Investing in Mutual Funds: A mutual investment is a scheme that accumulates money from many investors. Investing in Mutual Funds has become so simple and easy that one can consider investing in any number of funds without extra documentation.

Starting Mutual Fund financial backers need to finish their KYC that is a one-time process. You can move toward a distributor or investment counselor to assist you with finishing the KYC verification or, you could do e-KYC on the web. KYC resembles a key to the universe of Mutual Funds. Whenever you’ve finished your KYC, you can decide to invest in any asset without going through additional verification for each investment.

Starting Mutual Fund financial backers need to finish their KYC that is a one-time process. You can move toward a distributor or investment counselor to assist you with finishing the KYC verification or, you could do e-KYC on the web. KYC resembles a key to the universe of Mutual Funds. Whenever you’ve finished your KYC, you can decide to invest in any asset without going through additional verification for each investment.

When you are prepared to invest after KYC verification, you can decide to invest with the assistance of a mutual fund distributor, enlisted investment counselor, stock market broker, bank, or some other financial delegate. However, if you wish to invest alone, you can either visit the closest office of the fund house or visit their site to make an online investment or through any online platform.

When you are prepared to invest after KYC verification, you can decide to invest with the assistance of a mutual fund distributor, enlisted investment counselor, stock market broker, bank, or some other financial delegate. However, if you wish to invest alone, you can either visit the closest office of the fund house or visit their site to make an online investment or through any online platform.

Whether to invest through a distributor or to invest directly is based on an individual’s choice. If you like to deal with their investments alone, you can certainly invest online through the asset’s site or any online platform. In any case, if you like to seek advice or need assistance in investing, you can invest through a middle person like a merchant, investment advisor, bank, and so on.

Whether to invest through a distributor or to invest directly is based on an individual’s choice. If you like to deal with their investments alone, you can certainly invest online through the asset’s site or any online platform. In any case, if you like to seek advice or need assistance in investing, you can invest through a middle person like a merchant, investment advisor, bank, and so on.

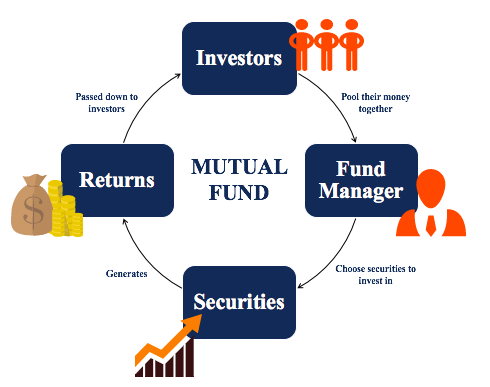

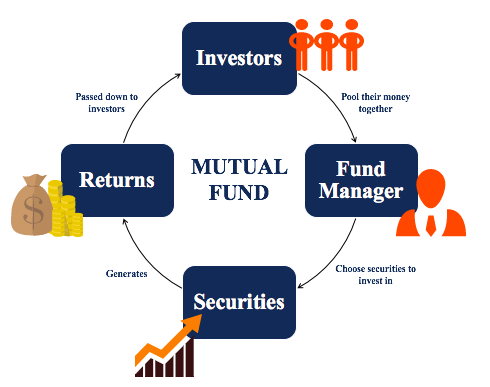

What are the Mutual Funds?

A mutual fund is an investment that pools together a lot of cash from financial investors to buy a bin of securities like stocks or bonds. By buying shares of a mutual fund, you are claiming a stake of all the investments in that asset.

A mutual fund is an investment that pools together a lot of cash from financial investors to buy a bin of securities like stocks or bonds. By buying shares of a mutual fund, you are claiming a stake of all the investments in that asset.

Liz Young, head of the investment system at SoFi, says mutual assets are utilized by various financial investors and are especially an incredible choice for a starter or an individual who has minimal expenditure to start with that. “You can consider them as bags stacked up with different kinds of protections, similar to stocks and bonds. Purchasing even one share of the asset puts you in all the individual protections the asset holds,” she says.

Liz Young, head of the investment system at SoFi, says mutual assets are utilized by various financial investors and are especially an incredible choice for a starter or an individual who has minimal expenditure to start with that. “You can consider them as bags stacked up with different kinds of protections, similar to stocks and bonds. Purchasing even one share of the asset puts you in all the individual protections the asset holds,” she says.

You can buy mutual assets rather than buying singular stocks, which require time, research, and more severe risk. Before you choose to invest in mutual assets, know their provisions. With this single investment, you have a portfolio of various securities that consequently enhances your investments, adequately lowering your risk.

You can buy mutual assets rather than buying singular stocks, which require time, research, and more severe risk. Before you choose to invest in mutual assets, know their provisions. With this single investment, you have a portfolio of various securities that consequently enhances your investments, adequately lowering your risk.

How Do You Select Mutual Funds for Your Portfolio?

Your investment objective and time frame: regarding picking which mutual assets to invest in, start with your investment objective and time frame. These two components will assist with figuring out what kind of mutual asset you should utilize.

Your investment objective and time frame: regarding picking which mutual assets to invest in, start with your investment objective and time frame. These two components will assist with figuring out what kind of mutual asset you should utilize.

Martha Post, chief, and principal operating officer at Team Hewins, says your objectives and time horizon are two significant factors that can assist you with deciding an asset allocation that works for you.

Martha Post, chief, and principal operating officer at Team Hewins, says your objectives and time horizon are two significant factors that can assist you with deciding an asset allocation that works for you.

Asset allocation: “An asset allocation insinuates the percent of your absolute portfolio invested into several asset classes, including stocks (huge and little, domestic and international) and bonds,” Post says.

Asset allocation: “An asset allocation insinuates the percent of your absolute portfolio invested into several asset classes, including stocks (huge and little, domestic and international) and bonds,” Post says.

A young financial investor with quite a long-time can take a more forceful asset allotment approach. A financial investor with a 30-year retirement objective who isn’t anxious about seeing their investment change in value between now and then could utilize a 90/10 or 80/20 asset allotment fund. These will contribute 90% or 80% of their resources in stocks, respectively, and the rest in bonds. Less forceful financial investors might choose a 70/30 or 60/40 designation.

A young financial investor with quite a long-time can take a more forceful asset allotment approach. A financial investor with a 30-year retirement objective who isn’t anxious about seeing their investment change in value between now and then could utilize a 90/10 or 80/20 asset allotment fund. These will contribute 90% or 80% of their resources in stocks, respectively, and the rest in bonds. Less forceful financial investors might choose a 70/30 or 60/40 designation.

Summary

Mutual funds are frequently explained as pooled investments. To select the best mutual fund, recognize your risk tolerance and goals, style and fund type, loads and fees, and passive vs. active management.

How to invest in Mutual Funds?

If you’re looking for assistance investing in mutual funds, follow these three easy steps to get started.

If you’re looking for assistance investing in mutual funds, follow these three easy steps to get started.

1. Decide on Your Mutual Fund Investment Goals

What financial objectives might you want to reach by investing in mutual funds? Are your objectives a couple of years away or a long time later on? If you’re contributing for a long-term objective, like retirement or your kid’s college education, stock-based mutual assets are best to invest.

What financial objectives might you want to reach by investing in mutual funds? Are your objectives a couple of years away or a long time later on? If you’re contributing for a long-term objective, like retirement or your kid’s college education, stock-based mutual assets are best to invest.

You have a lot of time to invest through the inevitable market, good and bad times. While no investment ensures a return, mutual assets are more secure than some different options because you’re invested in a broad range of organizations or companies.

You have a lot of time to invest through the inevitable market, good and bad times. While no investment ensures a return, mutual assets are more secure than some different options because you’re invested in a broad range of organizations or companies.

If you’re investing for a short-term objective like purchasing a vehicle or a home within the following few years, a currency market mutual asset or government security asset may be a good alternative.

If you’re investing for a short-term objective like purchasing a vehicle or a home within the following few years, a currency market mutual asset or government security asset may be a good alternative.

However, innovators who need simple admittance to their money in the near term should consider deposit account choices, for instance, high return investment accounts since they are governmentally safeguarded up to $250,000. Indeed, even the most secure mutual assets can’t offer that assurance.

However, innovators who need simple admittance to their money in the near term should consider deposit account choices, for instance, high return investment accounts since they are governmentally safeguarded up to $250,000. Indeed, even the most secure mutual assets can’t offer that assurance.

2. Select the Right Mutual Fund Strategy

Once you’ve identified your mutual fund investing goals, you can choose funds with the right investment strategy adjusted to your goals.

Once you’ve identified your mutual fund investing goals, you can choose funds with the right investment strategy adjusted to your goals.

Long-term goals: Long-term mutual asset investing implies you have a very long time to arrive at your monetary objectives. Because of that, your mutual asset allocation ought to likely be 70% to 100% in stock-based mutual assets to position you for the most investment development.

Long-term goals: Long-term mutual asset investing implies you have a very long time to arrive at your monetary objectives. Because of that, your mutual asset allocation ought to likely be 70% to 100% in stock-based mutual assets to position you for the most investment development.

You might search specifically for mutual funds named as “growth assets” to put resources into organizations that are expected to grow quicker than others. These assets have more danger, yet they additionally have more potential for enormous increases. Growth mutual assets to includes the Vanguard Growth Index Fund (VIGAX) and Fidelity Growth Discovery Fund (FDSVX).

You might search specifically for mutual funds named as “growth assets” to put resources into organizations that are expected to grow quicker than others. These assets have more danger, yet they additionally have more potential for enormous increases. Growth mutual assets to includes the Vanguard Growth Index Fund (VIGAX) and Fidelity Growth Discovery Fund (FDSVX).

Mid-term goals: If investing intensely in stocks makes you apprehensive or you have an objective that’s within five to 10 years away, you might need a methodology that decreases the potential for quick changes in investment value.

Mid-term goals: If investing intensely in stocks makes you apprehensive or you have an objective that’s within five to 10 years away, you might need a methodology that decreases the potential for quick changes in investment value.

Adjusted mutual assets put resources in both bonds and stocks, balancing a share of the danger related to stocks. Adjusted mutual assets include the Vanguard Wellesley Income Fund (VWINX) and the American Funds American Balanced Fund (ABALX).

Adjusted mutual assets put resources in both bonds and stocks, balancing a share of the danger related to stocks. Adjusted mutual assets include the Vanguard Wellesley Income Fund (VWINX) and the American Funds American Balanced Fund (ABALX).

Near-term goals: If you are only a few years away from your objective, your attention should be on limiting risk, so you don’t end up fast cash when you need it. You may intend to put 30% in stock mutual assets and the rest in security funds.

Near-term goals: If you are only a few years away from your objective, your attention should be on limiting risk, so you don’t end up fast cash when you need it. You may intend to put 30% in stock mutual assets and the rest in security funds.

The security funds will deliver consistent pay-through revenue payments, while the limited stock component might permit you to see some investment development. Pay-oriented mutual assets include the PIMCO Total Return (PTTAX) and the Vanguard Equity Income Fund (VEIPX).

The security funds will deliver consistent pay-through revenue payments, while the limited stock component might permit you to see some investment development. Pay-oriented mutual assets include the PIMCO Total Return (PTTAX) and the Vanguard Equity Income Fund (VEIPX).

3. Purchase Shares of the Mutual Funds

To begin investing in mutual assets, make sure you have sufficient money stored in your investment account. Remember that mutual assets might have higher investment essentials than other asset classes. For instance, Vanguard’s minimum investment for effectively managed mutual assets is $3,000. Different investments, similar to individual stocks or ETFs, usually don’t have these sorts of essentials.

To begin investing in mutual assets, make sure you have sufficient money stored in your investment account. Remember that mutual assets might have higher investment essentials than other asset classes. For instance, Vanguard’s minimum investment for effectively managed mutual assets is $3,000. Different investments, similar to individual stocks or ETFs, usually don’t have these sorts of essentials.

Kinds of Mutual Fund

| Equity |

Balanced |

Fixed Income |

Money Market |

| 75% -90% invested in stocks |

50% in stocks 50% in fixed-income securities |

100% in fixed-income securities |

100% in short term fixed-income securities |

| Average annual return: 15%-20% |

Average annual return: 10%-15% |

Average annual return: 6%-10% |

Average annual return: 1%-2% |

| For aggressive investors |

For balanced investors |

For long term capital preservation |

For very conservative investors |

Frequently Asked Questions

Here are some frequently asked questions regarding how to invest in mutual funds?

Q1. Are mutual funds a good investment?

All investments have some risks; however, mutual funds are commonly viewed as more secure investments than buying individual stocks. Since they hold many organization stocks inside one investment, they offer more broadening than possessing a couple of individual stocks.

Q2. How do beginners invest in mutual funds?

You can put resources into mutual funds offline or online through a mutual fund house or a mediator (dealer). You may likewise put resources into mutual funds through an online platform, for example, ClearTax invest. Select the amount you intend to invest in the mutual fund and the mode as One Time to put Rs 10,000 in mutual funds.

Q3. Can I invest 1000 RS in a mutual fund?

You can likewise put resources into mutual as a one-time single amount sum. But, there are a couple of mutual funds which will empower lumpsum investment beginning at Rs 1,000. Some mutual fund categories that might have exceptionally less or no assets under them permit you to contribute Rs 1,000 as a singular sum.

Q4. What is mutual fund investment in Pakistan?

A mutual fund is a company that pools money from numerous investors. An asset management company (AMC) appropriately authorized by the Securities and Exchange Commission of Pakistan (SECP) invests the cash for your benefit in securities or other monetary assets for profits/gains and pay.

Conclusion

It is feasible to invest if you are beginning with a small amount of cash. It’s more confounded than simply choosing a suitable investment (an accomplishment that is tough enough in itself). You must know about the limitations that you face as a new financial investor.

You’ll have to do your work to discover the minimum deposit necessities and compare the commissions with other investors afterward. Chances are you will not have the option to cost-successfully purchase individual stocks and still be diversified with a limited amount of cash. You will likewise need to decide on which investor you might want to open an account.

Related Articles

Definition of Mutual fund

United States Treasury Money Mutual Funds