How to invest in Bitcoin is a recent phenomenon and unlike banking or stock market investments, there are still few approved organizations to carry out the procedures for you in France. There are many scams around Bitcoin; therefore be vigilant and prefer to manage your investments yourself on recognized Bitcoin purchase sites.

But how do you get started? In this guide, we explain how to invest in bitcoin and our review of the best sites to do so.

How to invest in Bitcoin easily?

These days, investing in Bitcoin is not as difficult as it used to be. The steps to follow are indeed for beginner traders. Here is a summary:

-

Choose a platform to invest

-

Create an account

-

Fund your account

- Select the amount in euros you want to invest in Bitcoin.

Why invest in Bitcoin?

An investment in Bitcoin has many advantages, including that of diversifying your portfolio.

But why invest in Bitcoin? What are the advantages of investing in the first cryptocurrency in history?

1.1 Bitcoin, an alternative currency that inspires confidence

Since Bitcoin is a decentralized currency that was developed for people to regain power over their money, it offers an interesting monetary alternative for anyone who wants to become their own bank.

Since it is decentralized, it is immune to any price manipulation by a central body or any political influence.

1.2 An increasingly accepted means of payment

Bitcoin is a forward-looking cryptocurrency and more and more traders are starting to accept it as a **means of payment,** including many multinationals like KFC or Microsoft.

1.3 It is the most popular and the oldest cryptocurrency

Investing in Bitcoin also means taking advantage of the experience of the first cryptocurrency ever launched in 2009. Still there, Bitcoin is the most important cryptocurrency in terms of market capitalization.

1.4 It is a cheaper currency to use than traditional alternatives

Transferring Bitcoins helps avoid financial institution fees which can be high. There is no maximum amount of Bitcoin you can have, and there is no risk of over-drafting.

1.5 An increasingly rare digital currency

**Bitcoins are scarce**, as the number of available Bitcoins decreases over time. The total number of Bitcoins is 21 million. So there is a limited amount of BTC.

As you mine BTC, there is always less left and it becomes increasingly difficult and expensive to mine, which should increase its price especially if demand increases while supply decreases.

Where to invest in Bitcoin?

There are different places where you can get Bitcoin, both online and in real life. However, we advise you to get them on the internet for convenience and security.

These are regulated sites, and therefore relatively safe. Your purchase will be guaranteed, and you will not run into a scam.

You can also get your bitcoins in a specialized store. On the other hand, you have to be careful with this way of buying BTC. Some traders are regulated, but others with storefronts could also sell you these crypto-assets without having any legal authorization to do so.

The most iconic place to buy bitcoin in person is arguably Coinhouse, formerly the “ Maison du Bitcoin ”, which is located in Paris. The reputation of this place is well established, so you are sure to get your bitcoins after payment.

What strategy should you use to invest in cryptocurrencies?

Before talking about the investment strategies that exist, it is important to make an important point. Cryptocurrencies are assets that carry risk, like all types of investment. You should therefore only bet money that you are prepared to lose.

Now that this little remark has been made, it will now be necessary to decide how you want to invest in crypto-assets.

There are mainly two different strategies: " hold " and " trade ". Let’s take a look at each of these strategies briefly and which one might be right for you.

1,1 What does the “hold” strategy consist of that of long-term conservation?

The “hold” strategy is undoubtedly the easiest to master. Once you’ve bought your bitcoins, you just keep them. You have nothing else to do except decide when to cut your losses or when to take your profits.

For example, if you bought a bitcoin at $ 3,000, you can decide that from $ 2,000 you will resell your crypto-assets in order to limit your losses.

Conversely, you can also decide when you want to take your profits. If you have succeeded in doubling your stake, you can either sell everything, sell part of your investment or decide to keep everything to earn even more money.

It is important that you set yourself such goals before making your purchase and stick to them. If you don’t, you risk being overwhelmed by your emotions and making irrational choices and costly mistakes.

1.2 What does the “trade” strategy consist of, that is to say, that of regular buy/sell?

The name “trade” comes from the English term “trading”, that is to say, “exchange”. To practice this strategy, you will need to master more concepts than to practice the “hold” strategy.

The goal of trading bitcoin is to make purchases and resales over a relatively short period of time. The goal is to sell when Bitcoin (or any other acquired crypto-asset) is in the bottom of a curve, and resell it when it is at the top.

This strategy can be implemented using different indicators:

-

By analyzing the graphs of the evolution of bitcoin prices. You will then need to use different indicators to know what decisions to make.

-

By analyzing the news. For example, good news will raise prices and bad news will lower them. The goal is to buy before good news and sell before bad news.

-

By observing the intrinsic qualities of the asset in which you are investing. If a crypto asset is a rare, revolutionary, extremely useful but still little known, there is a good chance of making a profit. On the contrary, if it is a project that has no real utility, the only speculation could raise its price.

Mastering trading is very complicated, and you will need some experience before you can best practice this activity. This explanation remains very simplistic and serves just to express the idea behind this concept.

Who is the “hold” suitable for? Who is the “trade” suitable for?

If you are a beginner, we recommend that you only use the “hold” strategy, before you have learned more. Buying-selling is far too complex, and you risk making huge mistakes.

If you are at an intermediate level, we recommend that you once again practice “hold” with most of your investment. You can try the “trade” if you feel like it but only do so with 10 or 20% of the money you invested.

If you are at an advanced level then you are in a position to decide what is best for you. Be aware, however, that even the most experienced traders keep a large portion of their assets locked in.

The psychological aspect of investing in bitcoin

Another important point to take into consideration when investing in bitcoin is the psychological component associated with such type of investment.

The cryptocurrency market is still a very immature market. This means that volatility is very important. During certain periods, it will not be uncommon to make + 25% or -15% in a single day.

While a + 20% isn’t a problem for anyone, a -20% will be a problem for the vast majority of first-time investors. Unfortunately, this is an integral part of the cryptocurrency market. You will have no choice but to accept this state of affairs.

Here are 3 mistakes to avoid when making money too fast:

-

It is neither your talent nor your skills. So stay humble and keep a cool head. The backlash can also be very brutal.

-

Don’t start investing in just anything. Always think carefully before making an investment in anything.

-

Don’t start asking all of your friends or family to invest money in cryptocurrencies as well. Think about the consequences if they started with a -20% on the day. They will blame you for sure.

In case you are losing money too quickly, there are also 3 mistakes to avoid:

-

It is not necessarily your fault that you lose. You may have more or less responsibility, but if your initial analysis was good, then you have nothing to be ashamed of.

-

Don’t sell too quickly. As we explained to you in a previous point, it is advisable before any investment to set yourself a threshold where you will decide to cut your losses. This threshold must therefore be respected.

-

Don’t be impulsive. You may be tempted to do anything to recoup your losses. This is a huge mistake because in most cases you will amplify your losses.

Talking about investor psychology is a long and complex subject. We’ve only scratched the surface here to show you how this can affect the people and attitudes that need to be taken to deal with cryptocurrency volatility issues.

How much to invest in Bitcoin?

There are different ways to profit from Bitcoin. Ultimately, it is your available capital, your investment strategy and your financial goals that. will dictate the ideal amount to invest in Bitcoin.

If you want to participate in this monetary revolution and use BTC tokens, then you should buy Bitcoins through a crypto exchange like Libertex, Kraken, Coinbase or even Binance and place them in a wallet like the Ledger Nano S.

If your goal is to take advantage of the price volatility of the largest cryptocurrency without owning the tokens, then you can trade them through derivatives like CFDs through brokers like Libertex.

The amount you should invest in Bitcoin mainly depends on your budget and the initial amounts requested by the platforms. Some brokers impose minimum deposits on you depending on the payment method used.

You can for example open an account and start with $ 200 at Libertex. The advantage of using leverage and margin trading with CFDs is that you can increase your exposure to Bitcoin. You can therefore trade a larger sum than what you have in your account.

Opinion: Should we invest in Bitcoin in 2020?

This is undoubtedly the question that comes up the most since cryptocurrency prices have more or less stabilized after the significant drop observed in 2018.

In December, following the Bitcoin hype, many people fell prey to cryptocurrency investing because of largely positive Bitcoin reviews, without really understanding it, and left feathers there.

Today, almost everyone has heard of Bitcoin. It is therefore difficult to imagine a second bubble scenario around the ‘buzz’ and a sudden increase in prices similar to December 2017.

However, there are now other factors capable of influencing its price upward. We can for example cite the arrival of large firms like Facebook, Fidelity or JP Morgan, further legitimizing this asset class. Also, some investors are starting to see Bitcoin as a kind of digital gold because its total supply is limited (21 million units).

In addition, the current trade tensions between the United States and China, against the backdrop of the economic crisis, seem to be attracting investors to assets not correlated to the stock market and would explain the recent rise in the price of Bitcoin.

However, it is also necessary to take into account the factors that could influence its price downwards such as unexpected events such as strong regulations and to exercise caution.

No one is able to predict the future in the financial markets, especially when it comes to a new market based on technology that is still fairly experimental, although promising.

11 things to know before investing in Bitcoin

Here are 11 great tips to follow, especially if you’re just getting started with BTC investing.

1. Understanding the Bitcoin blockchain

The blockchain appeared in 2008 with Bitcoin. This new technology offers the possibility of transferring value online.

Thus, Internet users can now send money over the Internet independently, without third-party intervention (banks), and in a secure manner.

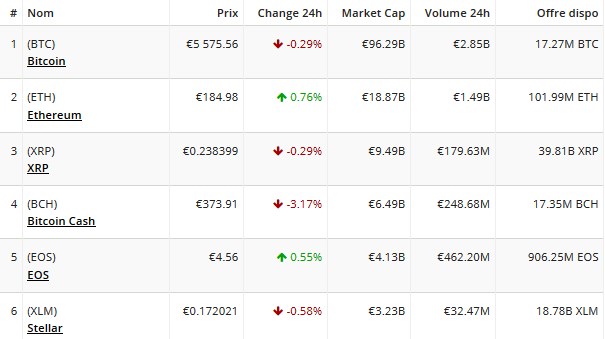

2. Know the main cryptocurrencies before investing in Bitcoin

Since the advent of Bitcoin, many cryptocurrencies have emerged. Most are just simple copies of Bitcoin and are unlikely to have a great future. However, some have created real innovations and so it is important to be familiar with the top and best cryptocurrencies in the ranking.

3. Understand the risks of Bitcoin investments

The high volatility of the price of cryptocurrencies often results in large fluctuations. While it can lead to big wins, it can also lead to big losses.

It is therefore recommended to invest only a small part of its capital. Some experts recommend that institutional (professional) investors invest only 2 to 5% of their capital in this new market. Bitcoin and other assets are also seen as a way to diversify your investments because their prices are not correlated to any other asset for the moment.

Perhaps the best advice is to invest what you can afford to lose.

4. Define your investment strategy

There are two main strategies.

- First, long-term bitcoin investing: Investors who buy currencies for a return over time. It is about investing in one or more crypto-currencies of your choice to make a profit over several months or even years.

- And the Bitcoin investment in the very short term: Traders who practice pure trading, that is to say, make dozens or even hundreds of transactions on cryptos on a daily basis. This second strategy requires much more involvement and technique.

5. Give priority to crypto-currencies that bring novelty

It is important that the currency has a utility and is not yet another copy of Bitcoin. For example, Ethereum makes it possible to launch a fundraiser in cryptocurrencies called ICO.

However, one should also be wary of cryptocurrencies promising wonders and offering far-fetched concepts. Keep it right and stick to the facts, not the promises.

6. Avoid Beginner’s Mistakes in Trading

The high price of a virtual currency does not necessarily mean a bigger and profitable investment. We must also take into account the daily transaction volume and especially the market capitalization of the currency.

Also, don’t invest in cryptocurrency because someone advised you to do so or because you have read that it is a ‘good investment’.

Prefer to investigate yourself and consult specialized forums to read, even discuss with expert people and form your own opinions.

7. Buy and trade Bitcoin

If you feel ready to invest in this sector, you can consult our dedicated guide to buying Bitcoin and cryptocurrencies to start your first investments.

For the moment, only about ten crypto-currencies are available for purchase (credit card, transfer or Paypal). These are the best known: Bitcoin, Ethereum, Ripple, Bitcoin Cash, IOTA, Cardano, Stellar, Dash, NEO, EOS, Litecoin and Ethereum Classic.

To get other less popular currencies such as TRON, Dogecoin or Binance Coin, you will need to trade once you have Bitcoins.

8. Secure your Bitcoins and crypto

Once your crypto-currencies are in your pocket, you can decide to leave them on online services or to keep them in a crypto or Bitcoin wallet outside the internet network and thus avoid potential hack risks.

A storage device of this type is called a hardware wallet, it is a palpable wallet that looks a lot like a USB key. For our part, knowing that an anti - theft product of this type costs around 100 €, we recommend its use when your investments exceed 500/1000 €.

Also, some services like Libertex offer investment in crypto-currencies through contracts. An interesting option for people who prefer to delegate custody of their assets.

9. Diversify your crypto investments, but not too much

Many newbie investors decide to acquire dozens of different cryptocurrencies in order to spread the risk. However, we now know that many projects are doomed to failure and that it is better to bet on a few safe stocks like Bitcoin.

In addition, if you own too many cryptocurrencies, you risk getting lost in your investments and making potential mistakes. So, as mentioned earlier, investigate and select a few assets that you think bring real added value.

10. Read the news on Bitcoin and cryptocurrencies

It is also essential to keep abreast of Bitcoin news to know which horse to bet on and to be able to make the right transactions at the right time. We offer it daily on Cryptonaute but you must also use other sources in addition.

11. Read books on cryptocurrency and investing

If you don’t know where to start, there are some very interesting books on the subject, especially to take a step back and see more clearly. Visit our file devoted to the best books on cryptocurrency if you are not afraid of reading.

How to secure your investments?

You’ve probably heard a lot of stories about bitcoin theft. While some like to amplify these stories, it should be borne in mind that most of these events unfortunately happened.

But does that necessarily mean that you too risk having your bitcoins stolen? Of course not!

Most of the cryptocurrency-related thefts have happened for roughly the same reasons:

-

Unscrupulous exchange sites have left with the cash.

-

The exchange sites have been hacked. It is now getting ■■■■■■ and ■■■■■■ as security grows on all platforms.

-

People have come across scams. They were quite simply naive and fell into the traps set by unscrupulous people.

Now, there are many protections that will make sure your bitcoins will be safe. You can therefore invest without being afraid of having your assets stolen.

Here are some options available to you to keep your bitcoins safe:

-

You can store them on a storage wallet. This can be done digitally, physically or even on a single sheet of paper. We invite you to consult our full article on this subject for more information: the best wallets to keep your bitcoins (BTC).

-

You can activate additional authentication measures, such as 2FA (two-factor authentication). Some exchange sites also require their users to use these security methods. Be aware, however, that the so-called TOTP 2FA methods, that is to say with an encrypted code changing every 30 seconds, are infinitely more secure than those based on SMS, as explained below.

-

You can authorize the transfer of your crypto-assets only after approving the transaction by e-mail.

As you can see, there are many options available to ensure the security of your investment. In addition, leaving them on certain exchange sites currently represents very little risk due to the drastic increase in their level of security.

Frequently asked Questions

1. Is it too late to invest in Bitcoin?

The price of Bitcoin often experiences sharp rises and falls in price that you can take advantage of. Currently below the psychological level of 10,000 dollars, many traders find it an interesting level to take advantage of the next upside that could take BTC / USD to its annual highs around $ 13,000.

2. What are the best platforms for investing in Bitcoin?

There are many platforms for investing in Bitcoin. Your choice will primarily depend on your trading needs and financial goals. Among the platforms we recommend, Libertex. This is indeed one of the best because it allows you to buy BTC and trade it with CFDs. Also, its platform is simple, intuitive and offers interesting trading conditions.

3. What is the minimum to invest in Bitcoin?

The minimum amount to invest in Bitcoin usually depends on the exchange or trading platform, as well as the payment method used and your location.

4. Can I invest in Bitcoin anonymously?

These days, it is difficult to buy Bitcoin anonymously on the internet. Indeed, when you buy tokens on a crypto-exchange or a trading platform, you must respect the KYC (Know Your Clients) and AML (Anti-Money Laundering) requirements of these platforms by providing personal data on you. There are a few peer-to-peer marketplaces that you can use to buy anonymous BTC but they are not recommended. You can also consider using a Bitcoin ATM.

5. Is Bitcoin Secure?

Bitcoin is a secure network because it offers a transparent and reliable system. The blockchain is also decentralized, which means that there is no central authority that governs Bitcoin and that the system is open to everyone. There is therefore no risk of falsifying transactions because the Bitcoin blockchain is immutable.

Conclusion: should you invest in Bitcoin?

Being one of the most popular, traded and accepted cryptocurrencies in physical or online stores, Bitcoin (BTC) is very popular with investors who want to diversify their portfolios with alternative assets and not. correlated to traditional stock markets.

You still have to avoid beginner’s mistakes and choose the right platform to invest in Bitcoin.

Libertex is one of the most popular platforms for new and advanced investors. They offer the possibility of buying tokens or trading them on margin. Its platform is simple and intuitive and therefore accessible to all. In addition, the regulated broker offers a safe trading environment and copy-trading options. Ideal for those who just want to profit from successful traders.

Read Also

How to Invest in Bitcoin?

Where to Buy Bitcoin?

How to Mine Bitcoin?