantees

8: Acting as an underwriter

9: Providing custody/trust services under certain conditions.

Frequently Asked Questions:

Q1. What do investment bankers do?

A: The performance of an investment banker. Investment banks help companies and governments raise funds by issuing stocks or obtaining loans. They also act as consultants and brokers in mergers and acquisitions. Highly regulated environmental issue.

Q2: In simple terms, what is investment banking?

A: Definition: Investment banking is a specialized part of the banking business, which can assist individuals or organizations in raising funds and provide financial consulting services. They act as intermediaries between issuers of securities. And investors and startups in IPOs.

Q3: Is there a lot of pressure on investment banking?

A: Investment banks are known for their busy schedules. Entry-level investment banking analysts usually work 100 hours a week. A few years ago, the tragic deaths of three junior investment bankers brought attention to the marathon they had participated in before their deaths.

Q4: Is investment banking difficult?

A: Investment bankers can work 100 hours a week, conducting research, financial modeling, and building presentations. In the banking industry, investment banking is also one of the most challenging and challenging career paths for IB.

Q5: What are an investment bank and its type?

A: When we define investment banking, banking can help companies, governments, and other organizations conduct large and complex financial transactions. This industry is full of large and small investment banks.

Q6: Is investment banking becoming a dying profession?

A: He is not ■■■■. There are many options, but nowadays, you don’t have to work more than 80 hours a week to make money. Provides a wider range of exit options, including options for financial recovery. I know that the income of financial/IB/PE people exceeds their income.

Q7: Is an investment bank recommended?

A: For reputable investors, the banking industry is a good choice. The intrinsic value of the stock that stock investors are looking for is lower than its intrinsic value. The banking industry has been reaping returns for a long time and has brought some profits to investors.

Q8: As an investment banker, can you work from home?

A: Work in finance at home. The shortest answer is no. In investment banking, the answer is yes. The young man from the investment bank did not sit in the office until late at night. At night, sometimes just to "spend time face to face.

Q9: Will all financial matters bring pressure?

A: The financial industry may be related to high salaries, but it is also related to high pressure. Some recent studies have examined the high stress associated with various occupations. For people in the financial industry, these percentages can even be increased.

Q10: Is investment banking a good career?

A: Indeed, investment banking is a very profitable industry. For stock research at a large investment bank, the typical salary for trading and sales is about $500,000. M&A professionals can get more. Investment banking sector.