Where can I load my chime card for free? We’ll examine the locations where you can get free recharge for your card so you can use it to make purchases. Once more, the balance will be accessible in your Chime account when you reload your card. The money you deposit into your Chime account can also be accessed using your debit card. This is because of the card’s affiliation with your Chime spending account.

You need to create a Chime account first before receiving your card. Since the platform is entirely online, everything takes place online. To open the account, you must a smartphone or a computer. You can also open an account with the use of a tablet. Online accounts are practical since you can open one without going to a real location. In this manner, you can use your valuable time to perform other things.

How can I sign up for a Chime account?

Where can I load my chime card for free? You must be aware that creating a spending account is a must to receive the Chime card. You must abide by the rules set forth by the federal government because the service is identical to any other financial institution. There are a lot of prerequisites, including a valid form of identification, your Social Security number, as well as your home address, email,, and phone number.

The identification document can be a state ID, a passport, or a driver’s license. The most recent utility bill statement or any other pertinent document containing your address must be provided to Chime and other banking institutions as confirmation of your physical residence. They can be certain that you gave them the right information if you do this.

To add money to your new Chime account, you might also need an outside bank account. To top up your Chime account, you can transfer funds using the account and routing numbers of another bank.

You can open your account as soon as everything is in your possession. The Chime app is preferred by the institution for creating new accounts. As a result, depending on your operating system, you should start by installing the program from your App Store or Google Play.

You can open the app after downloading it and precisely enter all the necessary information. Along with the spending account, a savings account can be opened. The Chime Spending Account is a type of checking account, by the way.

You can store money in a checking account for daily use. When you open a checking account, you receive a unique account number. Giving someone my Chime account number enables them to pay money to my Chime account from another bank, and then everything is set. Above all, there are no monthly or overdraft fees with the online checking account.

How much cash can I have in my Chime account?

What Are the Chime Withdrawal Limits?

| Type | Amount |

|---|---|

| ATM withdrawal limit | $500 per day |

| Cash back at the point of sale | Varies by the merchant, up to $500 per day |

| Over-the-counter withdrawal | $500 per day |

| Card purchases that require signature and pin | $2,500 per day |

How do I obtain a Chime card?

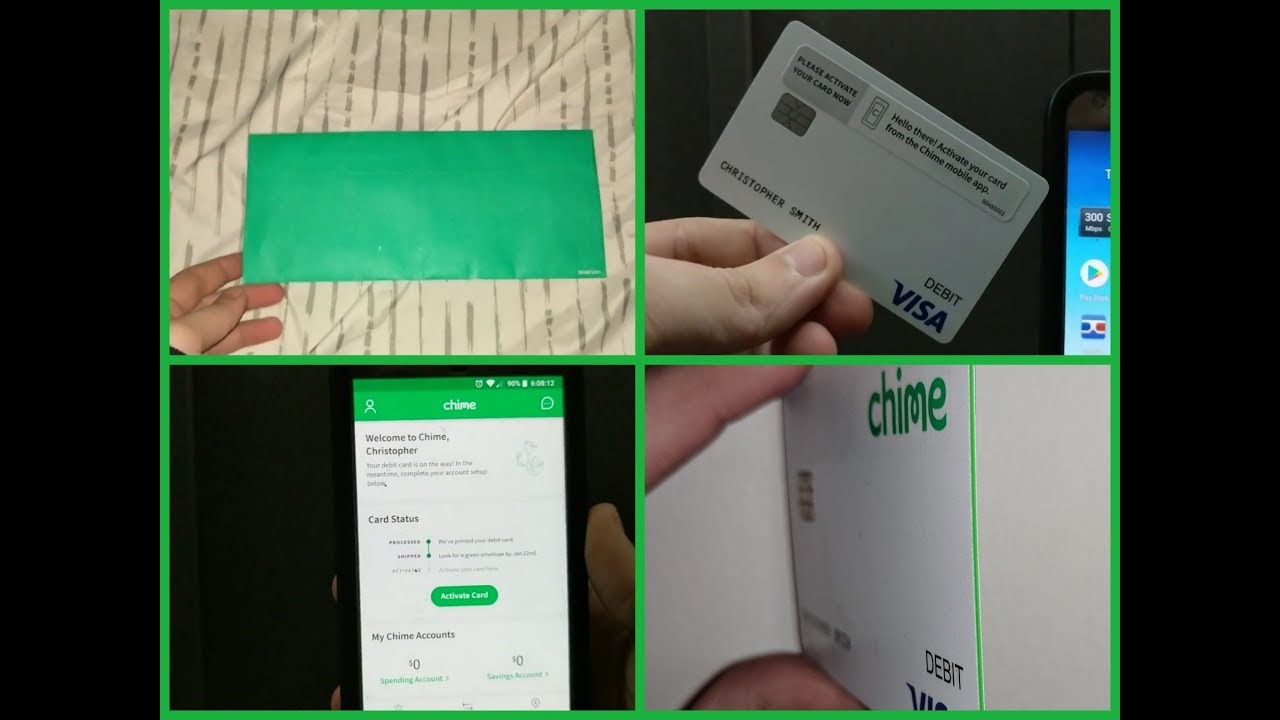

Where can I load my chime card for free? You can then apply for the Chime Visa debit card after creating an account with the business. In most circumstances, Chime enables you to request the card together with your account application. Even so, you can ask for the card later if you open your account without it.

You can receive the card at your physical address and activate it for use as most card applications are completed online. The card has the most recent EMV chip technology, which increases its security. Using the Chime app, you can activate your Chime card (version 3.3 or later)

You must log into your account to activate your card. A card widget labeled “Card Status” can be seen at the top of your app. Find the large green “Activate Card” button in the widget. If you can’t see the button, you can alternatively ask the chatbot to “Activate my card.” On the home screen, the Chatbot is typically at the very top. Help the Chime call center at 1-844-244-6363 if you have trouble activating your debit card.

Where can I get free Chime card loading?

Where can I load my chime card for free? You should load funds onto your card as soon as you acquire it to use it for your numerous transactions. Even while the card gives you access to your Chime account balance, you can load funds onto a Chime card at some physical stores. These are a few of them.

- Family Dollar at CVS

- American Motors Speedway

- Walmart

- Walgreens

- Stores at Holiday Station

- Travel Centers Pilot

- Circle K Retailers

- 7-Eleven

- Rite Aid and Duane Reade

- Investments by GPM

- Crown Farms

- Inc. Kwik Trip

- Gentle Krause (■■■ & Go)

- Sheetz Corporation Cumberland Farms Corporation TA Operating LLC (TravelCenters of America)

When you add money from businesses, you need to be aware that there may be transaction costs. Chime has no jurisdiction to determine the fees that shops may impose because they are free to run their own operations. To choose where to go for your transaction, you can view the different costs that each merchant charges prior to visiting them. To check fees, you can follow the steps listed below. - To log in to your Chime account, open the mobile app.

- Click the menu item labeled “Move Money.”

- Determining to "Deposit Cash."

- You can choose “See Locations Near Me” on the window that appears next.

- After that, tapping on it will display nearby retailers for you.

- Additionally, by tapping the “info” symbol next to the retailer’s name, you may view the transaction costs.

- You can deposit any amount after selecting the appropriate shop to make a cash deposit to Chime. As you may load your card for less than $5 at several businesses, the cost is typically not that high. The overall amount you deposit into your account will determine the final charges, though.

What other options are there for recharging a Chime card besides the refill locations?

Where can I load my chime card for free? Additional than at the refill places, there are other ways to reload your card. These are a few of them.

I) Have funds deposited into your Chime account

Where can I load my chime card for free? Account holders can transfer money to one another via Chime. You can let individuals send money to your account by giving them information like your Chime username. The methods listed below should be followed if you want to send money to another Chime account holder.

- Access to an online account is necessary

- Look up a friend’s or your $Chime Sign’s name. You can also input a non-Chime user’s email address or phone number as an alternative.

- Input the recipient’s desired payment amount. You can explain why you are sending them the funds in the message.

- Verify the addressee and the amount to send.

- To send the money, tap Pay now.

ii) Make a bank account contribution.

Where can I load my chime card for free? You can add money to Chime using a bank account. The steps listed below can be used to complete the procedure.

- Sign into your app account.

- Access Settings

- Enter the login information for your other bank by tapping “Link a Bank Account.”

- After the connection is finished, you should choose Move Money, then Transfers, and finally Funds.

- Also keep in mind that, should the necessity arise, you can move funds from Chime to a bank account. Sometimes you need money from your other bank to perform tasks that Chime does not allow you to.

These are some of the banks that Chime partners with. - American Bank

- One Capital

- Chase Charles Schwab

- Bank PNC

- SunTrust

- US Bank TD

- Citibank

- Fidelity

- Navy American Federal Bank

- Bank of America.

How is the Chime debit card used?

Where can I load my chime card for free? Your Chime debit card can be used in a variety of ways. These are a few of them.

1) Purchase products and services

Where can I load my chime card for free? Either online or offline stores are options for purchasing goods and services. You can utilize the card number, the card’s expiration date, and the CVV when making an online purchase. The necessary amount is then taken out of your account by the system. Because unscrupulous merchants may exploit your data, it’s crucial to only pay for things online at reputable retailers to avoid having money taken out of your account.

Additionally, you can swipe or tap to pay at actual branches. The payment option is the most popular because it enables in-person shopping.

2) Use an ATM to get cash

Where can I load my chime card for free? You may use the card to make cash withdrawals at many ATMs because it is a debit card. When you transfer money to your bank account, you can still withdraw cash from Chime without a card, but the debit card is still quite useful owing to its convenience. You must insert your card into the machine, enter your PIN, and select the amount you wish to withdraw to make a withdrawal at an ATM.

More than 60,000 ATMs across the nation are fee-free for cash withdrawals. The card is now quite helpful for your account as a result.

How does the Chime Card function?

Where can I load my chime card for free? Simply acquire your Chime Card online and fund it with money from your bank account to get started. You can use your card wherever Visa is accepted after you receive it. Although there is a $2.50 transaction fee, you can also use your card to get cash from ATMs. The money is promptly deducted from your account when you make a purchase.

What advantages come with utilizing a Chime Card?

Using Chime Card has numerous advantages, including

- No credit checks are necessary.

- No extra costs

- With direct deposit, you can receive your paycheck up to two days sooner.

- Use your card in-store or online anywhere Visa is accepted.

- Use ATMs to withdraw money (there is a $2.50 transaction fee)

- When you make purchases, the money is immediately taken out of your account.

Is Walmart a place where I can load my Chime Card?

Where can I load my chime card for free? Chime is a well-liked choice for anyone seeking for an alternative to a conventional bank. Possibilities people frequently inquire about is if they can load money onto their Chime cards at Walmart.

Walmart is one of Chime’s cash deposit partners, thus the answer is yes. The cost of this service, which ranges from $3.50 to $4.95, is the only drawback. Customers are also only permitted to load their card three times in a 24-hour period, with a $1,000 per transaction and $10,000 monthly cap. Many consumers believe that these limitations are worth it to take advantage of Chime’s advantages, such as no fees for international transactions or ATM withdrawals.

How can I top up my Chime card with cash at Walmart?

Where can I load my chime card for free? It’s quick and simple to add money to your Chime Spending Account at Walmart. Simply present the cash deposit amount at the Money Center counter or customer service desk. After paying a nominal loading charge, the funds will be immediately put into your account. After that, you can use your card anywhere that accepts Visa to make purchases. So, make sure to use this practical method of loading money onto your card the next time you’re at Walmart.

What time can I load money into my Walmart Chime Card?

Where can I load my chime card for free? Many individuals adore the ease of using reloadable cards for routine transactions, but occasionally they ask when the best time is to add funds to the card.

Customers can load their Chime cards at Walmart at any time while the store is open. Except on Christmas Day, Walmart normally opens at 8:00 am and closes at 11:00 pm on weekdays, weekends, and legal holidays.

You can always refill your Chime card at Walmart, whether you’re loading up on groceries first thing in the morning or buying a few things just before going to night. Use the online store finder to confirm the opening times of your neighborhood store before visiting.

Is there somewhere else besides Walmart where I can refill my Chime Card?

Where can I load my chime card for free? Over 90,000 establishments across the nation are Chime cash, deposit partners. Simply present your card to the cashier along with the desired amount of cash, and they will handle the rest. Ask before you deposit as fees may differ from store to store.

Several well-known businesses that accept cash deposits include Walgreens, 7-Eleven, Dollar General, Speedway, Family Dollar, Rite Aid, CVS, Holiday Station Stores, Kwik Trip Inc, and Royal Farms, With the range of options available, you’re certain to find a convenient place to load your Chime card.

What is the price to load a Chime Card?

The shop where you add money determines the reload cost for a Chime card. Although the maximum charge from third-party merchants is $4.95, the typical amount is closer to $3.50. By launching the Chime app and choosing “Move Money,” you may learn how much each retailer costs.

Then click on “See Locations Near Me” after selecting “Deposit Cash.” This will display a list of nearby retailers and their fees that can reload your Chime card. Most of the time, setting up a direct deposit or moving money from another account will allow you to completely avoid the reload cost. But if you require cash right away, loading it onto your Chime card is a speedy and practical choice.

Where can my chime card be loaded?

Where can I load my chime card for free? Don’t worry if you run out of cash and want to deposit funds specifically into a chime account in your account. Simply ask the clerk at Walgreens to load the money into your Chime account.

He will deposit the money into your account when you give him the cash. Several more sites, including Walmart, 7-Eleven, and Dollar Store, allow you to add money to Chime accounts. But it’s simpler to get to Walgreens.

How much does it cost to load a chime card at Walgreens?

Where can I load my chime card for free? The amount you want to load into your Chime account will directly affect the amount that is charged. There will be a small charge fee if you only want to deposit a small amount of money into your account.

Walgreens will charge additional fees if you load a large sum of cash. However, Walgreens often charges a fee that ranges from $3 to $12, depending on how much cash you deposit.

How quickly can you load money into a Chime card?

Where can I load my chime card for free? If you use the bank to recharge, it takes a few days. It can take up to five business days, Monday through Friday. Except on holidays, 5 working days after the transfer date. Banks recharge using an external account, and the cash transfer process takes close to 3 days. transfers starting Banks make every effort to complete the transaction as quickly as possible, but it still takes a minimum of 3 days.

Can I top off my chime card with cash at an ATM?

Where can I load my chime card for free? Since Chime does not handle ATM transactions, you cannot deposit cash into your Chime card or account. Because Chime does not take payments from ATMs, customers must deposit money into their Chime cards at places like Walgreens, Walmart, Dollar General, etc. Request that the cash is deposited into your Chime account by going to the Cashier. It’ll be simple to complete.

Service for Third-Party Transfer

Cash deposits made through Walgreens involve third-party financial transfers. There are several phases involved in this process of loading money onto your Chime card. These are the steps:

- Limits on account transfers and a variety of depositing options are permitted on a daily, weekly, and monthly basis.

- A transaction fee is assessed for each one.

- Cash deposits must be made in local money.

- Before depositing money onto your Chime card at Walgreens, keep in mind all these steps.

What is the purpose of Chime?

Where can I load my chime card for free? Chime’s goal is to provide traders with a financial mindset and ease their transactional process. Their primary goal is to expose everyone to the harsh realities of money and cash.

They are altering how bank employees view themselves. Chime safeguards financial practices and facilitates their management. Giving customers a convenient way to use money is Chime’s core business tenet.

Chime policy works to make allowances for your errors and disasters, and they never profit from circumstances where their use is restricted or interrupted. They just concentrate on making their users’ lives and businesses better.

How does Chime generate revenue?

Where can I load my chime card for free? Chime generates revenue via transaction exchange. For each transaction carried out through it, Chime charges a fee. When you use a Chime debit card or credit card to make a purchase that is processed through the Visa network, Chime will get a small charge in exchange for their services.

In contrast to banks, Chime just takes a small portion of the fee every time you use its services, and there are no additional fees. Because of this, it benefits everyone.

Can anyone use Chime?

Where can I load my chime card for free? Anyone who is an adult and at least 18 years old may use the chime. The use of this functionality for payment is encouraged in the United States.

Chime cards are a service that is available everywhere. They currently provide memberships to residents of the District of Columbia who have valid SSNs. Membership indicates that they are providing accounts to individuals in various parts of the world.

What kind of cards is Chime selling?

Where can I load my chime card for free? Chime is a platform for financial transactions, as is well known. Chime offers two different kinds of cards.

When you open a Chime spending account, you receive a Chime debit card in the mail. Any retailer that accepts Visa services can accept this Chime debit card. For the convenience of the customer, the Chime debit card sends notifications anytime it is scanned.

In addition to allowing and accepting Chime Debit Cards, mobile payment services like Apple Paytm, Google Paytm, and Samsung Paytm also support them. Chime also makes it possible to instantly block a card and replace it with a different debit card. All these features are provided via the Chime mobile app.

Chime Credit Builder: You may effortlessly build and store credit with the Chime Credit Builder Visa Card, which is a card without any fees. The Chime credit card doesn’t care about its service. You can use the card up to the amount of money that you deposit into your Chime Builder account. You can use this cash to pay down your monthly checks and balances. There are no pre-established boundaries at Credit Builder’s, and it has a unique operating policy.

After I open a Chime Spending Account, when will I get my Chime Visa Debit Card?

Where can I load my chime card for free? Your Chime debit card is mailed to you when you open an account with Chime so that it can be cleared within one business day. The Chime Visa Debit Card takes about 5 to 10 working days to arrive at your house. Your mail will arrive on time if your address is precise. If after 10 days you still haven’t received your Chime Visa Debit Card, email the support team.

Can I use a debit card to load my Chime card?

Where can I load my chime card for free? When you first add money to your Chime spending account, link it with an external bank account and enter your debit card information if you wish to make an instant transfer using your debit card. With the Chime Debit card, you may now instantly add a $200 deposit to your Chime card.

Summary

Where can I load my chime card for free? Can Walgreens help me top off my Chime card? We concluded that because Walgreens is so accessible, it is the most popular choice for customers who wish to fill out their Chime cards. Chime account policies are compatible with Walgreen’s policy. People, therefore, use Walgreens to make cash deposits into their Chime cards. Up to 90,000 retail, three deposits may be added each day. Additionally, Chime offers a Chime Debit Card and a Chime Visa Credit Builder Card.

Frequently Ask Questions

There are some Questions that are related to the keyword “Where can I load my chime card for free?” as below:

1.Where can I find my Chime card without paying a fee?

Walgreens has joined CVS, Walmart, and 7-Eleven in enabling users of the digital bank to make deposits at their physical shops. The only store that does so without charging Chime customers is Walgreens.

2.Does adding money to my Chime card cost anything?

Most merchants will only charge you less than $5 to fill your card. The final charges, however, will vary according to how much you deposit into your account.

3.Where near me can I load money onto my Chime card?

With the help of our cash deposit partners, you may make cash deposits into your Chime Checking Account at more than 90,000 retail locations.

4.What is the process for adding money to my Chime checking account?

- Walmart.

- 7-Eleven.

- Speedway.

- Money General

- Financial Family.

- CVS.

- “Rite Aid.”

- Travel Centers Pilot (Pilot Flying J)

5.How do I contribute money to my Chime account?

With the help of our cash deposit partners, you may make cash deposits into your Chime Checking Account at more than 90,000 retail locations. Request that the cashier deposit money right into your Chime Checking Account. In the Chime mobile app, navigate to Settings > View limits to see your deposit limits.

6.What is the cost to add money to my Chime card at Walgreens?

There is no charge to deposit cash at a Walgreens® location.

7.Where can Chime find a free ATM?

For Chime members, we have a network of more than 60,000 fee-free in-network ATMs. At any Money pass, All point, or Visa Plus Alliance ATM in a 7-Eleven, transactions are free of charge. Download the Chime mobile app, then select the ATM map to discover a fee-free ATM close to you. You can look up any ATM in our network.

8.Can you deposit money for Chime at an ATM?

Unfortunately, we are unable to accept any type of ATM deposit. With GreenDot, you can make cash deposits to your Chime Checking Account at more than 60,000 retail locations. Simply request at the register that the cashier add money to your Chime Checking Account.

9.At Walmart, can I put cash on my Chime card?

Yes, clients can load their chime cards at Walmart, or to put it another way, they can add money to their chime cards there. Walmart does, however, incur depositing fees for doing so, ranging from $3.50 to $4.95. The third-party deposit partners determine these depositing fees.

10.Do I have to have money to use my Chime credit builder card?

No. You must open a Chime Spending Account and have received at least $200 in direct payments into the account within the last 365 days to qualify for the Chime Credit Builder Visa® Credit Card. I have a Chime Credit Builder card; can I add money to it?

11.Where can I 24 hours load my Chime card?

A Chime card can be reloaded with cash. Over 90,000 retail establishments, including Walmart, 7-Eleven, Walgreens, Dollar General, Family Dollar, CVS, Rite Aid, and many others, accept cash deposits. You can deposit up to three times every day, add up to $1,000 per day, and deposit a maximum of ten thousand dollars per month.

12.Which banks support Chime?

Through its partner banks, Stride Bank, N.A. (FDIC No. 4091), or The Bancorp Bank, all Chime accounts are FDIC insured up to the normal amount of $250,000 per depositor, for each ownership category, in the event of a bank failure (FDIC No. 35444).

13.Where can I get free money to add to my Cash App?

To locate a deposit location close to you, use the map found in your Banking tab’s Paper Money section. To do this: On the home screen of the Cash App, tap the Banking tab.

- Depository Sites

- Walmart’s customer service counters and money machines

- Walgreens.

- Reade, Duane

- 7-Eleven.

- Financial Family.

- GoMart.

- Sheetz.

- KwikTrip.

14.Chime cards are loaded at CVS?

With more than 90,000 retail locations worldwide, Chime has several deposit partners. Walmart, Walgreens, and CVS are just a few of the well-known businesses in this list. You should be aware that you cannot load money onto the Chime card at an ATM.

15.Is the Chime ATM at Walgreens free?

Despite not accepting any form of deposits at ATMs, more than 8,500 Walgreens and Duane Reade locations accept fee-free cash deposits into Chime Checking Accounts.

16.All point for Chime is it free?

The corporations will increase clients’ access to surcharge-free ATMs in 2021 as per the deal. Members of Chime will have free access to their money through Chime’s ATMs. When consumers use their Chime debit cards to get cash out of All point ATMs owned by Cardtronics, this is applicable.

17.Is there a daily cap on Chime?

The daily withdrawal cap for the Chime prepaid card is $500 from any ATM. Additionally, you can get cash by traveling to a bank or credit union and showing the cashier your card. In this instance, the daily cap is also $500.

18.Will Chime return the money that was taken?

Does Chime Pay Back Stolen Funds? All disputes are swiftly investigated, according to one of their assistance articles. Chime issues the merchant a chargeback request while it conducts its inquiry. This is a tactful technique to request the merchant return the funds while the investigation is ongoing.

19.Can Chime be overdrawn?

In contrast to conventional banks, Chime doesn’t charge qualifying members who overdraw up to $100*

20.Can I use Chime to get a cash advance?

Chime only begins out with a $20 advance or overdraft, even though it offers a cash advance of up to $200. What are additional payday loans and cash advance apps that integrate with Chime till you’ve established your Chime account history to acquire more money?

Conclusion

Where can I load my chime card for free? A financial technology business called Chime offers services that are comparable to those provided by banks. You must download the Chime app or use the website to create an account on the platform, which is only accessible online if you have the necessary information. You can open a checking account and a savings account with the business. The Chime debit card can be used to make purchases of products and services as well as cash withdrawals from ATMs.