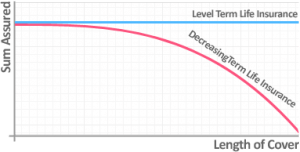

Decreasing term life insurance works in a way that the payout keeps decreasing with the increasing age of the policy, while the premiums remain constant. Decreasing term insurance is a renewable policy with terms ranging from 1 year to 30 years and the death benefit decreases monthly or annually at a pre-determined rate.

What is insurance?

Most of the people who are unaware of this kind of person often wonder what is insurance and how does it work?

Insurance is an agreement between an insurance company and an applicant according to which the insurance policyholder pays regular premiums and the insurance company guarantees the compensation for any unexpected loss to the life, health, property, or vehicle of the policyholder.

What kind of compensation or management is provided by the insurance company depends upon the type of policy an insured has bought. In the U.S, car insurance is necessary by law and each person has at least one kind of insurance. Some basic components of insurance are:

- Policy limit

- Deductibles

- Insurance premiums

What are the types of insurance?

Insurance acts as a shelter against any unexpected financial crisis faced by a person and has various types depending upon the component for which an insured wants to buy a policy. Some of these types have been discussed below:

1. Life insurance

-

Life insurance is the legal agreement between a policyholder and an insurance company.

-

Policyholder, also referred to as an insured, pays premiums, either monthly or annually according to his feasibility and in return, the insurance company pays a guaranteed death benefit to his beneficiaries when the policyholder dies.

2. Health insurance

-

In this age of increasing morbidities, it’s better to get health insurance to avoid the heavy hospital bills. What is health insurance and how to get health insurance is the topic of interest for a person who wants to buy a health insurance policy.

-

Health insurance is a type of insurance policy in which the insurance company pays the hospital bills or surgery related expenses of a policyholder. All this happens under an agreement between the insurance company and the policyholder.

3. Pet insurance

-

Pets are the best companions for most of people. Keeping a pet an easy thing but paying heavy veterinary bills is not a matter of joke. So, if a person wants to have a pet, he must know that what is pet insurance and from where he can buy the best pet health insurance.

-

Pet insurance is a type of insurance coverage that covers the illness, accidents, or other veterinary expenses of a pet. Pet owners must buy pet insurance, without thinking that is pet insurance worth it? By having a pet insurance policy, a pet owner actually buys peace of mind.

4. Car insurance

-

Most of the time of a car or vehicle owner is spent on the roads, that are packed with heavy traffic. Hence, there is always a fear of an accident that not only costs the driver’s life but also the vehicle that meets an accident.

-

Every person with a car should also go for a car insurance policy to avoid the costs of accidental damage to his car. Also, when there is an availability of cheap car insurance for young drivers from a number of cheap car insurance companies. Other than cars, there are other policies available for other types of vehicles.

5. Mortgage insurance

-

If you are a mortgage lender or investor, you should obviously know what is mortgage insurance and why you should go for mortgage insurance?

-

Mortgage Insurance is an insurance policy that offers compensation to lenders or investors for the unexpected loss because of a defaulted mortgage loan.

6. Travel insurance

-

Travel insurance is a type of insurance policy that provides coverage for the costs associated with traveling, either within the country or traveling abroad.

-

If you are a traveler and don’t that what is travel insurance, it may prevent you from the chance of acquiring the best travel insurance policy. If you are going for a travel, then instead of thinking that is travel insurance worth it, you should search that how much travel insurance do you need for the kind of travel I’m going to do.

Summary

Insurance policy has various types including life insurance, car insurance, health insurance, pet insurance, mortgage insurance, and travel insurance.

What is life insurance?

Whenever a person wants to go for an insurance policy, first thing that he searches for is what is life insurance? Life insurance is an agreement between a policyholder and an insurer that is represented by a policy. The policyholder pays regular premiums and the insurance company pays a guaranteed death benefit to the beneficiary when the insured dies.

The beneficiary is the person who is nominated by an insured to receive the death benefit in case of his death. The policyholder can nominate more than one beneficiary, defining the percentage of share that everyone will get.

In case of death of the primary beneficiary or any other unexpected situation (e.g. divorce), there is a contingent beneficiary. The contingent beneficiary is the one who will receive a death benefit at the place of the primary beneficiary.

Components of life insurance

Life insurance consists of three basic components:

- Insurance premium

- Cash-value account

- Death benefit

The cash-value account is just offered in permanent life insurance and it’s not the part of a term life insurance. The rest of the two components are the same for all types.

Types of life insurance

Life insurance has various types depending upon the duration of the policy and the number of premiums that are paid by the policyholder. There are two main types:

1. Permanent life insurance

2. Term life insurance

-

Permanent life insurance offers a death benefit along with an investment account that is known as a cash-value account. Permanent life insurance covers the whole life of an insured and is further divided into whole life insurance, variable life insurance, universal life insurance, and variable-universal life insurance.

-

The second type is term life insurance which differs from permanent life insurance in the duration of the policy. It gets expired after a specific pre-determined term and can be renewed, converted, or terminated by the policyholder.

How does life insurance work?

-

If a person wants to buy a life insurance policy for the secure future of his heirs, he should know that what is life insurance and how does life insurance work?

-

Proceedings of life insurance policy depend upon the type of policy that a policyholder buys. In the case of permanent life insurance, the premium is divided into two portions.

-

One part is taken as a cost of insurance while the other one is submitted in an investment account. An investment account is referred to as a cash-value plan and it keeps growing due to the accumulated interests.

-

Term life insurance works in a different way than the permanent insurance that it gets expired after a pre-decided term. There is no availability of an investment account.

Is life insurance taxable?

In the age of dearness, where each and everything is taxable, a policyholder often has a curiosity, is life insurance taxable? Generally speaking, life insurance is not taxable except in some situations. These situations can include:

- Employer-paid premiums

- Cash-value accumulation

- Delayed provision of the death benefit

- Estate or inheritance tax

What is term life insurance?

Before discussing the decreasing term life insurance, it would be better to know that what is term life insurance and how it works? As the name indicates, term life insurance is a type of insurance policy that remains active for a specified term. The term ranges from one to 30 years and that term reaches, policy gets expired. After the expiry of a term, the policyholder can respond in various ways:

- Renewal of policy for the next term

- Conversion of policy from term insurance to permanent insurance

- Termination of the insurance policy

Term life insurance requires low premiums as compared to permanent insurance and there is no cash value account. If the insured dies just after the expiry of the term, there will be no death benefit by the insurance company.

What are the types of term life insurance?

Term life insurance offers low policy premiums and that is the attractive point of this policy. Depending upon the way of functioning, term life insurance has further types, including:

- Policy premiums remain fixed throughout the term

- The death benefit is also fixed

2. Increasing term life insurance

- Death benefit increases either monthly or annually

- Premiums may vary or remain fixed

- Premium rates vary according to the age and medical condition of the policyholder

3. Decreasing term life insurance

- Death benefit decreases monthly or annually

- Premium rates are fixed throughout the term

- Mostly acquired by the people who want to pay the loans

Comparison of the types of term life insurance

Here is a slight comparison of all three types of term life insurance, considering several factors.

| Factor | Level-term policy | Increasing term policy | Decreasing term policy |

|---|---|---|---|

| Duration | 1 year to 30 year | 5 year to 30 year | 1 year to 30 year |

| Cash value | No | No | No |

| Premiums | Fixed | May or may not be fixed | Fixed |

| Death benefit | Guaranteed and fixed | Increases monthly or annually | Decreases monthly or annually |

| Benefit | Best coverage for a number of years | Best for increasing expenses | Best for mortgage or loan payment |

How does decreasing term life insurance work?

- Decreasing term life insurance is a type of life insurance that offers coverage that decreases at a pre-decided rate, with the increasing life of the policy, while the premium rates are fixed. It’s different than the other traditional term life policies because of level-premiums with the guarantee to never increase.

1. Renewable policy

-

Decreasing term insurance is a renewable policy and the death benefit decreases either monthly or annually depending upon the insurance company.

-

Terms for renewal can be variable ranging between the one year to thirty-year duration. However, the term duration depends upon the type of policy plan and the insurance company that offers that policy.

2. Difference from others

- The main difference of decreasing term life insurance from the other policies is that it has a different kind of payment plan. Death benefit gets lowered while the policy premiums don’t decrease relative to other types.

3. Decrease in death benefit

- Why does the payout of decreasing term insurance is decreased? it can be explained in the terms of decreasing expenses with the increasing age of the policyholder. With increasing age, certain needs of a person are decreased, hence the low death benefit with relatively fewer premiums is a reasonable offer.

4. Mortgage like insurance

-

Various active decreasing term life insurance becomes a mortgage life insurance, that benefits regarding the remaining mortgage cost of the policyholder.

-

Decreasing term life insurance is generally insufficient for meeting the life insurance needs of a person, especially if the policyholder has to support his family. So regular term insurance is a suitable option.

Summary

Decreasing term life insurance is a type of term insurance in which the death benefit decreases with the increasing life of policy while the premium rates remain fixed.

What are the pros and cons of decreasing term insurance?

Just like all other life insurance policies, decreasing term life insurance also has associated advantages and disadvantages. Some of these have been listed below.

Advantages of decreasing term life insurance

Decreasing term insurance is beneficial in following ways:

1. Moderate coverage

- Premiums are lower than the other term policies

- Cost-effective policy for a person with an average budget

2. Temporary fulfilments of needs

- A good option to cover mortgage expenses

- Provides financial security during the extreme needs

3. Safe future in case of death

- Offers financial relaxation in case of death of a person who has certain debts to be paid

- Dependents don’t suffer from mortgage expenses or loan payment

Disadvantages of decreasing term life insurance

-

With the above-mentioned benefits, there is a major disadvantage associated with decreasing term life insurance.

-

The disadvantage is the decrease in the death benefit with the level/fixed premiums. Who on the land will buy a policy with decreasing death benefit with increasing life of the policy?

-

Obviously, no one. Experts consider it the biggest disadvantage of decreasing term life insurance although insufficient coverage is also regarded as a disadvantage.

Summary

Benefits of decreasing term life insurance include low premiums, short term coverage for loan or mortgage payment. The main disadvantage of this policy involves the shrinking death benefit.

Why to choose decreasing term life insurance?

With the previously discussed major disadvantages of decreasing term life insurance, who will go for this policy? There are some situations that can compel a person to buy decreasing term insurance. This situation can be one of the following:

-

If a person has a family of dependents who can get a handsome financial aid in form of the death benefit if the policyholder dies young.

-

If a person has to pay a mortgage or personal loan that shrinks with the time, he can go for decreasing term insurance.

-

If a person feels that the expenses will lessen with the increasing age, he should not be worried to buy decreasing term insurance.

-

If a person has some serious morbidity and can’t buy a regular life insurance policy that requires a medical examination, he can buy a decreasing term policy, with no such requirements

Frequently asked questions

1. What decreases in decreasing term insurance?

Decreasing term life insurance is a subtype of term life insurance. As the name indicates, there is a decrease in death benefit with the increasing age of policy while the premium rates remain fixed.

Shrinkage of the death benefit I bearable for those whose needs will also shrink with the time, otherwise it’s not a wise decision to go for this policy. Decreasing term insurance is just the opposite of increasing term insurance in which death benefit increases.

2. Can I cancel decreasing term insurance?

Just like other policies e.g. auto insurance policy, decreasing term life insurance can also be canceled if a policyholder doesn’t want it anymore.

Term life insurance or mortgage insurance are known as pure protective policies and have an option to be canceled off if they are not needed by the policyholder.

3. What is the example of decreasing term life insurance?

Decreasing term life insurance can be explained by the following example:

-

A 25-year-old person with no smoking habits buys an insurance policy for a term of 20 years. He buys a $250,000 policy and pays the monthly premium of $30 for a decreasing term life insurance.

-

With increasing age, although the death benefit decreases, yet the policyholder is not at a loss as there are fewer expenses in the later age when the children are grown up and mortgage or personal debts have been paid.

-

If he buys a permanent life insurance policy, the basic premium rates will be more than $110.

4. Who has the lowest term life insurance?

Banner life, an American insurance company, offers the lowest premium rates for term life insurance. Its monthly rate is about $46.64 as quoted by an example of a 34 years old female policyholder, with normal health conditions, having a policy for a term of 20 years, for insurance coverage of 1 million dollars.

5. What are the average annual rates for term life and whole life insurance?

Average rates per year for the 20-year term life insurance and whole life insurance for year 2020 are given below:

| Age in years | Average annual rates for 20-year term insurance | Average annual rates for whole life insurance |

|---|---|---|

| 30 | $230 | $3,550 |

| 40 | $342 | $5,414 |

| 50 | $843 | $8,435 |

Conclusion

-

Decreasing term life insurance works in a way that policy premiums remain fixed throughout the term, while the death benefit shrinks with the increasing age of insurance policy, either on a monthly or annual basis.

-

It’s a good option for those people who have to pay the mortgage or personal loans that decrease with time.

-

Decreasing term life insurance offers low premium rates as compared to the other term life policies.

References

Related articles

What is life insurance? A complete guide for beginners

What is universal life insurance and how does it work?

What is term life insurance and how it works?

How does group term life insurance work?

What is universal life insurance?