In this article, we will discuss in detail insurances. Their weird type; Body Parts Insurance. What famous celebrities have them?

** Why does Insurance exist?**

Insurance is an arrangement of a mutual agreement between the person intends to get something insured and the company or the government to pay or provide protection against any possible incident which may cause loss or damage. This is the safest means of safeguarding or sheltering anything in the form of compensation from financial loss.

Starting the concept of Insurance

The first-ever insurance concept dates back to the Chinese and Babylon traders when they used to travel around the world for trading. According to experts, this started in 3rd millennia BC followed by 2nd millennia with advanced designed policy.

What was the first type of Insurance?

Property insurance is said to be the earliest and oldest type of insurance in the history of mankind when people of a certain area or village would agree on mutual terms that if somebody’s house caught fire the neighbour would help rebuilding it and vice versa. The sole purpose was to redistribute the risk upon mutual agreement. Later in the 1700s, as the trading grew so does the form of insurance. Persian Achaemenians used to be presented with gifts so that the traders can be protected from any theft or harm. Around the 1st millennia, the traders and the merchants started collected a sum of amount from each of the group members to reimburse them in the time of need especially while travelling if anybody losses his premiums due to storms, theft or sinkage. Similarly, in Europe societies, people used to pay a sum to help rebuild the needy in times of emergency. In 600 BC, the concept of @BenevolentSocieties was introduced in Greeks and Romans where they established guilds to lend care and help to the families of the deceased and to help them financially for funerals and other protocols.

The oldest and the formal form of Insurance was first operated in the United States with Presbyterian Ministers Fund in 1759.

When were insurance created?

The first-ever insurance was created in 1752 during the colonial days in the United States.

Who started the first Insurance Company?

The first insurance company was started in 1752 by Benjamin Franklin. It was the insurance of houses from fire, in which 8 fire companies participated voluntarily. It has 15000 employees and it worked as Philadelphia Contributorship. This is also known to be the birth of property insurances.

** Which is the first Insurance company in the world?**

In the modern world, considering the most formal setup of a company working globally for insurances was Phoenix, London. It was first founded by one of the sugar refinery owners in 1857 in London, England, UK. It is known to be Europe’s largest life and pensions consolidator. It operated from Royal oak with the name of @ThePearlLoanCompany. Later, in 1914 it changed its name to @ThePearlAssuranceCompany.

What are the types of Insurances?

In the recent world, a lot of new types of insurances are introduced in the market which is as follows:

-

Life Insurance

-

Property Insurance

-

Marine Insurance

-

Fire Insurance

-

Liability Insurance

-

Guarantee Insurance

-

Social Insurance

Life Insurance

Let’s look into life insurance:

Why do you need life insurance?

Insurances help you in times of need. If you have a dependency to look after you, for instance, your parents that are gradually ageing and retiring they would want an intense health care system and to support that you need their insurance, so one day when you cannot afford their treatments or because of any other cause, they could rely on their life insurance policy.

Who needs life insurance the most?

There are no particular criteria for requiring to have life insurance but generally, people with dependencies require insurance to help them in future.

How does life insurance work?

It is as simple as you provide an amount of money to the insurance company and if you die while your insurance is still active your loved ones get the tax-free sum from the money. This is called the death benefit.

Frequently asked basic questions in life insurances are:

Can I get money back if I cancel my life insurance?

Usually, the premiums paid previously are not refunded at the time of cancellation of life insurance.

What is not covered by life insurance?

Few types of death casualties are not covered in life insurances.

How much life insurance do I really need?

The number of years left until retirement is multiplied by your annual salary is the amount you have to pay for it. Another method may include seven or ten times your annual salary is the amount you pay for insurance.

What types of death are not covered by life insurance?

Eight types of death are not covered in life insurance such as the murder of policyholder, ■■■/Aids, non-disclosure of activities at the time of insurance like smoking drugs, death due to overdose of drugs, death due to pre-existing disease, suicidal death, death during delivery, death due to natural disaster or calamity.

Property Insurance

What are the two basic forms of property insurance?

All Risk Policies covers a wide range of compensations

Peril-specific Policies covers the specific losses as per mentioned in the list of policy

What is the difference between homeowners insurance and property insurance?

Homeowners Insurance covers your homes alone including additional structures attached to your homes

property insurance it covers all the types of property you get insurance for, it reimburses to you in situations like fire hazards, theft and weather damages etc.

Marine Insurance

It covers the damage of ships or cargos and all means of transports that held between the lodging and destination points.

What are the types of marine insurance?

Liability, Hull or marine cargo insurances are few of the types.

What is not covered in marine insurance?

Damage of all the goods transported by land through any means within the national boundaries. The goods can both be imported or exported ones

Fire Insurance

It covers all the property damage caused by fire along with the accommodation charges during the times when the house is not in the condition to live in.

What are the types of fire insurance?

Seven types of famous fire insurances are:

- Valued Policy:

- Specific Policy:

- Average Policy:

- Floating Policy:

- Comprehensive Policy:

- Consequential Loss Policy:

- Replacement Policy

Liability Insurance

Any damage of property or people is reimbursed in liability insurance. Property may include car, house or any other liability. It falls in two categories one is Physical injury and the other is property damage.

**What is the difference between liability and full coverage? **

liability is the damage caused by you to other people’s property or health when you interact with them on the road while full coverage is the compensation of damage caused to your vehicle

**What does Liability Insurance consist of? **

It consists of basic coverage of injuries or damage caused to people if they get in an accident with you

** Is liability cheaper than full coverage?**

Generally, it is cheaper but it only covers the damage to the third party caused by you whereas in full coverage the cost of the damage caused to your car is also covered.

Guarantee Insurance

What is guarantee Insurance?

It works like security or payment in advance for the work that is been agreed upon between the two parties.

**What is the difference between guarantee and insurance? **

The indirect agreement is called a guarantee whereas the direct agreement between policyholder and insurance provider is called insurance.

** What makes a guarantee valid?**

It can only be valid if it is written and signed between the guarantor and a borrower

Social Insurance:

When social markets are being intervened by the government to make sure that the process to serve the purpose are being met and the group of individuals being benefitted in case of emergencies.

** What are the types of social insurance?**

Social security, medicare, insurance programs of unemployment, disability insurance and worker’s compensations are few of the types.

** Why is social insurance important?**

It protects employees and workers in cases of families of disables or to provide after retirement benefits.

**Can I draw Social Security and still work? **

Yes, it can be drawn in form of retirement or survivor of benefits but if you are younger than the age of retirement and earns more than a certain amount per annum then your benefits will be reduced. To avail full benefits it is better to avail at the age of retirement.

These were some of the insurances that are utilized by the ordinary being of a working-class in every society.

But there is a specific class who enjoys another form of insurance that is more expensive than one’s lifetime earnings and property. These insurances usually range in millions of dollars and that too for a specific body part that one cannot imagine.

BODY PART INSURANCES!

Celebrities have gone extreme in getting their body parts insured. One would think that owning a house, a car or any other property would be the premium asset but who knows your waist, legs or even tongue can worth more than that.

Yes, hold your breath while we move forward to see the topmost interesting body part insurances that would WOW you.

LEGS:

• Taylor Swift: Worth $26.5 Million

She being the busiest singer stays always on the go and hence probably think of getting her legs insured.

• David Beckham: Worth $70 Million

David Beckham is an ace footballer who got his legs insured for $70 million. He has fans all around the world. Because of his fame and athletic body he is also been modelling for quite some time now.

No doubt the money they spent on their single body part can take our lives to earn.

Mariah Carey: Worth $ 1 Billion

Yeah, you hear me right! It’s $1Billion. She’s been known to have “Legs of Goddess” by Gillette Razors campaign which made her think to get them insured before she losses the spark.

Cristiano Ronaldo: Worth $195 Million

Getting body parts insured is not only limited to Hollywood characters but it is famous in players and athletes too. Who doesn’t know Ronaldo for his game and mostly for his looks. He has also been famously known for his hefty amounts of charity. Though, to remain in the game they get their legs insured so that their career stays on the safe side.

Rihanna: Worth $1 Million

Rihanna keeps it to herself for quite a while unless everyone knew that she is on the list with all her bad-■■■ image. It is reported that her legs worth $1 million (£786k). After having won the Goddess award in 2007 by Gillette’s Venus Breeze Celebrity legs she is been much concerned about protecting them now. She insured them so that she gets the hefty amount if they ever get less attractive.

Tina Turner £1.5 million.

Turner’s reported to had her legs insured in her times. She has seen the peak of her career and people who love her singing claims that her legs were beautiful too.

Tongues:

Gene Simmons: Worth $1 Million

The legendary bass guitarist did this bizarre kind of insurance to enhance his demonic stature by getting it for $1Million.

Miley Cyrus: Worth $1 Million

A former Disney star Miley Cyrus when found it old and dull to pose same for every picture thought of taking her tongue out. Later it got famous into a Punk Style look which she later posed for all of her pictures. This is why we believe pretty much she realized the worth of her tongue after that and got it insured.

Waist:

Bette Davis’ waist – Worth $500,000 (£394k)

In the 1940s this actress got her waist insured for $28,000 at the time which is around $500,000 in today’s money. This was initially to bring in some fortune. She got fame and she believed that her tiny waist was the main reason for getting her work. This is one of the strangest kind of insurance on the list.

Hair:

Troy Polamalu’s hair – $1 million (£786k)

American footballer Troy Polamalu has been the spokesperson of Head & Shoulders in 2010 who kept on growing his hair since 2000 and haven’t cut an inch. His curly hair is famous among his fans and Facebook has a separate page of his tight locked curly hair where his fans won’t stop appraising them. Besides, he got his luscious locks hair insured for $1 million (£786k) which makes him held the Guinness World Record for the highest valued head of hair after insuring his luscious locks

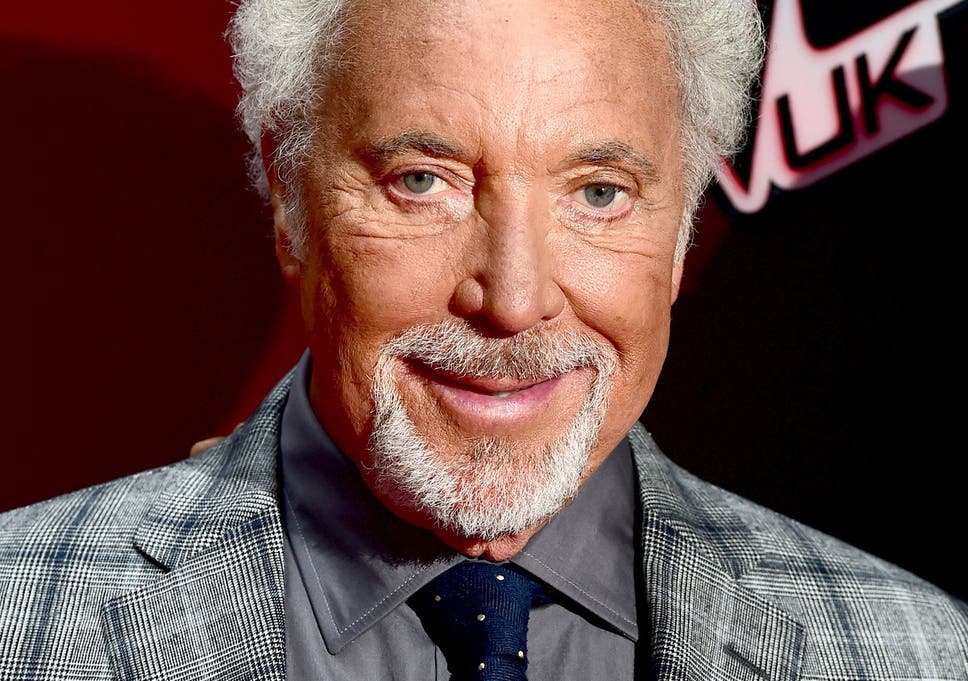

Tom Jones: Worth $6.8 million:

We got that Eww feeling when we hear chest hair could cost $6.8 million. This is one of the weirdest and bizarre thing one could spend this much money on. He got his insurance done in 2008. And we still think the reasons behind his insecurities of losing chest hair.

Smile:

Julia Roberts: Worth $30 million

This one is rather a genius idea to do so. We all know we’ll be ageing soon and require expensive teeth treatment. Who wouldn’t want getting broken teeth repaired and cavities done from the insurance money? Julia is known for the wide smile which is pretty much famous in the Hollywood industry.

America Ferrera - Worth £7 million

It is reported that Ferrera got her smile insured for £7 million. She is the famous actress of Ugly Betty, American series during which it got all over screens. She has also lead a campaign of Aqua Frech for whitening teeth.

Bruce Springsteen: Vocal cords Worth $6 million

Bruce is a famous American living legend. He got his vocal cords insured for $6million because he certainly cannot afford to lose his voice

The list hasn’t ended yet. There is an ongoing competition of getting body parts insured that ranges from weirdest to craziest.

Where James Bond’s leading star “Daniel Craig” has his body insured for $9.5 million to Pilot of Formula 1 “Fernando Alfonso” getting his thumb insured for 11.7 million USD. Celebrities getting their curves insured to their buttocks, hands, feet, moustache and what not.

Conclusion:

Seeing all these happening in the world makes us jaw-dropped because we know a million dollars is a lot to invest in a body part that’s just like an ordinary one. The ■■■■ for fame and excess of money does make you go extreme zoned.