Amazon Payment Revision Requirement is a message informing you that verification is required of your payment because the bank has refused your payment. Amazon Payment Revision Requirement means that your purchase transaction has not been completed; again, you must complete it.

Amazon payment revision needed means:

Many Amazon buyers have seen the message “Need to confirm payment.” What does the message “proof of delivery” mean? The “payment Confirmation Message” message from Amazon means the bank has refused your payment and has not completed the transaction.

Maybe by mistake, you have changed your card, or may some unexpected reason interrupted payment. You may have clicked the return button and closed or updated the page at the time of purchase.

These events suspend payments. In addition to the reasons listed above, your payment failed for several reasons. You may have entered the wrong billing address, card name, CVV, or expiration date. Don’t hesitate to contact your bank if all the information you have entered is correct. And you reported a problem.

Payment Confirmation Required-Amazon:

If you receive a “Payment Confirmation Required” notification from Amazon, your payment failed, and the bank rejected your payment. Did not complete the transaction because you may accidentally cancel the process by clicking the “Back” button during the checkout process, or you may close or refresh the page during the transaction process.

This interruption stopped the billing process before completion. You may also have changed your card but did not change the number on your Amazon account.

Why did you receive a payment confirmation notification from Amazon?

The following is a summary of why an Amazon payment change notification is required.

Payment failed.

Your bank rejected your payment.

Did not complete the transaction.

You accidentally updated or closed the page.

You pressed when you ■■■■■■■■ the transaction 1Pressed the return button.

The connection with Amazon and your bank failed due to technical reasons, and You lost your card and forgot to update your Amazon account.

What should you do if you receive a payment confirmation notification from Amazon:

Log in to your account;

Scroll down to “Your order”;

Scroll to the order you want to view, click to view payment method; Select the payment method you want,

click “Repeat Payment”;

If you want to cancel your order on Amazon, please go to Require Amazon Payment Verification: Cancel Order.

What if Amazon still refuses your payment?

If Amazon still refuses your payment when activity the higher than steps, you must contact your bank and perform the subsequent actions:

1. evoke payment rules:

If you’ve got not purchased on Amazon, your bank will settle for your payment. Delay once you receive it verbally to confirm that the group action is legal. Your bank sometimes flags these new or sudden operations. Therefore, you wish to authorize 1the payment.

Verification of your account sometimes takes some seconds; however, in some cases, the method may take weeks or months; this verification depends on the bank’s responsibility. The response time of your bank depends partly on the accuracy of your bank information.

2. Ensure you’ve got enough funds:

Check your balance to examine if you have enough funds to create a purchase. You’ll not have enough 1funds to purchase your purchase on Amazon.

3. If the matter isn’t solved, attempt another card:

If you and the bank cannot solve the problem and you wish to shop for one thing urgently, you’ll be able to amend a different card.

4. Inquiry concerning credit limit :

Your purchase might exceed the credit limit set by the bank or daily withdrawals. Ask your bank for this info and regulate 1your credit limit accordingly.

5. may are frozen your open-end credit :

A similar incident might have occurred when entering the incorrect PIN code multiple times. Your bank will reset your PIN along with your consent.

6. Check the knowledge provided:

Is that the MasterCard variety you entered correctly? What’s the validity amount of your card? have you ever entered the proper asking address and made contact with a phone number? Raise your bank whether or not the private banking information in your hands matches the bank information.

Amazon Payment:

Amazon allows a kind of repayment plans, including debit and credit cards:

- American Express gift cards or prepaid credit cards

- Visa

- Amazon Credit Builder

- Amazon Rewards Visa Signature Card

- Amazon Store Card

- Amazon Gifts

- Diner’s Club Card (the US only)

- China UnionPay (credit cards only)

- MasterCard / EuroCard

- NYCE

- STAR

- JCB

- American Express Discover Network

Can you use PayPal on Amazon?

You cannot directly use PayPal to pay for purchases on Amazon, but you can use it indirectly.

The method is as follows:

1. Accept PayPal to get Amazon gift cards :

You can use your PayPal account to buy Amazon gift cards on eGifter.com. Then, you can use Amazon gift cards to shop on Amazon. Before buying a card, please make sure that the website is legal.

2. Use your PayPal money to open a debit card:

You can also open a debit card, such as PayPal Business Debit MasterCard or Eon bank account, to transfer PayPal money. Use the card for shopping on Amazon.

3. Using the PayPal Cash card:

You can order the PayPal Cash card and use it like any other card to purchase goods from Amazon. You must provide the associated phone number and address with your PayPal account.

It would be best if you also used PayPal to verify your Social Security number and date of birth so there are no issues with your account. By providing this information to PayPal, you can apply for a PayPal card here to receive cash.

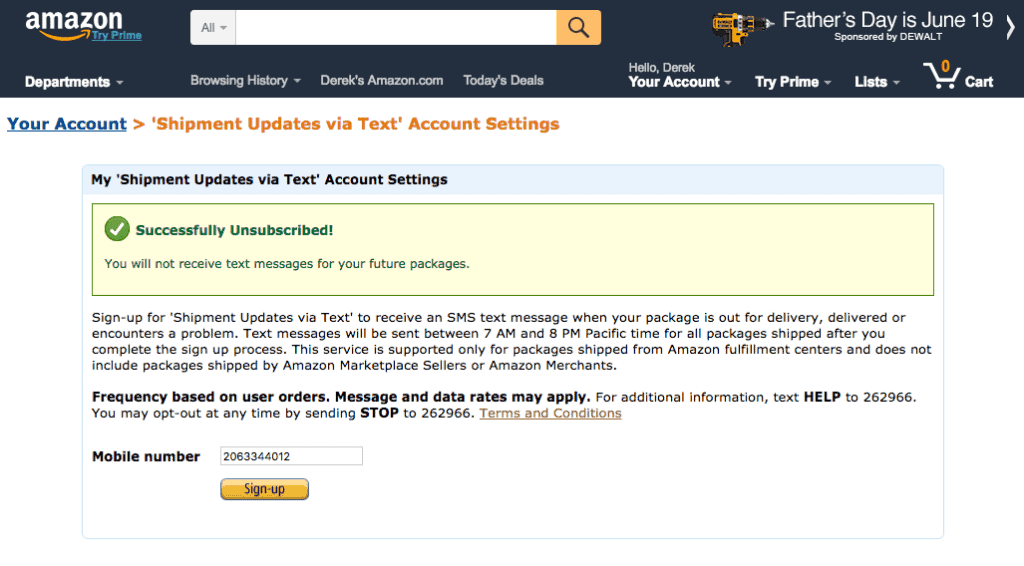

How long does Amazon wait for payment?

Amazon usually waits for 7 days but can wait for 21 days for some special reason. So for a seller, it is better to wait for amazon’s pending status clearance before shipping because some sellers cancel the order after three days of unpaid.

So, avoid the cancelation you inform the Amazon or seller. A message may appear on Amazon saying “payment verification required-order cancellation” or “payment verification required-update payment method.” Contact the financial institution if you see this message because they may decline the payment.

How do you know if your purchase has been paid?

You usually receive payment confirmation immediately, but this process may take a few days, depending on the agreement with the seller.

Has Amazon blocked buyers?

Amazon rarely suspends buyer accounts; however, in some cases, Amazon will do so because of police abuse, such as B. Use your account to purchase products related to fraud or sales programs. Amazon also prevents sellers who are proven to violate its policies and regulations, such as making false reviews, brushing teeth, and raising prices.

What if Amazon continues to send messages?

You have sufficient funds, bank information is correct, and everything is in order, but Amazon continues sending messages requesting payment verification. These problems can happen for other reasons. Other possible reasons include using a VPN, or your Amazon buying behavior is unstable.

You can explore these aspects. You can also forward the question to Amazon customer service. Similarly, the “Payment Confirmation Required-Amazon” notification will appear if your payment and transaction fail.

One of the reasons is that you may forget to change the card number after losing, accidentally refresh the page, or click the back button. Next, we will learn more about successful payment and shopping tips on Amazon.

Amazon shopping success tips:

1. Know whether your payment method is accepted on Amazon:

Use the list above to verify whether your payment method is accepted on Amazon. Check if you have enough 1funds to pay for the purchase.

2. Beware of affected stocks:

People can sell almost anything on Amazon as long as they meet the website’s requirements. However, there are some false third-party reports. So it is best to buy directly from Amazon.

You must use the seller’s history to verify your purchase if you need to buy from a third-party vendor. Only buy from trusted sellers.

3. Beware of false customer reviews:

Some sellers spend money to ask people to post false reviews. If you read more than one negative comment, the negative comment is likely to be real customer information.

4. Some items should not be purchased from Amazon:

You should never buy these items from Amazon because you may not get the best quality: Groceries, Beauty products, Jewelry, Batteries Collectibles from many previous nearby Goods supermarkets and specialty stores.

You can also quickly bring them back to the branch in the event of a failure. However, it may take several weeks to replace a defective Amazon product.

5. Don’t pass your bank details unnecessarily:

Never pass your bank details unnecessarily to third-party sellers, even if they contact you directly. Only Amazon should have this information. As long as you are careful, your bank details are safe on Amazon.

6. New customer checkout may take longer:

The checkout process may take longer if you are a new Amazon customer. Your bank and Amazon may need to verify that you are the true owner of the account and no one else. Use it. Elderly customers outside the normal consumption range may also encounter verification problems. Inform the bank in advance of the estimated cost.

7. Check your bank’s special regulations for online or electronic shopping:

You should know whether your bank has special regulations for shopping, electronic products, or the Internet. Before purchasing the goods, please ask the bank whether it allows you to pay for the goods.

8. Using a credit card is safer than using a debit card:

Uses a credit card instead of a debit card when shopping online. It applies not only to Amazon but also to other online shopping. Amazon may not accept debit cards anytime soon, especially if you are a new buyer (seller).

9. Do not pay directly to the seller:

Amazon is a secure marketplace that gives suitable pay systems. If the seller contacts you and asks you to pay in other ways, you must notify the seller because they do not agree with Amazon’s policies. Can only make payments through Amazon.

10. Using Amazon Pay is the safest third-party method:

Amazon Pay is the safest payment method if you need to shop through a third party. With this method, you don’t need to provide your bank details to an external reseller; in this way, your bank details are safe on Amazon.

Recurring payment value:

Recurring payments or bills occur when merchants automatically charge for goods or services according to a predetermined schedule. If you have authorized a merchant to debit your monthly credit or debit card, your bank statement or transaction record will show regular payments.

It is the monthly payment for goods or services provided to you. In short, you have subscribed to their monthly service, and your payment will be automatically deducted through virtual transactions.

The recurring billing system is very suitable for paying utility bills, such as telephone bills, cable TV bills, utility bills, Etc. Paying for magazine subscription fees and even gym membership fees is also great.

If you do not remember to allow repeated payments, you should contact the company or supplier to stop the repeated payments. Or tell your financial institution to no longer make regular payments.

Easy registration in the revolving payment system:

Of course, there are many benefits to participating in the revolving payment system, but the main one is its convenience to consumers. Consumers are already familiar with online transactions, but before the launch of this AutoPay system, they Complete monthly online bill payments by entering the same payment details every month.

For most people, this has become commonplace. The consumer’s payment method at this time. But with the advent of the circular payment system, it has become more convenient for consumers. So there is no need to visit the merchant or bank website to pay monthly bills. Link your bank account to a one-time merchant and set up a payment plan. The amount will be automatically deducted from your bank account every month.

Even if you fail to pay the bill, there is no need to worry anymore. This time, you always pay your bills on time as needed. Your bank account has sufficient funds. Therefore, you can also pay your monthly bills on time. However, when paying a credit card bill, you should link your bank account or debit card here so you don’t have to worry about paying the credit card bill.

Periodic payment limit:

Unfortunately, periodic payment has its disadvantages.

These include:

-

The inconvenience of fixing bill errors.

-

Paying unnecessary fees.

-

Rejecting bank accounts.

1. The inconvenience of fixing the billing error:

First, let’s talk about how the online payment solution works before the automatic payment solution before we had to wait for settlement. It gives us time to check the bill for any billing errors. If there are errors, please get in touch with the seller to correct the errors. We are required to pay the invoice only after receiving the correct statement.

Many customers are still using this payment system, especially those who have not registered for the recurring payment system. But what if you use this automatic payment system and there is an error in your bill? It is a problem. If there is an error in your report, you may have already paid the invoice.

What if you pay more than the correct amount? How do you repay? To solve this problem, immediately contact the seller and tell them about the mistake. The seller will then refund the amount but, in most cases, will not resolve this immediately.

In this case, the seller still needs to coordinate with the bank and wait for the bank to complete the processing. In some cases, they Can be completed the settlement in real-time, but this is not always the case.

2. Pay unnecessary fees:

Another disadvantage is that if you do not cancel the monthly subscription of the mobile application that you no longer use, you will end up paying unnecessary fees. The recurring payment plan is usually used to pay monthly mobile application subscription fees.

It can, of course, avoid unsubscribing because you can pay on time, but sometimes you no longer need and prefer to cancel your subscription for some applications. Sadly, you did not cancel your subscription before it expired. In this case, the application will automatically charge for its services.

*3. Rejected bank account:

You must ensure sufficient funds in your bank account to pay your bills on time. Otherwise, banks can reject the payment advice.

Recurring payment value:

The recurring payment is a transaction that occurs when merchants automatically charge customers for regular use of products or services. It is also called automatic invoice payment.

This payment system has several advantages. One of them is that it saves time for both consumers and merchants by providing a unique and convenient payment method. The regular payment platform allows merchants to generate reports at any time.

In addition, when the payment is transferred to their bank account, the merchant will automatically receive a notification. Customers can also choose to generate reports of all online transactions. They will be asked for every new online transaction so that they can track the amount withdrawn from their bank account. Another advantage of distributors is customer loyalty and loyalty.

As long as they are convenient for your customers, you can guarantee to maintain and expand your customer base. The regular payment system provides us several advantages, which we cannot ignore. Of course, there are also disadvantages. We must always be careful not to become a victim of fraud.

Prudence also saves us the inconvenience of wrong invoices. But the focus of this discussion is that the regular payment system is a technology that provides various conveniences.

What does the dealer get from it?

Merchants can use recurring payment systems as customer loyalty tools, mainly because they provide convenience to customers, but the system also provides other merchant benefits. This automatic payment system ensures that the goods or services purchased by sellers and customers are paid, benefiting their cash flow and reducing costs by eliminating billing and collection costs.

It can automatically process most of your claims. Has advantages and disadvantages, including that this program does not eliminate administrative tasks. If the customer’s bank account does not have enough money or the customer’s credit card runs out, this is problematic for the merchant.

The worst part for sellers is that they cannot collect much money. Some complex systems are very suitable for dealers to solve some of these problems. Other systems are also very suitable for customers to monitor their transactions online conveniently.

Reminders to customers and merchants involved in the revolving payment system

Whether you are a buyer or a seller, please keep the following tips in mind:

- Be careful when registering on the revolving payment platform.

- Check whether the payment method has the functions you need.

- As a salesperson, think about the churn rate.

- Monitor activities daily.

1. Be careful when registering on the regular payment platform:

For merchants, please research before registering your business on the regular payment platform. Try to verify that your subscription provider follows PCI industry-standard practices specific to payment security. You must ensure that your funds and overall business areas are free from fraud as your customers.

Look for articles or reviews about the company. Reading customer reviews is also very helpful.

2. Check whether the payment method has the functions you need:

If you are a merchant with foreign buyers, you must ensure that your payment method is flexible. Make sure you can accept payments in different currencies. As a customer, you should also check whether these features suit you. Do you support other types of online remittances?

3. As a salesperson, consider the churn rate:

All salespersons will naturally always consider business continuity. For continuity, many factors need to be considered. One of them is the churn rate. The churn rate is the annual percentage of customers who cancel subscriptions. In this way, your business will remain profitable.

4. Daily monitoring of activities:

Transaction monitoring is an activity that all traders must strictly observe every day. Consumers also need to personally monitor their online transactions to spot incorrect bills or inconsistencies in transactions. Don’t bank always remind us to protect ourselves from fraud?

Varieties of recurring debts:

There are a couple of kinds of recurring debts:

- Fixed recurring payments

- Variable recurring payments

1. Fixed, regular payment:

Using this payment method, consumers pay the same amount regularly. Such recurring payments include gym memberships, magazine subscriptions, pay-TV shows, and movie subscriptions.

2. Variable recurring payments:

Variable periodic payments refer to those payments that do not have a fixed price. The amount varies depending on the payment. Examples of such recurring payments are utility bills or telephone bills.

Frequently Asked Questions:

Q1: How long will Amazon wait for my payment to be verified?

A: Amazon usually waits for 7 days but can wait for 21 days for some special reason. So for a seller, it is better to wait for amazon’s pending status clearance before shipping because some sellers cancel the order after three days of unpaid.

Q2: Why is my card rejected when I have money?

A: The debit card may be rejected even if you have cash. Get assured you have cash, use the right PIN code and actuate the card. Your card type may be rejected, expired, or marked as suspicious. Please get assured that you have inserted the right data. If the difficulty continues, please reach your bank.

Q3: What is payment verification?

A: Payment history is a function of Amazon. If your transaction fails in the previous attempt, you can try your payment method again or use a different payment method.

Q4: How to cancel an order to check the payment on Amazon?

A: Cancel a product or order:

- Open the “Orders” section and select whatever you want to cancel.

- To cancel the entire order, please select all items.

- When finished, choose to deselect selected items.

Q5: How to check whether the debit card is frozen?

A: If your account is frozen, please call the bank and contact the branch representative.

Q6: Why did the bank refuse the transaction?

A: Rejected (the card issuer rejected the card, please get in touch with the card issuer for a reason). Two reasons usually cause this: The customer’s credit card issuer did not approve the transaction. It may be due to a lack of funds, frozen bills, or invalid invoices. Credit card number or expiration date, Etc.

Q7: Will there be refunds for orders canceled by Amazon?

A: If you cancel the order, the buyer will receive an automatic refund. The amount refunded by Amazon must appear on your credit card statement within two days. Before you mark the product as shipped, Amazon will not process any payments in your seller’s account.

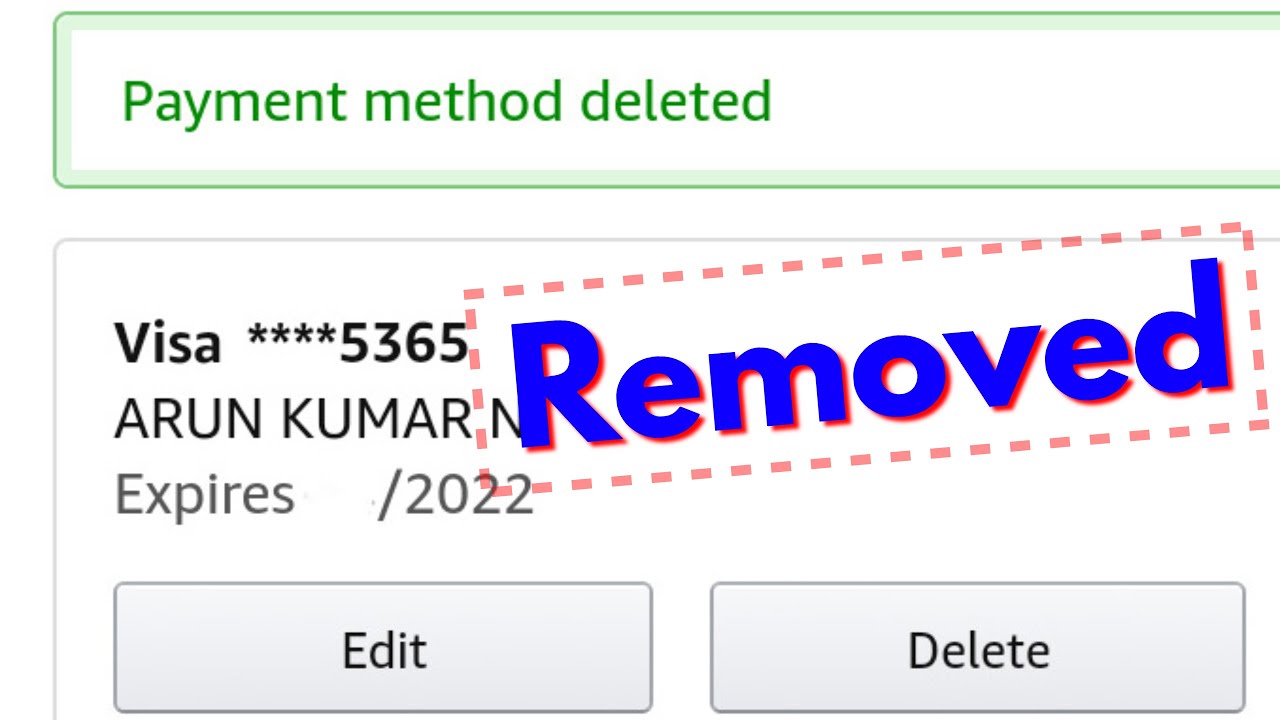

Q8: Can I change the payment method after purchasing from Amazon?

A: You can go to the “Your Orders” section of your account to update your delivery address, payment method, and other parameters for orders that have not yet entered the delivery process. To edit an order sent from Amazon, select Edit next to the details you want to change (shipping address, payment method, gift options, Etc.

Conclusion:

When your bank rejects your payment, an “Amazon Payment Verification Required” notification will appear. You may have changed your card and forgotten to change your details. You may have accidentally closed the site, clicked the back button, or refreshed the page while the transaction was in progress.

If the process is interrupted, these operations will stop payment. You may see a message on Amazon that says “payment verification required-order cancellation” or “payment verification required-update payment method.”

Suppose you received this message, contact the financial institution because they declined the payment.

Amazon Customer Service will give a reply if you have more questions. Shopping on Amazon is convenient and fun, but you need to know when, how and what to buy. Now that you understand the shortcomings of the Amazon payment system, you can avoid these shortcomings and enjoy shopping.

READ ALSO

https://howtodiscuss.com/t/selling-on-amazon-reviews/125774

https://howtodiscuss.com/t/amazon-referral-fee/100625

https://howtodiscuss.com/t/ebay-credit-card/127217

https://howtodiscuss.com/t/reseller-online/115918

https://howtodiscuss.com/t/reseller-online/115918