What is a zip on a debit card? The zip code on a credit card is an additional line of security that ensures if the card is being used by the cardholder or an authorized user. It’s associated with the cardholder’s billing address’s five-digit postcode. The postal code on your debit card statement is much like the postal code on your bank account statement, and it may be visible on your debit card statement or banking account.

Zip on a Debit Card:

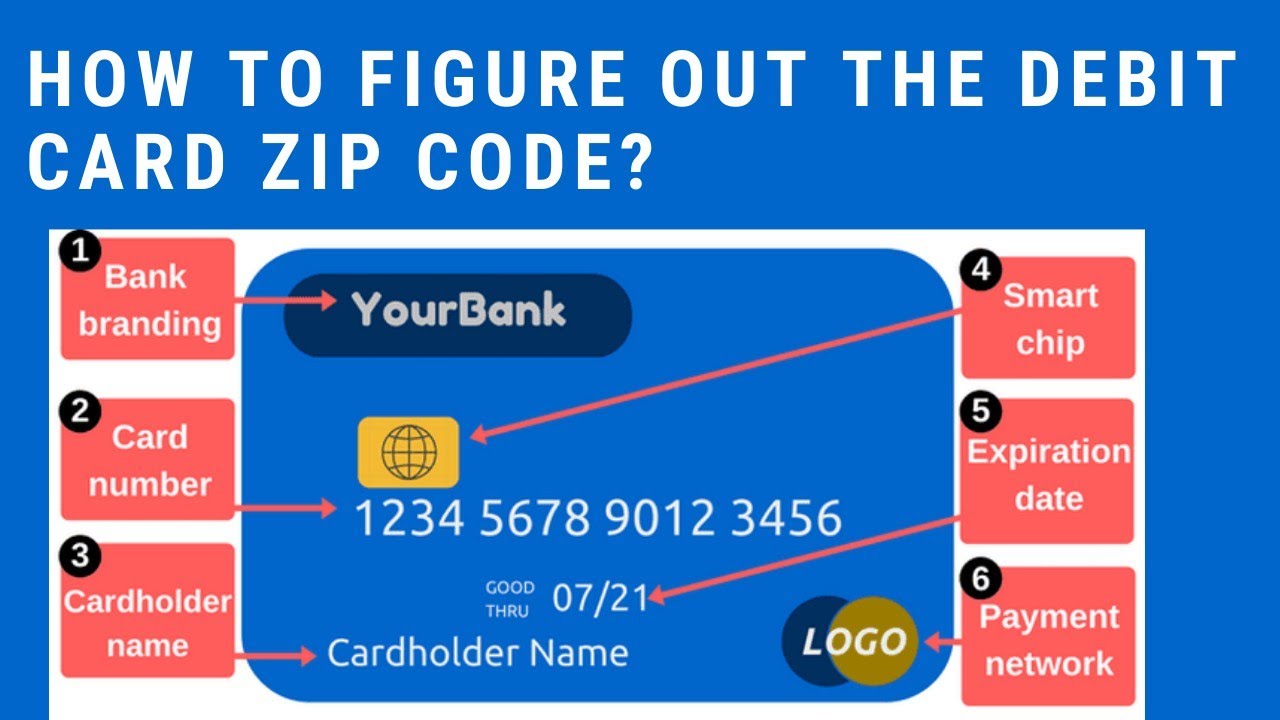

Regardless of the type of account you have, you will receive three items: a checkbook, a passbook, and a debit card in return for specific information such as your name, address, and other personal information. A debit card is a hybrid of an ATM card and a credit card that is connected directly to your bank account. When you swipe your debit card, it deducts money from your account that has already been deposited.

Your debit card’s ZIP code should be included in the address you provided to your bank or creditor. Zip Code for Debit Card Debit card zip code is the postal code you provide in a financial institution account statement. You may see it on your debit card statement or in your banking account.

What is the meaning of a ZIP code?

The term “ZIP” represents for Zone Improvement Plan. The USPS, on the other hand, created the acronym to underline that mail goes higher when senders include the postal code on their parcels and envelopes. In 1963, the main system of ZIP codes that we use today was introduced… Five digits make up the basic ZIP code.

When buying online, what does ZIP stand for?

Plan for Zone Improvement

The word ZIP stands for Zone Improvement Plan, and it was selected to imply that when senders utilize the code in the postal address, the mail goes more effectively and rapidly (zipping along). Five digits make up the fundamental format.

How can I identify the zip code for my debit card?

Debit card zip code is the postal code that you put on your bank account, therefore check your bank statement if you want to figure out what zip code is related to your debit card.

Is it possible to read the postal code on a Visa Debit card?

On a Visa debit card, you will not be able to view your postal code or zip code. Your account statement is the only method to locate it.

Summary:

The zip code on your debit card is included in the address you provide for creating a bank account, whether it is temporary or permanent. For example, if you live in the 450023 zip code and get your mail there, your zip code is 450023.

Billing ZIP Code:

A billing zip code is a location where credit card statements, for example, are sent. This is the most common application of “Billing Zip Codes.” Healthcare providers may also utilize it to safeguard your privacy and identification.

Your home address, for example, maybe 12435 Peach Street Anytown, Oh 44100, yet your credit card bills could be delivered to a P.O. Box in a different (44101) Zip Code.

What is the location of my billing zip code?

To get your billing zip code, go to the same drop-down menu and choose My Account, then Manage Firm. In the Billing Contact Info area, scroll down to find the billing zip code.

What is a Visa billing zip code?

A Zip Code is an address that appears on your bank’s credit card bills. The term “Billing Zip Codes” has never been used before. Healthcare providers may also utilize it to protect your privacy and identity.

What is the zip code on a line of credit?

If you have a credit card, you’ll need to know the zip code for the billing address. Unless you’ve subsequently relocated and changed your information, that’s the address you gave on your application. If you haven’t gone paperless, it’s also where you’ll get your monthly bill.

Is it accurate to say that the billing and delivery addresses are identical?

A billing address is a physical location associated with a certain method of payment, most commonly a credit or debit card. Businesses check the billing address to see if a card is being used lawfully. Companies often use it to deliver paper invoices and bank statements.

What does America’s ZIP Code mean?

2018

| level | ZIP CODE | States |

|---|---|---|

| 1 | 94027 | CA |

| 2 | 90210 | CA |

| 3 | 94301 | CA |

Frequently asked questions  :

:

There are some questions asked by the different people about the zip code on a debit card are as follows:

Q1: What is the zip code for Nigeria?

Q1: What is the zip code for Nigeria?

00176-0000

It’s worth noting, though, that the USPS (United States Postal Service) has codes for foreign nations that it uses while processing packages. All of these codes are identical to those that are used in the United States, known as ZIP codes. Nigeria’s country code is 00176-0000.

Q2: What is the credit card zip code in Malaysia?

Q2: What is the credit card zip code in Malaysia?

Postcode and ZIP Code are the same thing (in Malaysia). Let’s assume you want to ship a package to Malaysia’s Kuala Lumpur. The easiest way to double-check the street address is to use Google, which will usually include the postcode 50450.

Q3: Is the ZIP code safe to enter?

Q3: Is the ZIP code safe to enter?

Someone may opt to test the local zip code once the card is ready. It’s not as irrational or secure as a PIN, but it’s a security measure to assist approve transactions and prevent unauthorized card usage.

Q4: What is the best way to read a ZIP code on a credit card?

Q4: What is the best way to read a ZIP code on a credit card?

The first digit of a ZIP code represents the United States, the second and third digits indicate the area within that group, and the fourth and fifth digits represent the group of addresses sent to that place.

Q5: Is it true that zip codes are utilized on the internet?

Q5: Is it true that zip codes are utilized on the internet?

Yes, zip codes are utilized on the internet to offer precise locations when a specific address is not necessary but the precise location is.

For business purposes, several websites in the United States utilize zip codes. As a result, no one from outside the United States will be able to register on these sites. Some websites, on the other hand, buy postal codes and then register individuals from other countries.

Q6: Is there a distinction between the zip code and the area code?

Q6: Is there a distinction between the zip code and the area code?

A zip code is sometimes referred to as a postal code. It used to be used to process mail. Zip+4 can include coding that is used to identify the zip code’s path.

A telephone number’s area code is a part of the number. It can be linked to a person’s geographical location. One code is for one individual at a time. It will be determined by the users’ present location at the moment the service is launched.

Q7: What exactly is a billing code?

Q7: What exactly is a billing code?

A billing code is an entity that was developed to represent a billable carrier or object that is no longer a physical inventory item (which include Inventory objects might be). Various sorts of hard work charges, diagnostic charges, fabric charges, and taxes are examples of Billing Codes.

Q8: How can I find out what my billing zip code is?

Q8: How can I find out what my billing zip code is?

To get your billing zip code, go to the My Account tab in the same drop-down menu, then Manage Firm. Scroll all the way to the bottom to see the Billing Contact Info section, where you’ll see the billing zip code.

Q9: What exactly does a ZIP code imply?

Q9: What exactly does a ZIP code imply?

The term “ZIP” stands for Zone Improvement Plan. The USPS, on the other hand, used the acronym to signify that mail goes at a faster rate when senders include the postal code on their programs and envelopes. The popular ZIP code system, which is still in use today, was first used in 1963. The main ZIP code consists of five digits.

Q10: What if the billing address and shipping address are the same things?

Q10: What if the billing address and shipping address are the same things?

A billing address is an address associated with a particular method of payment, such as a credit or debit card. Companies utilize the billing deal to ensure that one of these cards is being used legally. Businesses also use it to send paper payments and bank statements.

Conclusion:

The code is represented by the zip on the card. Your bank card has a ZIP code on it that you supplied to your bank or credit union. A debit card is a card that a bank issues once you create a bank account. It’s also known as a bank card. It’s important to remember that customer protection is a must. Consumer protection varies depending on whose network they utilize. The consumer credit card for unauthorized instances is the same in certain countries for both bank and credit card cards. College students who have not yet established a credit history choose debit cards and safe credit cards.