A charge card is like an electronic payment card that allows the cardholder to make purchases when needed, cardholders are supposed to pay back the debt to the card issuer every month or on a given date cardholder will be subjected to pay the late fees and will get restrictions on further use of the card.

What is a Charge card?

In this fast, modern, and growing world, the ratio of Charge cards has been increased with excellent performance and have rare although they can still be kept among some issuers, such as for purchasing gas American Express was a primary issuer of charge cards, including its iconic Green, Gold, and Platinum cards In any circumstance, when we need urgent money on any occasion, we can get money with the help of a charge card. Charge cards made our life easier in this modern age.

A charge card is the second name of an electronic payment card. They have an uncapped spending boundary with significant reward services for the cardholder, but generally, the charge has a high annual fee. Charge cards do not have specific limitations or charge interest.

Type of charge cards:

There are two main types of charge cards such as.

1. Debit cards

Debit cards allow you to withdraw money from your account when you make a purchase.

2. Credit cards.

A credit card does not allow you to withdraw money rather you pay a bill within a month.

What is the difference between a credit card and a charge card?

I carry a balance — that is, roll the debt over from one month to the next. If you’re unlikely to carry a balance and you are willing to pay an annual fee, a charge card is worth considering. Traditional credit cards are the better choice if you might carry a balance from time to time or you’re more interested in a fee-free card.

| Charge card | Credit card |

|---|---|

| 1. Pay in full each month and used to carry a balance. | 1. Can pay the minimum month to month and used for carrying a balance. |

| 2.No specified limit and worth consideration. | 2. Has credit limit and is also good for time to time transactions. |

| 3. Can be authorized for enormous sums. | 3. Improved for going over the limit |

| 4.Nowadays, a charge card is used to build credit. | 4. In the Traditional ages, credit cards are used to invent credit. |

| 5. Often with a large amount of annual fee. | 5. Can have no annual fee |

Importance Of Charge Card:

In the present years, the charge card has Amex that began rolling out its “Pay Over Time” and “Pay It Plan” It shows that gives us payment more quickly, sufficiently, and flexibly Pay over Time gives users the option on interests$100 or more to reserve the balance for which is the purpose of they will be charged into the interest. The users have an option on or off as per need Pay It Plan gives the choice to disconnect purchases of at least $100 in equal monthly payments with must give fixed fee but no interest.

Furthermore, the cards can only work equally like the credit cards, however, it has Amex no longer refers to them and fulfills their consumer needs. For example, there is no difficulty in using the credit limit, the cards give us a variety of powerful honors because of their proficiency, effectiveness, and more reliability in this age but it has paid heavy annual fees. Charge card users must pay monthly charges if you don’t pay on time and spent the due date of submission means the due date is over, then late fees will be charged with the card submission w/c are very expensive

How a charge card can work?

A Charge Card acts like a Credit Card. Charge cards usage is very easy we can keep in pockets, violet, and clutches, etc. You are required to pay your charge with the card bill in full by the due date. fee-free card. have no limit.

It doesn’t mean that you can spend an unlimited amount. However, it does not mean the charge card has an unpublished ultimate spending limit for the account established on your spending habits, income, and creditworthiness. A charge card can work more efficiently and sufficiently.

Charge cards assign a credit application for authorization, and they are normally approved for high-quality borrowers with excellent or sufficient credit performance.

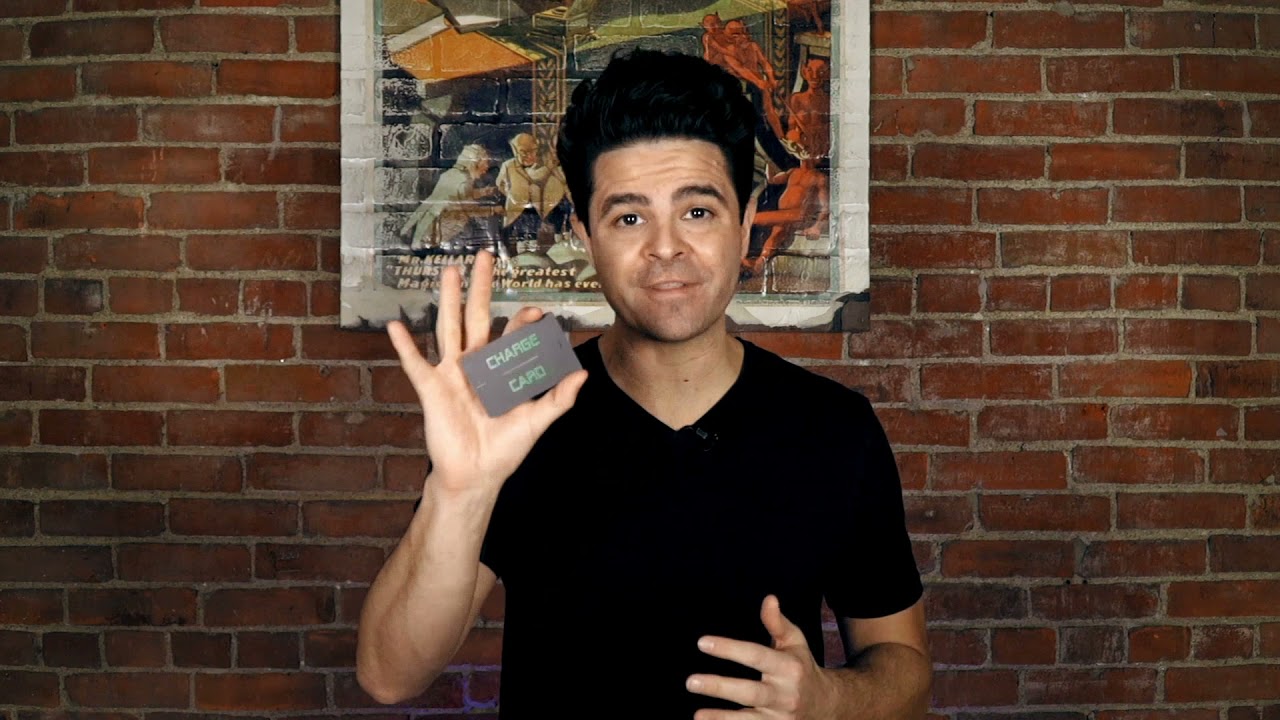

Below is the video that shows what a charge card is? And how charge card can work?

Summary:

In short charge card allows making purchases, is easy to use, and can be kept easily in your pocket. It works like a credit card.

What is a charge account?

A charge is basically an account through which a consumer purchases goods, as well as services, and May, also charge on credit.

Types of charge accounts:

There are mainly three types of charge accounts such as:

1. Regular Accounts:

A regular account permits you to spend up to a fixed amount. It avoids interest charges and fees there are various businesses like retail stores and clothing store that offer a regular account that has a limit of$1,000.

2. Revolving:

The revolving account gives you the benefit of making purchases to a maximum dollar limit. Also after paying the balance you can reuse the account also on outstanding balance it requires interest.

3. Budget:

A budget account allows you with a utility company to make purchases on a fixed amount on monthly basis and here if you use an amount more than budgeted for then you have to pay for the extra usage at the end of the year.

Advantages Of Charge Card:

-

A business person must use a charge card. The charge card is perfectly made for a business person who sometimes needs to make large purchases and where the credit limit won’t work. You can be approved in minutes with the help of a charge card and go right to the counter.

-

Someone you can pay in full each of the months. If you can’t pay in full each month, this is not the work for you. You want to be established sufficient to be able to only put on the card what you can afford to pay back in the due date.

-

Now in days many peoples who want rich rewards. Charge cards often provide us with the help of rich offerings, such as significant rewards for business expenses.

-

These cards typically pay a high annual fee.

-

Charge cards provide many facilities to fulfill our consumer’s satisfaction.

-

When you are using a charge card makes you financially disciplined.

-

A charge card can help you to get a lower interest rate on loans. Because it can help boost your credit score.

-

Charge card has no risk to the safety of your accounts.

-

You can get withdraw in any case of time.

-

A charge card is more reliable sufficient, and easier to use rather than a credit card.

If u get a charge card you must concern the following.

- Potentially high fees but still want to earn rewards.

- It’s worth keeping in mind that some of the best rewards credit cards require no annual fees.

Disadvantages Of Charge Card:

-

Charge cards paid high annual fees, while many fee-free credit and debit cards are available.

-

Charge cards are offered by a limited number of issuers as compared to credit cards.

-

However, late payments can be more harmful to your credit. You can’t be late to pay the dues of the card. If you don’t pay this fee you charge late fees some times the late charge fee can be very expensive.

-

A charge card allows you to spend money that you do not have.

-

They are not eligible for borrowing over a longer period than a month, because your balance must be paid in full at the end of each month

Summary:

Different accounts give different benefits some have fixed amount limit if purchasing while some have maximum amount limit.

The best varieties of charge cards:

The best charge card is often used in the whole world.

1.The Platinum Card® from American Express:

Brief overview:

-

Earn 100,000 Membership Rewards Points after you spend $6,000 on purchases on the Card in use early first 6 months.

-

With this American Express Travel, on prepaid hotels get 5X membership rewards points.

-

When you pay with your platinum card, each year get $200 back in statement cards on prepaid Fine Hotels + Resorts.

-

The Centurion Network expanded in America so now Platinum Card can get you complimentary entry too.

-

Enjoy Uber rides and save up to $200.

-

Get up to $25 back on memberships each month.

-

Get up to $179 on CLEAR membership per year.

-

Annual Fee of the charge card is $695.

Specifications:

| Welcome Bonus | 100,000 Membership Rewards |

|---|---|

| Annual Fee | $695 |

| Regular APR | Pay Over Time APR |

| Credit Score | Excellent/Good(700-749) |

2.Citi® Double Cash Card

Brief Overview:

Citi Double Cash’s long-lasting APR offer and simple cashback structure make it a favorite among those who want to set it When you earn cashback pay at least the lowest due on that time. Balance Transfers do not receive cashback if you transfer a balance, interest will be charged on your purchases. You pay your entire balance by the due date of each month plus a long-lasting 0% intro APR offer.

Advantages:

- Earn 2% on every purchase with infinite 1% cashback on purchasing through which payment on account is made.

- No annual fee.

- No limit on cashback amount that can be earned as well as no cashback cap.

Disadvantages:

- 0% APR on purchases with a lack of benefits.

- Foreign transaction and Balance transfer fee.

Specifications:

| Welcome bonus | None |

|---|---|

| annual fee | $0 |

| Regular APR | 13.99%-23.99%(Variable) |

| Credit Score | Excellent, Good (700-749) |

3.Chase Sapphire Preferred® Card

Brief overview:

This Chase Sapphire Preferred Card offers high reward rates as this card is like a dream for those who spend a lot on traveling and dining if and only if charge a modest annual fee.

Advantages:

- Earn double of 2 points on dining & traveling.

- Multi-protection on shopping & traveling.

- Can also transfer points to your travel partner at the rate of 1:1.

Disadvantages:

- No intro APR offer

- Annual fee

Specifications:

| Annual fee | $95 |

|---|---|

| Regular APR | 15.99%-22.99% Variable |

| Cashback | Intro offer |

| Credit score | Excellent/Good(700-749) |

4.Discover it® Balance Transfer

Brief overview:

Only from Discover, you will get an unlimited Cashback Match. Discover will automatically adjust all the cashback that you have earned at the end of the first year! It has no minimum or maximum spending rewards; on $300 you could turn $150 cashback. Earn infinite 1% cashback on all other purchases. This card has no paid annual fee.

Redeem cashback at any time at any amount. The card has never expired. The Most Trusted Credit Card according to use for Investor’s Business Daily. 99% of the places discover is accepted nationwide as per your requirement to take credit cards.

Specifications:

| Annual fee | $0 |

|---|---|

| Regular APR | 11.99% - 22.99% Variable APR |

| Intro APR | 0% Intro APR on 6 months purchases and 0% intro APR on Balance Transfer for 18 months |

| Credit score | Good /Excellent(690-850) |

Advantages:

1.No annual and foreign transaction fee.

2.Bonus cashback.

Disadvantages:

-

Less merchant acceptance in the US for discover.

-

Acceptance of the US can be an issue outside.

5.Blue Cash Preferred® Card from American Express

Brief overview:

This Blue Cash Preferred Card gives an offer of 6% cashback in the US. Blue Card also gives offers on supermarkets on up to $6,000 and if spent annually then 1% on US streaming services if we talk about gas stations then 3% back on transit and on all other purchases 1% back also on purchases this blue Card offers an introductory APR.

You can cashback and receive in the form of Reward Dollars that can be restored as well as a statement credit.

Earn 20% back on purchases at Amazon. com within 6 months of card membership up to $200 back.

Specifications:

| Annual fee | $0 |

|---|---|

| Rewards Rate | 1%-6% |

| Cashback | Intro offer $350 |

| Credit score | Excellent/Good(690-850) |

Advantages:

- Enrollment is not required also the cashback is automatic.

- In some categories high cashback rewards.

Disadvantages:

- At $6,000 in annual spending, you will get 6% cash back at US Supermarkets.

- Cash advance fee is very high.

- Foreign transaction fee is 2.7%

Summary:

Charge card has different varieties and every variety has its own specifications, advantages, and disadvantages.

Credit card dispute charge:

It all goes through a process like consumers can dispute for the fraud that has made charges on their bill so by calling the issuer. So nothing to worry about simply the issuer will cancel and reissue a new one. So there is an option either you can refund or charge back.

Kohl’s charged card login:

Kohl’s card is basically a retail charge card that can only allow you to purchase kohl’s merchandise and only the purchases can be made from kohl’s store as well as online so in order to login kohl’s charge card, first of all, you have to log in then by tapping on “Pay Now” which is at the bottom of the screen or you can also go to “Menu” then by tapping on “Make a Payment” click on “Sign in which is on the top of the page you will see an opening of a new window press “Sign in” to your Kohl’s card account.

Credit Card Chargeback:

An action which is taken by a bank to reverse your electronic payments is called chargeback As a user of banking products or credit cards you have the ability to issue a chargeback which is the most important tool where it comes in resolving billing disputes or when you face any kind of fraud. Chargebacks are only issued due to the following reasons.

1. Return credit not processed.

2. Fraud or unauthorized use.

3. Goods or services were not as described.

4. Services or Goods not delivered.

5. Incorrect amount.

6.Recurring billing was not stopped.

How to submit Credit card chargeback? :

If a chargeback request cannot be online then you can call via the phone number which is on the back of your credit card or the customer service phone number.

Summary:

In this article, according to the knowledge and research the charge card is very useful in every situation. It provides us many facilities and also fulfills consumers’ needs There are also many varieties available in charge card with different specifications some has its advantages and some have disadvantages.

Frequently Asked Questions:

Charge card users will be curious and a little bit confused about some of the things which are maybe left in the discussion so below are the questions that will help you clear every confusion.

1. Are charge cards good for credit scores?

Oh! Yes of course charge cards don’t have a limit as compared to a credit card. They don’t affect your credit utilization probability, which is the ratio of the total credit you’re using. Like most credit applications, relating to a charge card will appear as a new analysis on your credit document, which may temporarily lower your score a few steps. Charge cards provide us variety of facilities that you needed to pay for purchases in full within a specific time. These are very effective and sufficient for a charge card.

2. Are charge cards good?

Yes! Of course, a charge card is one of the best cards rather than some other cards. While credit card provides all the consumer protections it is less risky than a debit card. If a hacker gets your debit card, there’s a risk that he could break into your current account.

3. How can use one charge card?

In today’s time, the popularity of charge cards is increasing day by day but You cannot charge one credit card’s debt to another card that’s simple you can transfer the balance. Charge cards fulfill consumer needs. When users want to withdraw a huge amount of money without any limit the charge card is the best choice for you.

4.What charge cards exist?

Charge cards exist in a wide range so they varieties. Some American Express and Diners Club cards are the charge cards that exist we must use only charge cards, rather than credit or debit cards such as VISA and MasterCard. The most famous cards are “The Coutts Silk Charge Card”, and “the Centurion Card”.

5. Are charge cards easier to get?

Charge cards work like credit cards. Charge card has no limitations, although the issues can only be your buying limit. A charge card is easier to get, you can apply for it and use it for purchasing goods and services and also pay bills, charge cards require excellent credits.

6. Which is the best charge card?

| Charge Card | Annual Fee | Best for |

|---|---|---|

| From American Express The Plum Card® | $0 INTRO after 1st year $250 | Early-Pay Discount |

| Sunoco Gas Card | None | Gas Rewards |

| Brex Corporate Card for Startups | $0 | Business Rewards |

| Centurion® Card from American Express | $5000 | VIPs |

7. Who uses charge cards?

Those people will use charge cards that are organized and might need comfort with no set of limits and outstanding benefits. Charge cards provide us lot of benefits, and rewards mostly business people use charge cards to maintain their discipline.

8. What is the limit on a charge card?

There is no such specified limit of charge cards and it is a benefit of making large purchases. In the US limits may vary by age and location. if we talk about average then Americans have a total of $22,751 limit across all their credit cards.

Conclusion:

The charge card is very useful and can be used among many people who afford it. It is a type of electronic payment card that requires no interest you just need to pay in full on the due date.