How to Activate your Venmo Debit Card? To activate your Venmo Credit Card, just use your phone’s camera to scan the QR code on the front of the card. You may also utilize the Venmo app’s QR code scanner. If you prefer to activate by phone, please contact Synchrony Bank at 855-890-6779.

How to Activate your Venmo Debit Card?

How to Activate your Venmo Debit Card?

Venmo is a mobile digital payment service and social app owned by PayPal. The Venmo app makes it simple to communicate with friends and transfer and receive money.

What started as a text-messaging platform has evolved into a digital wallet software with over 60 million users that provides both the Venmo Visa credit card and the Venmo MasterCard debit card.

The Venmo debit card enables users to spend their Venmo balance wherever MasterCard is accepted in the United States, and they may even receive cash back at certain merchants.

The debit card may also be used to withdraw cash for free from any MoneyPass ATM.

![]() How do I Activate my Venmo Debit Card online?

How do I Activate my Venmo Debit Card online?

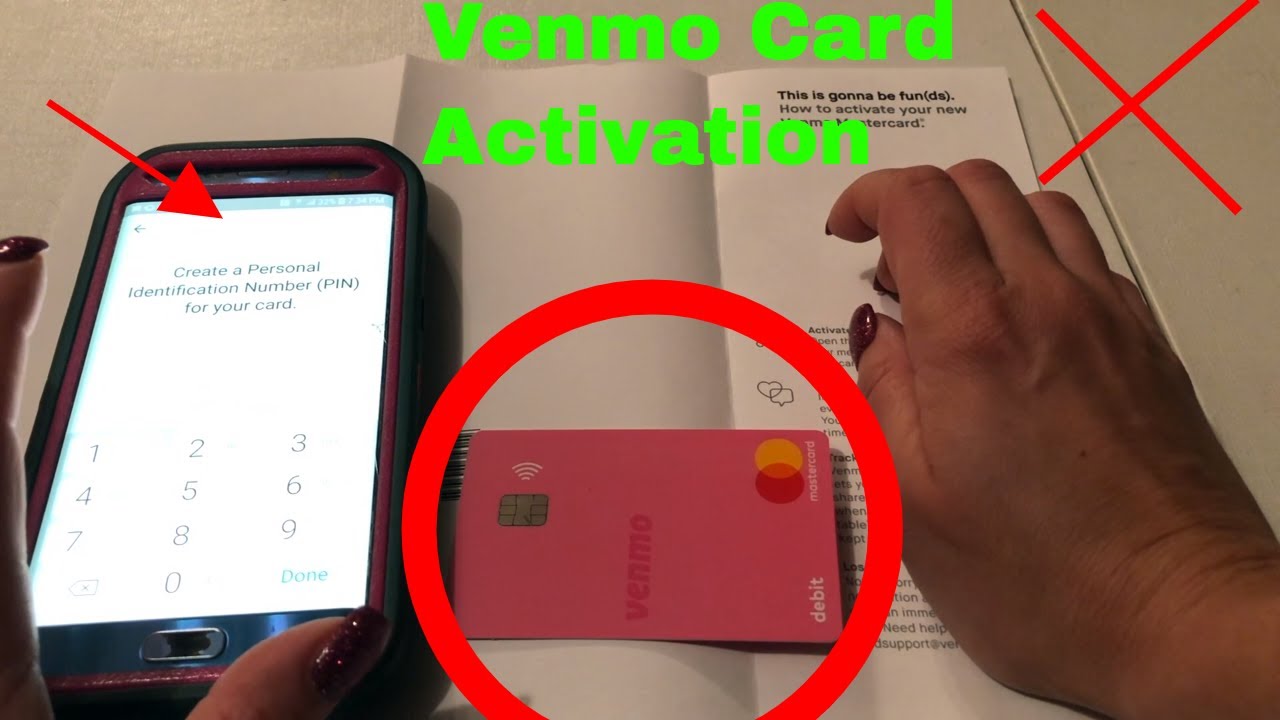

Venmo debit cardholders must first activate the card before using it. Activation requires access to the debit card in order to get the necessary card details.

In a few easy steps, users may activate a Venmo debit card online through the app:

-

On a mobile device, launch the Venmo app

-

In the upper-right corner, tap the menu symbol

-

Select the Venmo card option

-

Select Activate

-

Enter the expiry date of the debit card

-

Enter your debit card information

-

Enter the CVV code from your debit card

-

Enter and confirm your PIN. A message should appear confirming that your card has been activated

![]() How do I Add Money to my Venmo Debit Card?

How do I Add Money to my Venmo Debit Card?

Venmo debit cards may fund their accounts using a confirmed bank account. The Venmo app may be used to verify a bank account. After verifying a bank account, a cardholder may add money to their Venmo balance for usage with the debit card.

Follow these procedures to add money to your Venmo balance:

-

On a mobile device, launch the Venmo app

-

Select the person symbol

-

Select “Manage Balance”

-

Enter the amount that you want to send to your Venmo account

-

Select “Next”

-

Confirm the transfer information

-

To begin the transfer, tap “Add [amount] immediately”

Transfers from a confirmed bank account to a Venmo account take three to five business days on average.

![]() Venmo Flow Chart

Venmo Flow Chart

| 1st step | Download Venmo app |

|---|---|

| 2nd step | Sign up and Verify |

| 3rd step | Add card or Account Details |

| 4th step | Add/ Search/ Invite Friends |

| 5th step | Send/ Receive Money |

| 6th step | Cash out |

| 7th step | Feed Published to Social Network |

![]() How do I get a Venmo Debit Card?

How do I get a Venmo Debit Card?

Users of the Venmo app may obtain a Venmo debit card by performing the following:

-

On a mobile device, launch the Venmo app

-

Choose the “Cards” tab

-

To apply, choose Venmo Debit Card

-

A Better Banking Experience

All Venmo users do not yet have access to the Venmo debit card. If the card is not yet available, customers will get a “Get in Line” notice. Within three weeks, the Venmo debit card should come in the mail.

![]() How do I Replace a lost or stolen Venmo Debit Card?

How do I Replace a lost or stolen Venmo Debit Card?

If your Venmo debit card is lost or stolen, utilize the app to deactivate it so that it can no longer be used. Here are the steps you must take:

-

On a mobile device, launch the Venmo app

-

Under the Venmo Debit Card section, tap the picture of the lost or stolen card

-

To disable the card, choose the option

-

If you can’t go into the Venmo app, phone 855-204-4090 to cancel the card

Recovered Venmo debit cards may be renewed at any time through the app or by phone. To reactivate a Venmo debit card through the app, follow these steps:

-

On a mobile device, launch the Venmo app

-

Under the Venmo Debit Card section, tap the picture of the lost or stolen card

-

To reactivate the card, choose the option

To purchase a replacement Venmo debit card, call 855-204-4090 or utilize the Venmo website’s contact form.

Summary

The Venmo Debit Card, issued by The Bancorp Bank, enables you to withdraw cash from ATMs for free as long as you use a MoneyPass ATM in the United States. Outside of the MoneyPass network, ATM withdrawals cost $2.50.

What is Venmo?

What is Venmo?

Venmo is a peer-to-peer (P2P) payment software for iPhones and Android phones that enables the rapid and simple exchange of money between people.

Venmo launched as a text-message-based payment delivery system in 2009. The firm then created a platform with an integrated social network in March 2012 in an attempt to profit on the booming P2P economy.

Braintree, the mobile payment system used by Airbnb, Uber, and other ecommerce titans, purchased Venmo for $26.2 million less than six months later.

Less than a year later, Venmo saw a significant increase of users when eBay paid $800 million for Braintree and integrated it into its PayPal division.

Venmo originated in 2009 as a peer-to-peer payment platform based on text messages; three years later, it released a platform with an integrated social network. Braintree bought it out in 2012, and eBay bought it out a year later.

Sending money via Venmo incurs a normal 3% charge, however the price is waived when the transaction is paid using a Venmo balance, a bank account, or a debit card.

When consumers transfer money using a credit card, the 3% charge is not waived. Venmo is accepted as payment by about 2 million online and offline shops.

![]() Working of Venmo

Working of Venmo

Venmo users may quickly begin transferring dollars with one another after downloading the app on their phones and connecting their Venmo accounts to their credit card, debit card, or bank accounts, with Venmo acting as a virtual fiscal mediator.

In other words, Venmo may be seen as a mediator between the two users making a payment transaction and their respective bank accounts.

Consider the following example: Sally agrees to sell a jewelry to Mary for $50. Mary transfers the cash to Sally through Venmo, which increases Sally’s Venmo balance by $50 while decreasing Mary’s Venmo balance by the same amount.

A Venmo balance is, in this sense, a virtual ledger that symbolizes monies moving hands inside the Venmo platform. The money isn’t officially in that user’s hands until Venmo deposits it into the recipient’s bank account.

Money may be given or requested on the Venmo app by pressing the pay or request button and then inputting the other party’s email address, phone number, or username.

If you are the recipient of money, you have the option of keeping them in your balance or transferring them to your associated bank account. Money may be contributed to your Venmo account through your bank, as well as a debit card or other payment method.

It is also possible to make payments using the app without having the appropriate cash on hand. If you make a payment that is more than your current Venmo balance, the money will be deducted from your associated bank account.

In contrast, if the transfer amount is equal to or less than your balance, the platform funds will be utilized.

![]() How long does it take to send and receive money?

How long does it take to send and receive money?

Money transferred from one Venmo user to another should show in the recipient’s account instantly. External bank transfers are a little more involved, with speeds changing based on whether or not you’re ready to pay a charge.

If you add money to your Venmo balance from your bank account, the transaction may take three to five business days to complete. Money transfers in the other way might take up to three business days.

If you need to get your money out quickly, you may choose a fast transfer. These transactions may take up to 30 minutes to complete, and Venmo presently charges a 1.5 percent fee, with a maximum price of $15 per transfer.

PayPal has stated that Venmo’s fees would be increased to 1.75 percent and $25, respectively, beginning May 23, 2022. The new prices will go into effect for PayPal clients on June 17, 2022.

![]() Social side of Venmo

Social side of Venmo

Venmo has dominated the P2P payment business by making money transfers enjoyable and entertaining. Users may spice up the deal by describing the traded things using emoticons.

For example, if one friend pays for a glass of wine for another friend, the friend may make a Venmo payment with the addition of a wine glass emoji as a humorous gesture.

“This removes the unpleasantness of asking your buddy to pay back their half of the bar bill, merging the social and financial elements,” Venmo representative Josh Criscoe adds.

![]() Venmo’s Fees

Venmo’s Fees

According to Venmo’s website, there is no cost for transferring money over the platform provided the funds are financed using a Venmo balance, a bank account, or a debit card.

However, credit card payments trigger a regular 3 percent charge, which originates with the credit card issuers and is merely passed on to customers via Venmo.

Summarized

The Venmo MasterCard Debit Card is a MasterCard network-enabled debit card. It’s connected to your Venmo account and lets you spend your Venmo balance dollars anywhere you like. MasterCard is accepted in the United States and its territories.

How Venmo makes Money?

How Venmo makes Money?

Venmo makes a considerable amount of money through the per-transaction fees it charges merchants. Venmo is compatible with at least 2 million retailers thanks to PayPal’s infrastructure, giving it with two distinct revenue streams.

The first sort of income is made possible via a “smart payment button” that can be integrated into other applications to allow for in-app purchases.

For example, Uber implemented a feature in 2018 that lets app users to pay for trips and Uber Eats using Venmo without ever leaving the Uber app. Furthermore, the Uber app allows numerous users to split the cost of transportation and meals.

The Venmo debit card, which draws directly from a user’s Venmo balance, is the second source of merchant income. This card is issued by MasterCard and may be used at any merchant that accepts MasterCard.

This feature has allowed Venmo to grow outside its unique P2P platform, enabling clients to interact directly with online businesses and physical stores.

Venmo charges merchants a 1.9 percent fee plus 10 cents each transaction in both revenue-generating situations. Companies are prepared to pay these prices because of the influx of new clients brought in by Venmo.

Furthermore, Venmo users are more inclined to promote participating firms’ profiles on their social media sites.

“Collaborating with Venmo is similar to partnering with a credit card processor, but with far greater potential,” consultant Richard Crone explains. "Retailers spend a lot of money trying to get you to like and follow them on Facebook and Twitter.

However, they may be able to get these items for free as a result of permitting Venmo payments.

People may see where their friends have gone and what they’ve purchased, thus turning users into marketing for companies in a highly desired target group."

![]() Is Venmo Safe?

Is Venmo Safe?

Security flaws may affect any Internet-connected application. As a result, Venmo and other platforms that are directly connected to consumer bank accounts must adhere to the strictest security requirements.

Venmo employs data encryption technologies to safeguard consumers from unauthorized transactions while maintaining user information on secure servers.

Users may also utilize the mobile payment service to log out of lost or stolen phones and set up personal identification number (PIN) codes for mobile apps.

Unfortunately, hackers and fraudsters have still been able to get through these precautions. Hackers may quickly move a user’s Venmo balance to a new bank account after getting access to the user’s account.

Hackers may also redirect a user’s transaction alerts by altering the user’s connected email address, keeping them in the dark until the bank ultimately tells them of balance changes long after crimes have occurred.

There have been reports of Venmo users losing thousands of dollars.

![]() Venmo under Pressure to clean up its Act

Venmo under Pressure to clean up its Act

Venmo has been chastised for its lack of security, sluggish customer support response times in the event of a breach, and inability to safeguard customers’ privacy.

These criticisms have highlighted the app’s flaws, but on the plus side, they have spurred the firm to take steps to avoid future blunders and better serve its consumers.

In 2016, a significant settlement was struck in response to a lawsuit filed by Texas Attorney General Ken Paxton accusing Venmo of improper privacy, safety, and security practices.

The settlement includes a payout to the state of $175,000 as well as improvements to these practices.

Furthermore, in February 2018, Venmo reached a settlement with the Federal Trade Commission (FTC) for the company’s failure to provide information regarding privacy settings to users.

The FTC also found the corporation to be in breach of the Gramm-Leach-Bliley Act (GLBA) Safeguards Rule, which requires financial institutions to put in place safeguards to preserve the security, confidentiality, and integrity of consumer information.

Venmo is committed to biannual, third-party audits of its compliance efforts as part of the settlement for a period of ten years. Violations of these conditions may result in a civil penalty of up to $41,484 per violation.

![]() How to protect yourself with Venmo

How to protect yourself with Venmo

To resist hacking, users may take the following precautions:

-

Never keep a huge sum of money in your Venmo balance

-

Transfer Venmo transactions to associated bank accounts as soon as possible

-

Only use Venmo to trade money with individuals you know

-

Be wary of fraudsters that send emails requesting your password or other sensitive information pertaining to your account

-

Venmo will never ask you for this information and encourages users to report any suspicious behavior to support Venmo

-

To hide transaction records, change the setting to private. Otherwise, anybody, even strangers, may read the specifics of your transactions by clicking on your profile

Avoid losing money with Venmo

Avoid losing money with Venmo

The detail is below:

1. Choose a unique Password

Avoid using passwords that are simple to guess when creating your Venmo account password. Make use of upper and lowercase letters, numerals, and special symbols.

Instead of using a whole word, try employing a unique and rare abbreviation or phrase that will make it more difficult for a hacker to recognize. A password manager may also be useful.

2. Enable PIN Protection and Multifactor Authentication

These two procedures only take a few minutes to do, but they may help protect your Venmo account if your mobile device is lost or stolen. You should also set up a password or lock on your phone if you don’t already have one.

3. Link Credit Cards, not Debit Cards

Venmo lets you add credit and debit cards to your account and use them as payment options. In terms of security, a credit card is preferable than a debit card since credit cards have stronger legal safeguards against fraud than debit cards.

To be Precise

Venmo is generally secure, but each time you transmit money online, you are incurring a risk. Being aware of possible security concerns and adopting protective measures will help lessen the likelihood of losing money using Venmo or another financial app.

Frequently Asked Questions:

Here are some questions about How to activate your Venmo Debit Card:

1. How can you get the debit card activated?

Place your debit card in the ATM. Enter your debit card number as well as your ATM pin. You’ll next be asked to generate a new ATM pin. Follow the on-screen prompts to input your new ATM PIN, and your card will be activated.

2. Why isn’t my Venmo debit card functioning properly?

Venmo payments may be denied for a variety of reasons. Among the most prevalent explanations are: Your bank or credit card company has declined the transaction (outside of Venmo) One of Venmo’s automatic security flags was raised as a result of the payment.

3. Can you use the Venmo debit card in the same way as you would any other debit card?

PayPal, Venmo’s parent firm, debuted the Venmo card in 2018, and it functions similarly to many other debit cards. You may use it everywhere MasterCard is accepted, including shops and online, as well as ATMs that show the MasterCard, Pulse, or Cirrus acceptance logos.

4. Is it necessary to activate a new debit card?

When you get your new debit card, it will be activated and available to use right immediately. If you wish to make a contactless payment, you must first do a chip-and-PIN transaction.

5. Is it possible to use my Venmo debit card at an ATM?

Yes! You may use your Venmo Debit Card to withdraw cash from ATMs or as cash back when making a transaction anywhere in the United States. Simply check for the MasterCard, PULSE, Cirrus, or MoneyPass acceptance markings at ATMs and the MasterCard, Maestro, or PULSE acceptance marks at POS.

6. Is Venmo accepted at Walmart?

As of 2022, Walmart allows Venmo as a payment method. Install the Venmo app and scan the QR code at the self-checkout counter to pay in-store. Venmo may be used online by choosing PayPal at the checkout and then Venmo from the PayPal page.

7. What exactly is a Venmo debit card?

The Venmo MasterCard Debit Card is a MasterCard network-enabled debit card. It is connected to your Venmo account and enables you to spend your Venmo balance money everywhere MasterCard is accepted in the United States and its territories.

8. What is the number on my Venmo debit card?

The Venmo Credit Card portion of the Venmo app contains your virtual card number. Please keep in mind that you must validate the last four digits of your Social Security Number in order to display the virtual card number, expiry date, and CVV.

9. Can I use Venmo if I don’t have a bank account?

For withdrawals or topping up, most Venmo users connect their US bank accounts to their Venmo accounts. If you don’t have a bank account, you can still use Venmo to obtain cash. You just need a Venmo Debit Card. The card functions similarly to other normal bank and credit union cards.

10. How long do Venmo debit cards last?

Replacement cards that have not been activated within 90 days will be closed permanently. Once your new card is activated, the old one should be discarded. The Bancorp Bank provides the Venmo MasterCard Debit Card under license from MasterCard International Incorporated.

Conclusion

To conclude the topic about How to activate your Venmo Debit Card, we can say that Even though it may seem risky to transmit actual money using an app, Venmo is quite secure to use. Because it employs data encryption technology to safeguard your account information, no one else will be able to access your credit card or bank account.

Related Articles

Can You Use An Unactivated Debit Card

How To Use Debit Card Without Pin