| Jim Cramer Net Worth: | $150 Million |

|---|---|

| Date of Birth: | Feb 10, 1955 |

| Gender: | Male |

| Height: | 5 ft 5 in (1.6764 m) |

| Profession: | Journalist, Businessperson, Presenter, Lawyer, Commentator, Investor, Author, TV Personality, Actor |

| Nationality: | United States of America |

| Last Updated: | 2020 |

| Age | 66 years old |

| Spouse | Karen Backfisch (m. 1988 - 2009) Lisa Cadette Detwiler (m. 2015) |

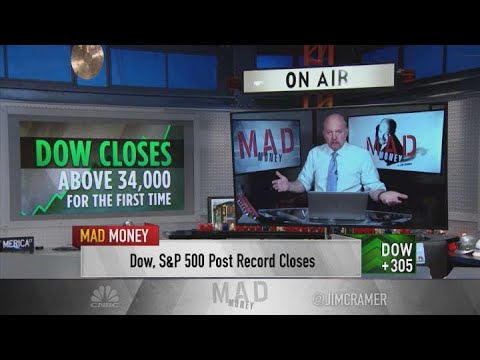

| Known for | Hosting “Mad Money” Co-founder of TheStreet.com |

| Occupation | Television personality, author |

| Children | 2 |

| Education | Harvard University |

| Born | James Joseph |

Jim Cramer net worth is $150 million dollars and is best-selling author, famous television personality, former hedge fund manager. He has gained much popularity after hosting CNBC’s “Mad Money”, and becoming co-founder and chairman of TheStreet.com. For his different positions at CNBC, Jim Cramer gets a yearly salary of $5 million. He additionally acquires an ample amount of pay from book eminences and advances.

https://live.staticflickr.com/4125/4947324683_ded7ecc368_b.jpg

Early Life:

Early Life:

Jim Cramer was brought into the world by Jewish parents in 1955 in Pennsylvania (a suburb of Philadelphia), Wyndmoor, Louise A. was his mother. She was a craftsman. N. Ken Cramer was his dad. He was a businessman. He claimed International Packaging Products, a Philadelphia-based organization that sold wrapping paper, boxes, and sacks to retailers and cafés. Cramer went to Pennsylvania, there he got admission in Sylvania Springfield Township High School in Montgomery County. In 1971, among his first positions, Cramer sold frozen yogurt and Coca-Cola at Veterans Stadium during Philadelphia Phillies games. At that time he started earning on his own. Surprisingly, Cramer had build interest in stocks when he was in 4th grade. Therefore, in 4th grade he started contemplating stocks and proceeded with this work to secondary school and then to college for higher education. He was interested in the stock market from his childhood. He made his ordinary portfolio and got best job oppurtunites. Then he learned many cooperate symbols.

Summary:

Summary:

Jim Cramer net worth is $150 millions. Jim Cramer’s parents were Jewish. He was born in 1955. He was blessed with creative parents. He was a businessman who owned a company that was selling wrapping paper, bags, and boxes. His mother was an artist. Probably Jim has inherited the trait of acting from his mother.

Early Education and Career:

Early Education and Career:

In 1977, Jim Cramer got a degree in magna ■■■ laude from Harvard College. There he did his Bachelor of Arts in government . Additionally, Cramer was the President and Editor-in-Chief of The Harvard Crimson at Harvard College. Additionally, Cramer was a National Merit Scholar.

After school, Cramer was a section-level journalist. Jim Cramer net worth increased in that that time. He was making $15,000 per year. Cramer worked for the Tallahassee Democrat in Tallahassee, Florida in beginning March 1, 1978. There he was the one of all to cover the Ted Bundy murders since he lived a couple of squares away. Richard Oppel was the chief supervisor at that time. He said “Cramer resembled a driving ram. This complement was all in one for Cramer. It motivated him to do further work. He was extraordinary at getting the story.” He in this way worked for the Los Angeles Herald-Examiner composing eulogies. During this time, some robbers came to his apartment and looted him and he lost everything. He was unfortunate enough to live out of his vehicle for 9 months. He likewise worked for Governor of California Jerry Brown. Cramer was one of the principal journalists at American Lawyer.

Cramer got a Juris Doctor certificate from Harvard Law School in 1984. Jim Cramer began putting resources into the financial exchange while he went to law school. At that time he gained much interest and experience in the stock exchange which led him to continue his work. He made enough from the stock market. Therefore he was able to cover tuition. Cramer started advancing his property by leaving stock singles out his replying mail. While at Harvard, graduate Michael Kinsley acquainted him with The New Republic proprietor Martin Peretz, who reached Cramer to compose a book audit. After first benefitting from the stock picks he heard on Cramer’s replying mail, Peretz gave Cramer $500,000 to contribute. In two years, Cramer made $150,000 for Peretz. During his years at Harvard Law School, Cramer functioned as an exploration right hand for Alan Dershowitz. He helped Dershowitz’s mission to clear claimed killer Claus von Bülow notwithstanding the way that Cramer accepted von Bülow was "especially liable”.

Summary:

Summary:

Jim Crammer graduated from Harvard University in 1977. There he got a Bachelors’s degree and earned enough experience in the stock market and finance exchanging. While in 1984, graduated magna ■■■ laude, and his Juris Doctorate degree at Harvard Law School. As he was a good reporter, he columnist in Tallahassee, Florida, Cramer covered the Ted Bundy murder.

Net Worth And Current Influence:

Net Worth And Current Influence:

Jim Cramer net worth is somewhere between $100 and $150. It is all that a successful person earns in his lifetime. A substantial amount of his success came from his hedge fund. But his success story was not limited to the hedge fund only. Through hedge funds, Jim Cramer gained much experience in investment and earning. Cramer expanded his total assets through a broadened methodology of numerous revenue sources.

The market cap and income from his responsibility of TheStreet.com have influenced Jim Cramer net worthhis total net worth as has his reputation and accomplishment as the host of “Mad Money.” “Mad Money” has kept up Cramer’s solid impact inside the venture account domain. He is one of the most popular personalities of stock exchange exhortation.

Career:

Career:

He has earned much popularity during his graduation period from Harvard University. After that, his career started. Like every successful person, he had also faced many ups and downs in his early as well as late career. After that the Jim Cramer net worth increased. Here we have compiled a brief description of his career.

Goldman Sachs:

Goldman Sachs:

After years of expertise, Jim Cramer became a stockbroker at Goldman Sachs. There he continued his work in trading, sailing, and exchanging goods. Jim Cramer got admission to New York State Bar Association in 1985 but did not learn anything. His official permission letter to specialize in legal matters was suspended on April 2, 2009, for inability to pay the enlistment expense.

Hedge Fund:

Hedge Fund:

In 1987, Cramer left Goldman Sachs and began a speculative stock investment, Cramer and Co. (later Cramer, Berkowitz, and Co.). The asset worked out of the workplaces of Michael Steinhardt. Early financial backers included companion and cohort Eliot Spitzer, Steve Brill, and Martin Peretz. Cramer brought $450 million up in $5 million additions and got a charge of 20% of the benefits he produced.

Cramer professes to have sold the entirety of his stocks on the Friday before Black Monday (1987). From 1988 to 2000, Cramer professes to have had just a single year of negative returns - 1998, a year when the S&P 500 Index rose 29%. The underperformance in 1998 prompted huge financial backer withdrawals. In 1999, the asset returned 47% and in 2000, it returned 28%, beating the S&P 500 Index by 38 rate focuses. Cramer professes to have created a 24% normal yearly return more than 14 years and “regularly [taken] home $10 million every year and more.” However, his outcomes have been questioned. Hedge Fund was one of the sources of increasing his net worth.

In 2001, Cramer resigned from dealing with the fence fund. The asset was then taken over by his previous colleague, Jeff Berkowitz.

SmartMoney:

SmartMoney:

After Hedge Fund, Cramer started his work as an editor at SmartMoney. There he started editing magazines. They accused him because of his limited practice. He could not do his practice due to the expiration of his practice license. Just before he published his article, he earned $2 million after buying stocks for his personal gain.

TheStreet.com:

TheStreet.com:

A piece of financial news and financial website, TheStreet.com was launched by Cramer and Peretz in 1996. Cramer was the organization’s most striking pundit and gave exchange subtleties to his Action Alerts PLUS Portfolio, a magnanimous trust, for paid endorsers of the site. TheMaven obtained the organization for $16.5 million in August 2019

CNBC:

CNBC:

In late 1990, Jim Cramer was a guest commenter on CNBC. Cramer co-facilitated Kudlow and Cramer (first called America Now) with Larry Kudlow in the time between 2002 to 2005. In 2005, Jim Cramer’s play Mad Money was first uploaded and aired on CNBC. The main aim of the play was to encourage people on how to do-it-yourself ingesting with "the knowledge and gadgets to help you become the best investor of all times”. His play Mad Money encouraged thousands of people to wake up and earn. He guided them on how to earn from the stock exchange and investing.

Cramer is needed to uncover any positions he holds in a stock that is examined on the show and isn’t permitted to exchange any security he has spoken about on CNBC for five days following the transmission.

Other Media Appearances:

Other Media Appearances:

Cramer facilitated a one-hour public broadcast, Jim Cramer’s Real Money, until December 2006, which generated Mad Money. On November 13, 2005, Dan Rather talked with Cramer for an hour. Among the subjects of conversation were Cramer’s past at his speculative stock investments; including his fierce temper. Jim Cramer showed up as himself in two scenes of Arrested Development in 2005. He reported that he had overhauled Bluth Company stock to a “Don’t Buy” from a “Triple Sell,” and afterward to say that the stock was not a “Don’t Buy” any longer, but rather an “Unsafe.”

Cramer has likewise attended Today, NBC Nightly News, Cheap Seats, Late Night with Conan O’Brien, Live with Regis and Kelly, Late Show with David Letterman, The Tonight Show with Jay Leno, Jimmy Kimmel Live! in February 2008, as a visitor judge on The Apprentice in January 2007, and was met by Jon Stewart on The Daily Show in March 2009 (see Jon Stewart–Jim Cramer struggle). Cramer likewise showed up in the 2008 movie Iron Man caricaturing Stark Industries on his show Mad Money, and he additionally showed up in the film Wall Street: Money Never Sleeps. He likewise claims to have counseled for the first Wall Street film by telling the producers how he would break through to Gordon Gekko.

Controversies:

Controversies:

Fox News Channel Lawsuit:

Fox News Channel Lawsuit:

In 2000, Cramer and TheStreet.com settled a claim with Fox News Channel in which Fox had asserted Cramer had reneged on an arrangement to create a show for Fox. The contention started when Fox griped that Cramer advanced TheStreet.com stock on its organization

Admission of Market Manipulation:

Admission of Market Manipulation:

In a December 2006 meeting, Cramer portrayed exercises utilized by Hedge funds supervisors to control stock costs—some of questionable legal and others unlawful. He portrayed how he could push stocks higher or lower with just $5 million in the capital when he was running his multifaceted investments. Cramer said, “A ton of times when I was short at my speculative hedge funds, At the point when I was situated short—which means I required it down—I would make a degree of movement in advance that could drive the prospects.” He likewise urged hedge funds to participate in this sort of action since it is “a speedy method to bring in cash.”

Cramer expressed that all that he did was lawful, however, that criminal behavior is normal in the stock market and hedge funds industry too. He likewise expressed that some multifaceted investments supervisors spread bogus bits of hearsay to drive a stock down: “What’s significant when you are in that flexible investments mode is to do nothing distantly honest in light of the fact that actually so against your view, that it’s critical to make another reality, to build up a fiction.” Cramer depicted an assortment of strategies that hedge funds chiefs use to influence a stock’s cost.

Jim Cramer added that one procedure to hold a stock cost down is to spread false news to columnists he depicted as “the Pisani’s of the world,” concerning CNBC journalist Bob Pisani, who Cramer intimated had the option to be controlled, saying “You need to utilize these folks.” He likewise talked about offering data to “the bozo correspondent from The Wall Street Journal” to get an article published. Cramer said this training, albeit unlawful, is not difficult to do “on the grounds that the SEC doesn’t comprehend it.” During the meeting, Cramer alluded to himself as a “banking-class hero.”

Performance of Jim Cramer’s Investment:

Performance of Jim Cramer’s Investment:

As supervisor of his multifaceted investments, Jim Cramer claimed to have understood a “pace of return of 24% after all charges for a very long time” until he resigned from the mutual funds in 2001. He self-announced a 36% return in 2000, at the pinnacle of the website bubble. However, this exhibition has not been freely checked. In January 2000, near the pinnacle of the website bubble, Cramer suggested putting resources into innovation stocks and proposed a rehash of the stock exhibition of 1999.

In February 2000, the year in which Cramer professed to have delivered a 36% return, Cramer guaranteed that there were just 10 stocks he needed to claim and he was getting them consistently. These stocks were Digital Island, 724 Solutions, Ariba, Mercury Interactive, Exodus Communications, InfoSpace, Inktomi, Sonera, VeriSign, and Veritas Software. He likewise excused the contributing system of Benjamin Graham and David Dodd and asserted that value income proportions didn’t matter. All 10 of these stock picks fell in esteem fundamentally during 2000 as the website bubble burst, making the 36% return during that year questionable.[citation needed]

On October 6, 2008, Today, when the S&P 500 Index was esteemed at 1,056, Jim Cramer recommended to financial backers, “Whatever cash you need for the following five years, kindly remove it from the securities exchange.” Five months after the fact, the market lined at 666, a 36.9% decrease. Five years after the fact on October 6, 2013, the S&P 500 Index has esteemed at 1,678 an expansion of 58.7%.

Jim Cramer suggested putting resources into Bear Stearns, Morgan Stanley, Merrill ■■■■■, and Lehman Brothers before the stocks fell in esteem significantly. On August 8, 2008, preceding the peak of the monetary emergency of 2007-2008, Cramer suggested putting resources into bank stocks. An August 20, 2007 article in The Wall Street Journal expressed that “his picks haven’t beaten the market. In the course of recent years, watchers holding Cramer’s stocks would be up 12% while the Dow rose 22% and the S&P 500 16%.”

In March 2009 Criticism of Obama’s policies:

In March 2009 Criticism of Obama’s policies:

On March 2, 2009, Cramer said that President Barack Obama was liable for "the huge wealth annihilation I have seen by a president”. An outraged Presidential organization shot back, with Press Secretary Robert Gibbs expressing, “In the event that you turn on a specific program, it’s equipped to a little crowd. I’m not totally sure the thing he’s highlighting makes a portion of the statements. You can return and take a gander at quite a few proclamations he’s made in the past about the economy and marvel where a portion of the back-ups for those are, as well.”

Jim Cramer reacted to the White House, saying, “Reinforcement? On March 5, 2009. Have a look at the unbelievable decrease in the financial exchange, in all files, since the initiation of the president, with the drop speeding up when the spending plan became visible due to the gigantic dread and hesitation the archive planted: Raising duties just before what could be a second Great Depression, obliterating the benefits in medical care organizations, dabbling with the home loan allowance when U.S. house value devaluation is behind a large part of the world’s quagmire and surely the decimation influencing our banks, and pushing a forceful cap and exchange program that could raise the cost of energy for thousands of individuals.”

Most Motivational Quotes By Jim Cramer:

Most Motivational Quotes By Jim Cramer:

Cramer once said, “I’ve lost huge measures of cash in different business sectors, and I feel that that is something that improves you at my specific employment, not more terrible.”

This inspirational quote represents the struggle he has done in a hedge fund like a stock exchanger. If you an entrepreneur or investor for a long time then you more at the risk of losing money. But it doesn’t mean that loss is the future of investors. He gets enough profit as well. Ups and downs are part of life. These are the learning phases of an investor which makes them stronger in the game day by day.

“I will defend what I accept and for what I have consistently accepted,” Cramer likewise said. “Each individual has a privilege to be wealthy in this country, and I need to encourage them in gaining it.”

How Jim Cramer Became a Stock Exchange Expert:

How Jim Cramer Became a Stock Exchange Expert:

From the very beginning, Jim Cramer had much interest in the stock market. His interest led him to study the stock exchange market and investment. His passion for the stock exchange was sky high that he started leaving guide for stock exchange on the answering machine as well. His step-by-step guide was so easy to understand and appealing that people gained interest in it. After seeing his guide, one person presented his half-million dollars for stock investment because Cramer had much knowledge about it already. His struggle made his fruits. His prosperity with that cash, at last, found him a task at Goldman Sachs (NYSE: GS), and following three years at Goldman, Cramer began his flexible investments.

Cramer spent incalculable hours investigating stocks and turned out to be so acceptable at it that it reliably tracked down those that could beat the market. Indeed, from 1988 to 2000 he just had one unfortunate year as a stock picker and finished his vocation with normal yearly returns of 24% more than 14 years. To place those profits into point of view, Cramer was in reality somewhat better than Warren Buffet at picking stocks: From 1965 to the furthest limit of 2012, Buffett’s Berkshire Hathaway (NYSE: BRK.A) (NYSE: BRK.B) appreciated a build yearly pace of return of 19.7% and two down years. That being said, Buffett’s prosperity was throughout a more extended timeframe and transformed him into a multibillionaire with a fortune adding up to $88.2 billion, though Cramer’s total assets would be simply an adjusting mistake for Buffett.

However, Cramer parlayed his speculative stock investments accomplishment into large close-to-home additions. Jim Cramer net worth was $10 million at that time. He regularly brought home more than $10 million every year in his prime. It has brought him as much popularity as it has fortune. But, however rich as Cramer maybe, he might have had much more.

FREQUENTLY ASKED QUESTIONS:

FREQUENTLY ASKED QUESTIONS:

Do you think Jim Cramer get out of the game before time?

Do you think Jim Cramer get out of the game before time?

Unsurprisingly Yes! If we compare the net worth of Buffet and Jim Cramer then we can say that Carmer left the game too soon. But as long as he was in it he did his best. For instance, Forbes reported that there are 45 extremely rich people who made their fortunes by running hedge stock investments. George Soros had been the most wealthy person with more than $25 billion in bank balance. But later on, he gave them 80% of his bank balance to the poor as charity.

Surprisingly if we compare the annual earning of Jim Cramer and the managers of the Hedge fund then we will see a huge change. The manager’s annual earnings are much more than Jim Cramer net worth. In 2016, the best 25 most earning mutual funds organization and brokers pulled in an astonishing $11 billion and that was in a year that they created disillusioning returns for financial backers. The top worker pulled in $1.6 billion while the 10th most generously compensated manager of hedge fund took $410 million. That is almost five times more than the total net worth of Jim Cramer.

What we have learned from Jim Cramer?

What we have learned from Jim Cramer?

There are several lessons to learn from the entire success story of Jim Cramer. The main thing is one should have a passion to get something. You don’t need to pay tons of money for formal training in the stock exchange. If you have the interest and passion to get this then you can achieve your goal with a little effort. Although it is quite impossible to become as much rich and successful as the Jim Cramer and Hedge Fund Managers at least we can take the stock exchange as a ticket to our bright future. Jim Cramer net worth is $150 million. He had achieve it all with struggle. This career will definitely support you financially in different ways.

What is the reason behind the popularity of Jim Cramer?

What is the reason behind the popularity of Jim Cramer?

Jim Cramer’s knowledge of the stock market led him to much popularity. With his stock market knowledge, he inaugurated his company Cramer and Co. Cramer ran his asset from 1987 to 2000 and had just a single year of negative returns. He ultimately resigned from his multifaceted investments in 2001, posting a general yearly return of 24% from 1987 to 2001 and yielding a total of more than $10 million every year in his 14-year time span.

During his Hedge fund time, Cramer co-founded a commentary and advice fund exchange market which is TheStreet.com. Cramer is the second-biggest investor of the organization and, at a certain point, the organization arrived at a market cap of $1.7 billion.9

Then in 2005, Jim Cramer was declared as the host of the CNBC show “Mad Money.” This is his one of the most popular show in the entire career. The aim of the show is to encourage people to think as professional investors and let other people realize that you are thinking. The show’s popularity has reached sky-high in the past 10 years which is phenomenal.

What are the famous sayings of Jim Cramer?

What are the famous sayings of Jim Cramer?

Following are the famous motivational sayings of Jim Cramer which led his followers to do investment in the stock market:

• “I mean I’m not smarter than the market, but I can recognize a good tape and a bad tape. I recognize when it’s right and when it’s wrong and that’s what my strength is.”

• “I made a small fortune. I made a lot of money and I made a lot of other people wealthy.”

• “The party line is that stocks historically have outperformed all other investment plans.”

• “The people who are buying stocks because they’re going up and they don’t know what they do deserve to lose money.”

What are the Jim Cramers top dividend stock picks for fixed income investors?

What are the Jim Cramers top dividend stock picks for fixed income investors?

Jim Cramer Stock Picks

Following are the top stock picks for fixed income investors:

• Dow Inc (NYSE: DOW): It yields 5.02%.

• IBM (NYSE: IBM): It yields 5.17%.

• AbbVie Inc (NYSE: ABBV): It yields 4.88%.

• B&G Foods, Inc. (NYSE: BGS): It yields 7.11%.

• Chevron Corporation (NYSE: CVX): It yields 5.93%.

• Verizon Communications Inc. (NYSE: VZ): It yields 4.28%.

• American Electric Power Company Inc (NASDAQ: AEP) with a 3.64% yield

• Dominion Energy Inc (NYSE: D) with a 3.45% yield

• Entergy Corporation (NYSE: ETR) with a 3.93% yield.

Which stocks will go sky high with government stimulus?

Which stocks will go sky high with government stimulus?

Below is the list of the stock that will go sky high if it gets attention from the government:

• Taiwan Semiconductor Manufacturing Co. (NYSE: TMS)

• Apple (NASDAQ: AAPL)

• Applied Materials (NASDAQ: AMAT)

• Home Depot (NYSE: HD)

• Floor & Decor Holdings (NYSE: FND)

• United Microelectronics (NYSE: UM)

• Gogo Inc (NASDAQ: GOGO)

Is Jim Cramer a Millionaire?

Is Jim Cramer a Millionaire?

Yes, Jim Cramer is a millionaire. He has an unbelievable net worth of $150 million. He has gained much popularity from his well-known show “Mad Money”. Additionally, Jim Cramer has played vital roles in the stock market. He was a member of a Hedge fund. There he earned much popularity as well as wealth by ingesting many stocks.

Can Jim Cramer own stocks?

Can Jim Cramer own stocks?

Surprisingly, No! Jim Cramer has no permission to own any stock picks. He can only own the stock picks which are related to CNBC or Comcast. All things being equal, he runs a trust and distributes those stock choices through a member-only club called Action Alerts Plus.

How can I contact Jim Cramer?

How can I contact Jim Cramer?

The call-in number of Jim Cramer is 1-800-743-CNBC. Cramer’s organization email address is madmoney@cnbc.com.

Jim Cramer receives the calls as a co-host of CNBC’s “Mad Money”. You can also contact him through email and comments. In eastern time, on weekdays the Mad Money show airs live at 5.pm.

Describe the personal life of Jim Crammer?

Describe the personal life of Jim Crammer?

Karen Backfisch was the co-worker of Jim Cramer. Later he married her in 1988. They had two daughters but get divorced in 2009 due to some personal reasons. Cece Cramer and Emma Cramer are his two daughters from his first marriage.

Lise Detwiler is Jim Cramer’s present spouse that he wedded in Brooklyn, on April 18, 2015. She is ahead supervisor of an Italian café called “The Longshoreman”. She’s likewise a land merchant.

11. How many restaurant does Jim Cramer own?

Two restaurant! Jim Cramer owns two restaurants. On 5 April, 2019 Jim Cramer made a tweet where he clarified that he own two restaurants.

12. What restaurant does Jim Cramer Own?

Jim Cramer owns Bar San Miguel. This is a good, chill and high profilen Mexican restaurant.

Conclusion:

Conclusion:

Jim Cramer net worth is $150 million dollars. He was born in 1955. His parents were Jewish. His father was an entrepreneur while his mother was an artist. He had inherited the tops qualities of his mother and father. He is a well-known TV host. He also worked in the stock market as an investor. He had seen huge ups and downs in his entire career. Cramer went to Springfield Township High School in Montgomery County, Pennsylvania. He earned his graduate degree from Harvard University. But his passion for the stock market led him to study stocks from the fourth class. Cramer became a stockbroker at Goldman Sachs in 1984 where he worked on trading and sales. Cramer left Goldman Sachs and began a mutual fund, Cramer and Co in 1987. He was also an editor at TheStreet.com. Afterward, his first show “Mad Money” was aired on CNBC.