States without Sales Tax are Alaska, Montana which does not have sales tax but 1.991% of rental tax, Delaware, New Hampshire, Oregon. Sales tax is additional money a person pays while purchasing goods and services and it is imposed by the government. Retailers charge the sales tax and pass it to governing bodies.

sales tax in US

Sales Tax is money a person pays while purchasing goods and services collected by governing bodies depending on some factors like in which states you live in - you only have to pay tax in states where you have a connection as Sales tax is governed at the state level and no national sales tax imposed in the U.S.

The goods or services as different tax rates apply to different goods and individuals can also be exempted from taxes depending on states like living in States without Sales Tax, that are Alaska, Montana Delaware, New Hampshire, Oregon. This can differ from state to state.

Alaska – One of the States without Sales Tax

The State of Alaska (AK) does not have any state sales tax but local sales tax is collected in addition to the Alaska sales tax of 0%. The state of Alaska allows counties and its cities to collect a local sales tax (under local governments ) of 7.00% but they do have the highest sales tax rate in the city Homer with 7.85% of sales tax on all non-exempted purchases within their jurisdiction. There are a total of 141 local tax jurisdictions across Alaska, and they collect an average of 1.669%.

In some states, items like alcohol and prepared food (with restaurant prepared meals and some premade supermarket goods) are charged at a higher sales tax. The Alaska sales tax applicable to the sale of boats, cars, and real estate sales may also vary by local tax jurisdiction.

So, the actual sales tax you pay on goods and services in Alaska may vary between 0% and 7.85% depending on which county or city the sale is made in.

The following counties in Alaska have a sales tax rate that occurs within that county is:

- Aleutians East Borough has a sales tax of 6%

- Aleutians West Census Area has a sales tax of 4%.

- Bethel Census Area has a sales tax of 6%.

- Dillingham Census Area has a sales tax of 6%.

- Haines Borough has a sales tax of 4%.

- Hoonah-Angoon Borough has a sales tax of 6.5%.

- Juneau Borough has a sales tax of 5%.

- Kenai Peninsula Borough has a sales tax of 7.85%.

- Ketchikan Gateway Borough has a sales tax of 6.5%.

- Kodiak Island Borough has a sales tax of 7%.

- Lake And Peninsula Borough have a sales tax of 6%.

- Matanuska-Susitna Borough have a sales tax of 3%.

- Nome Census Area has a sales tax of 7%.

- North Slope Borough has a sales tax of 3%.

- Northwest Arctic Borough have a sales tax of 6.5%.

- Petersburg Borough has a sales tax of 6%.

- Prince Of Wales-Outer Ketchikan Borough has a sales tax of 7%.

- Sitka Borough has a sales tax of 6%.

- Skagway Borough has a sales tax of 5%.

- Valdez-Cordova Census Area have a sales tax of 6%.

- Wade Hampton Census Area has a sales tax of 6%.

- Wrangell Borough have a sales tax of 7%.

- Yakutat Borough have sales tax of 5%.

Average Local Sales Tax

1.669%Alaska does not have a state sales tax, which means their State Rate is equal to 0%. but local sales tax is collected in addition to the Alaska sales tax. Sales tax on common exempted goods like $100 Restaurant Dinner, Groceries of $100, clothes of $100, consumer product of $100 are 0% which means the total bill is $100.

Delaware – State without sales tax

There is no state sales tax in Delaware. There is also no state corporate income tax on goods and services provided by Delaware corporations operating outside of Delaware.

- Delaware is a state without sales tax

- The state of Delaware does not allow cities or counties to apply any type of sales tax

- Businesses pay tax on their gross receipts as an alternative to sales tax, but this tax is not passed on to consumers.

- The state has no value-added taxes (VATs),

- It does not apply tax on business transactions

- It does not have a use tax, inventory, or unitary tax.

- No inheritance tax in Delaware

- No capital shares or stock transfer taxes.

In Delaware, there is sometimes a county-level real estate property tax, but that tax is very low compared to other U.S. states. Also, it does not matter if a company’s location is within the state or not – as a Delaware company, no in-state tax is applicable on the purchase of goods and services.

Types of Delaware Tax

- Delaware tax on gas, on regular gasoline, is $0.23 per gallon and diesel fuel tax is $0.23.

- Delaware tax on Alcohol, that is 16 cents per gallon, and ■■■■■■ tax is $3.75

- Delaware tax on cigarettes

- Property Tax, typical Delaware homeowner pays just $1212 every year in these taxes

- Capital Gains tax, an individual that lives in a different state is taxed at 6.75 percent.

- Estate Tax

- Real property tax

- Gross Receipts

- Personal income tax

The State of Delaware sales tax only applies to buyers of the product. Entities purchasing goods for resale or improvement can use a Delaware Sales Tax Exemption Form to buy the goods tax-free.

Delaware sales tax on cars

If someone is purchasing a car in Delaware, they may have to pay 4.25% of additional money as a “Motor Vehicle Document Fee”.

Average Local Sales Tax

0.000%

The Delaware state sales tax of 0% is applicable statewide. Companies or individuals who wish to make a qualifying purchase tax-free must have a Delaware state sales tax exemption certificate, which can be obtained from the Delaware Division of Revenue. Individuals and companies who are purchasing goods for resale, improvement, or as raw materials can use a Delaware Sales Tax Exemption Form to buy these goods tax-free. A 3.75% “document fee” is collected on all automobile sales and necessities such as groceries, clothes, and drugs are exempted from the sales tax. However, Some goods may not be eligible for these sales tax exemption rates, such as expensive clothing, junk food, and non-essential pharmaceuticals.

Montana – State without sales tax

Montana is also one of the states without sales tax which is 0.000%. There are also no local sales taxes beyond the state rate.

- Montana charges no sales tax on goods and services purchased within the state.

- In Montana, cities, and counties also do not charge any type of sales tax on general purchases.

- enjoys tax-free shopping.

- $1.70 of tax for a standard pack of 20 cigarettes,

- Some locations charge tax on lodging in the state of Montana, such as Whitefish.

- The average Montana sales tax after local surtaxes is 0%.

- But there are some additional taxes on tourism-related businesses such as hotels (7%) and rental car companies (4%).

- It imposes 4% of selective sales and Use tax on vehicles rented.

Average Local Sales Tax

0.000%

Montana also does not allow local jurisdictions to collect a local sales tax. The Montana state sales tax of 0% is applicable statewide but when making online travel arrangements for tourism or other purposes, a person will be charged federal taxes on airline tickets and may be charged state and local taxes on hotel or rental car and also all basic necessities like grocery, clothing under $100 are exempted from sales tax but not the expensive and luxury ones.

New Hampshire – State without sales tax

New Hampshire is also one of the states without sales tax and Local governments are not allowed to declare sales taxes in light of the statewide 0% sales tax.

But, the state also has one of the highest costs of living at 5% above the national average and the ninth highest in the country.

- A sales tax of 9% exists on prepared meals in restaurants, short-term room rentals, and car rentals.

- Also 7% tax on phone services

- $.75 per $100 tax on real estate sales.

- Some excise taxes are applied on sales of tobacco and electricity in the state.

- its residents of New Hampshire don’t have to pay any sales tax.

- Forest tax is imposed at the time of cutting woods, at 10% of the total value of the wood, excluding cutting.

- Income tax in New Hampshire is only applicable to interest income and dividend income.

Oregon – State without sales tax

Oregon is also a state with 0.000% of state and local sales tax and has a lower cost of living if compared to the national average of the U.S.

- But, cities in Oregon may impose sales taxes on certain goods.

- There is an excise tax on tobacco and on pre-packaged alcoholic beverages.

- Oregon has a high personal income tax relative to other states.

- But, the state of Oregon has a lower personal income per capita, at $40,000, the 15th lowest according to the USA.

- Many local bodies also collect additional lodging taxes.

The state of Oregon has high income tax so, as an individual, if you are lucky at the supermarket with 0 sales tax on your goods in Oregon, you may be charged high for residing in the state.

States without Sales Tax on Cars

When purchasing a car you aren’t required to pay sales tax for cars if you are in a State without Sales Tax. The list of these states with minimal to 0 sales tax on cars are as follows:

- Alaska – 0%

- Delaware – 4.25% “Motor Vehicle Document Fee”

- Montana – 0%

- New Hampshire – 0%

- Oregon – on Used Vehicles: 0% and on New Vehicles: 0.5% (One-half of 1 percent)

- Iowa – 5%

- New Mexico – 3%

- North Carolina – 3%

- South Dakota – 4%

If you live near these states, you can save while purchasing cars because you don’t have to pay any state sales tax. Some states do charge use taxes or Document Fee, which may be as expensive as sales taxes, depending on where you purchase a car.

States with no income tax

There are 9 states in the U.S. with no income tax and that are Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, Wyoming

have no income taxes on their citizens. Income tax is usually how much an individual makes, which means if you make more you’ll pay more, but living in a state with no income tax, you’ll probably not have to pay huge money in terms of taxes.

But states with no income tax are not always beneficial for a person who thought of moving to a no income tax state, because governing bodies get that taxes through other sources like having higher property and sales tax.

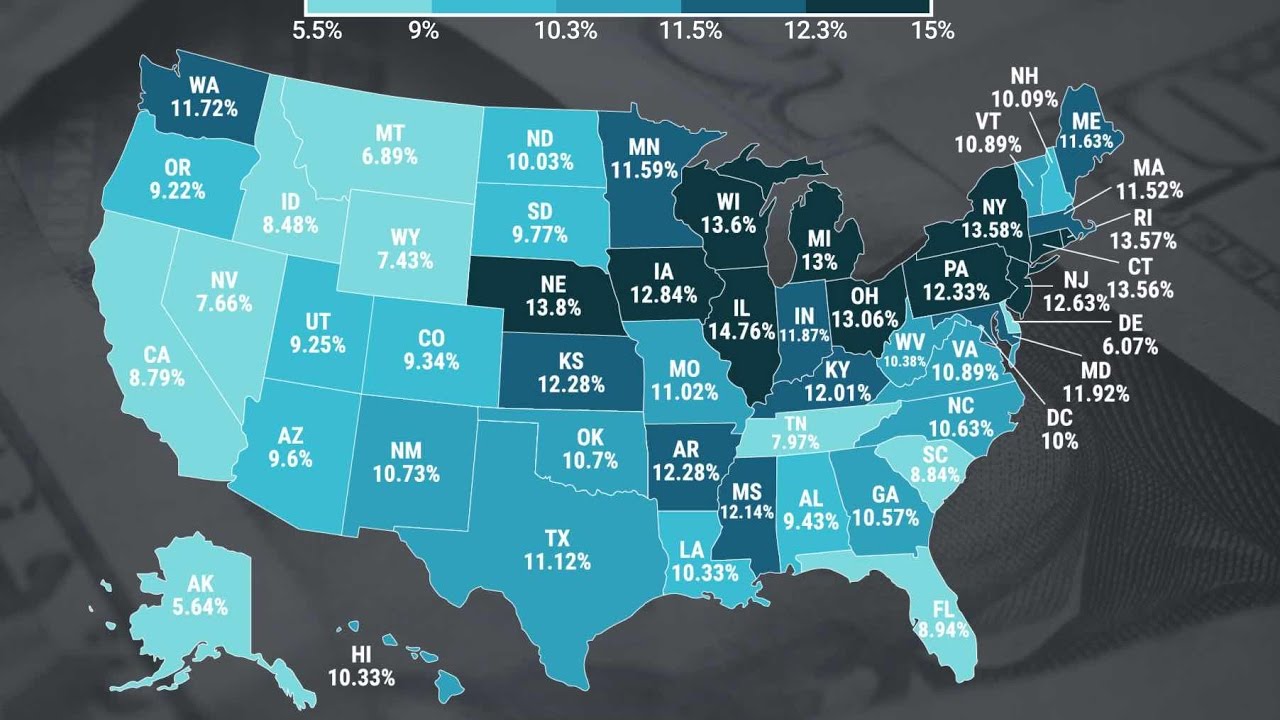

States with highest sales tax

Some states with the highest sales taxes are as follows:

- Tennessee with sales tax of (9.55 percent)

- Louisiana with sales tax of (9.52 percent)

- Arkansas with sales tax of (9.51 percent)

- Washington with sales tax of (9.23 percent)

- Alabama with sales tax of (9.22 percent)

Sales tax in NewYork

In the state of New York, the sales tax range is from 7% to 8.875% with most counties and cities charging a high sales tax of 8% and total sales tax in the state of New York is 8.875% which is the highest rate in the state. With such a high sales tax, the cost of living in New York City is also high.

when talking about sales tax, the sales tax rate in New York includes two separate taxes: sales tax and use tax, and both taxes are the same rate so it doesn’t matter where you purchase things. New York City has its own rules, so the state charges a sales tax on some goods and services that the state doesn’t tax.

- New York sales tax is currently 4%.

- Each county in NY charges an additional sales tax between 3% to 4.5%.

- Counties in the metropolitan commuter transportation district also collect a sales tax of almost 0.375%.

- Each county or city in the state of NYC adds its own sales tax.

- There is also sometimes a transit tax, which includes along with sales tax.

- Common goods that are exempted from sales tax include groceries and clothing or footwear that cost less than $110.

- Clothing and Footwear under $110 are exempt from New York City and NY State Sales Tax. However, purchases above $110 are subject to a 4.5% NYC Sales Tax and a 4% NY State Sales Tax.

- The City Sales Tax on services like Beauty, barbering, massage, tattooing and other, similar services like Health and Fitness clubs, gymnasiums is 4.5%, there is no New York State Sales Tax. If products are purchased, an 8.875% combined City and State tax will be charged.

Sales tax in California

- In most areas of California, their local jurisdictions of state increase district taxes that increase the tax owed by a seller. Those districts’ taxes range from 0.10% to 1.00%.

- The state tax rate is 7.25%. Every Sellers is required to report about taxes and pay those to the district.

- Sellers who wanted to start any business in California must be registered with the California Department of Tax and Fee Administration (CDTFA) and must pay the state’s sales tax that applies to all retail sales of goods and services except those sales that are exempted by law.

- The use tax mostly applies to storages or consumption in California of goods purchased from sellers in transactions, this use tax not subject to the sales tax.

- Use tax also applies to purchases shipped to California like when consumer orders from another state, including purchases made by email order, telephone, or online.

- The state could require to register and collect and remit sales tax from entities only if they had a physical presence in the state of California, such as employees, retail stores, or warehouses.

The sales and use tax rate in different locations of California has three parts:

- the state tax rate

- the local tax rate

- any district tax rate that may be in effect.

Some customers under specific conditions are exempted from paying sales tax under California law. Like, government agencies, nonprofit organizations, and wholesalers who purchase goods for resale and retailers are required to collect exemption or resale certificates from buyers to complete each exempted transaction.

In terms of Sales tax nexus in California, the Supreme Court of the U.S. had overruled the physical presence rule with its decision in South Dakota v. Wayfair, Inc. States are now free to tax businesses. This decision has had an important impact on online sellers as they are no longer bound to have a physical presence in California in order to trigger a connection between a retailer and a state that requires the retailer to register then collect and remit sales tax.

Frequently Asked Questions (FAQs)

1. What 7 states have no taxes?

The states of Alaska, Florida, Nevada, South Dakota, Texas, Washington, and Wyoming of the U.S. do not impose the income tax

2. Which state in the U.S. has the lowest sales tax?

The lowest sales tax in the state and average local sales taxes after Alaska’s state are in Hawaii with 4.44%, and Wyoming 5.34%.

3. How many States without Sales Tax in the USA?

There are 5 States without Sales Tax that are Alaska, Montana, Delaware, New Hampshire, and Oregon.

4. What is the least taxed state?

After Alaska, the least taxed states are Hawaii with 4.44%, and Wyoming with 5.34% of sales tax.

5. How can I live tax free?

Actually, It’s not possible to completely live a tax free life as taxes transferred to government bodies to collect revenue as they contribute to the gross domestic product (GDP) of a country but there are some ways anybody can use to reduce some of their taxes like:

- Invest in municipal bonds

- Hold your stocks for the long-term

- Receive gifts

- Rent your home

6. What state has the highest sales tax?

California has the highest sales tax rate of 7.25% and the second highest sales tax rate at 7% is in Indiana, Mississippi, Rhode Island, and Tennessee.

7. What are the 10 highest taxed states?

In 2020, the 10 highest income taxed states are:

- California 13.3%

- Hawaii 11%

- New Jersey 10.75%

- Oregon 9.9%

- Minnesota 9.85%

- District of Columbia 8.95%

- New York 8.82%

- Vermont 8.75%

- Iowa 8.53%

- Wisconsin 7.65%

8. What city has the highest sales tax?

Sales taxes in the U.S. are imposed by state, counties and local bodies, Some of the highest combined state and local sales taxes are in cities of:

- Chicago,

- Illinois

- Long Beach, California, with the highest percentage of 10.25 %.

Conclusion

Sales taxes can have an immediate impact on the state but States without Sales Taxes do not matter a lot in some cases as they are just a part of an all-tax structure by governing bodies. For example, Tennessee has high sales taxes but no wage income tax whereas Oregon has no sales tax but has high-income taxes in the country also factors influence business location and investments, local governing bodies, etc.