According to my perception It is necessary to be familiar with decreasing term life insurance policies which are not worthy for interest only mortgages This is because this kind of a mortgage can only be rewarded off at the end of the mortgage term

.

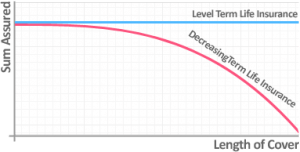

As the name suggests, the death benefit of a decreasing term policy does just that: decreases. Like a level term policy, decreasing term policies often come with varying death benefit amounts and are available in various increments, such as 15, 20, 25, or 30 year plans.

How is the rate determined?

Sad to say, there isn’t a simple standard formula that can tell you exactly the amount the benefit decreases each year, or the rate at which it decreases. Like many things in the world of insurance, there are a variety of factors that are taken into consideration, such as the age of the applicant, health, and the amount of life insurance coverage .Though, the rate, as well as other policy information, should be made available to you after you request an initial quote from the insurance company.

How Does Decreasing Life Assurance Decline Over Time?

Make sure your Decreasing Life Insurance has a maximum interest rate that is high enough above your mortgage rate that you have a buffer for fluctuations.

If your mortgage interest rate was to rise above the maximum you could be left with a shortfall if you die during the policy’s term.

How does a decreasing term policy work?

Just like a level term policy, decreasing term policies often come with varying death benefit amounts and are available in various increments, such as 15, 20, 25, or 30 year plans.

After selecting the policy particulars that are right for you, you would pay the premium, and over time, the death benefit of the policy reduces at a predetermined rate, usually each year. In the event that you (the policyholder) should pass during that time, the benefit is then paid to the beneficiary.

Why should someone consider buying a decreasing term policy?

As we know that the death benefit of a decreasing term policy goes down over time, but the premium stays the same. So why would you choose that over a level term policy?

Affordability

Simply put, a decreasing term policy is often a more affordable option than a level term policy.

Because the death benefit decreases over time, you’re usually able to get a similar amount of coverage for a lower premium. For that reason, a decreasing term policy can be a way for an individual to get affordable coverage when the premiums of a similar level term policy may be cost-prohibitive.

To cover debt and other financial obligations

For many families, debt and other financial obligations typically decrease over time and thus, your need for a higher amount of coverage decreases, too. For example, if you are just starting a family, you probably have a fair number of financial obligations and loans. You have a mortgage, a car payment, and of course, the cost of raising a child. During that portion of your life, you had a much larger amount of coverage.

Summary:

In short we can say that “Decreasing term” provides a death benefit that declines over the life of the “term”. This means that the decreasing cash benefit corresponds to the decrease need for them.

Purchasing a Decreasing term policy:

To purchase a decreasing term policy It is common to cover a mortgage or a decreasing liability. Let’s clear it with an example When a business partnership where often times there is a need for a startup capital. In order to protect the partners, each will take out a decreasing term policy on the other. This protects each partner against the loss of income producing partner and the ability of the remaining partners to repay the loan.

Cheapest term life insurance companies in 2020:

There are multiple companies providing term life insurance.Some of the cheapest life insurance companies are as follows.

- Banner Life

- Pacific Life

- Principal

- Protective

- Mutual of Omaha

List of term life insurance companies available in U.S.A:

- American National

- Guardian Life Insurance

- Transamerica

- Seth Preus

- ameritas

- Sagicor

- Cincinnati

- Lincoln Financial

List of term life insurance companies available in UK:

- Halifax

- Axa

- Nationwide

- Scottish Widows

- Friends Life

- Direct Line

- Bupa

- AA

- Abbey Life

- SunLife

- Post Office

- Zurich

- Barclays

- HSBC

- Royal London

- Age Concern

- Age UK

- Allianz

- Bank of Ireland

- Liverpool Victoria (LV)

- Beagle Street

- Cavendish

- Churchill

- Citibank

- Clydesdale

- Countrywide

- Covea

- Direct Life

- Direct Line

- Fidelity

- Foresters

- Guardian

- Endsleigh

- Engage

- Esure

- L&G

- London Life

- Macmillan

- Marks & Spencers

- Metrobank

- NFU

- Old Mutual

- One Family

- Optimum

- Police Mutual

- RBS

- Reassure

- Royal Sun

- Scottish Friendly

- Shepherds

- St Andrews

- Staysure

- Sun Alliance

- Wesleyan

- Yorkshire

- Yu Life

- Swinton

- TSB

- Unison

- Unite Union

List of term life insurance companies available in Canada:

- Aviva Canada

- Protective Life Insurance Company

- Commercial Insurance Provider

- OTIP

- Pafco

- Pembridge Insurance

- Peel Mutual Insurance

- Perth Insurance

- Grey Power Insurance -

- Gore Mutual Insurance Company

- JEVCO Insurance Company

- AXA - Global Healthcare

List of term life insurance companies available in Australia:

- TAL Life Limited

- AIA Australia Limited

- Zurich

- MLC Limited

- AMP Limited

- BT Financial Group

- CommInsure

- MetLife Insurance Limited

- Australian Policy Traders

- Spotter Finance Pty Ltd

- Life Insurance Comparison

- Proud Financial Pty Ltd

Frequently asked question:

Here are some commonly asked questions which are described below

1) Can you have two different life insurance policies?

It is totally possible and legal to have multiple insurance policies and it is a good way to save money too.

2) Can I cancel decreasing term life insurance?

Yes, no one can stop you to cancel decreasing term life insurance As we know different companies have different policies So like one of the company policy is If you cancel within 30 days company will return. If you cancel after 30 days you won’t get anything back.

3) What is the best term life insurance?

The 7 Best Term Life Insurance Companies of 2020

-

Northwestern Mutual : Best Overall.

-

John Hancock : Runner-Up, Best Overall.

-

AIG: Best Level Term.

-

Transamerica: Best Guaranteed Renewable Term.

-

MassMutual : Best Instant Issue Term.

-

State Farm : Best Return of Premium With Cash Value.

-

Mutual of Omaha: Best for Young Families.

4) Is AAA Term Life Insurance Good?

- A triple AAA insurance is obtainable by the car Association of America, also observed as Triple-A and AAA.

It offers good whole ,term and life insurance policies even when you are not a member.

Conclusion:

Decreasing term policies often come with varying death benefit amounts and are available in various increments, It’s different than the other traditional term life policies because of level-premiums with the guarantee to never increase.