USAA Pay Dates: USAA Military Members receive paid twice a month, on the 1st and the 15th, unless those days occur on a weekend or a holiday. If so, military members receive paid on the prior business day.

What is USAA?

The United Services Automobile Association (USAA) is a San Antonio-based Fortune 500 diversified financial services group of companies, including a Texas Department of Insurance-regulated reciprocal inter-insurance exchange and subsidiaries offering banking, investing, and insurance to people and families who serve or served in the United States Armed Forces. More than 13 million people will be a part of it by the year 2020.

USAA was created in 1922 in San Antonio by a group of 25 U.S. Army officers as a method for mutual self-insurance after they were unable to get vehicle insurance because of the belief that they, as military officials, were a high-risk group. USAA has now grown to provide banking and insurance services to former and current members of the Armed Forces, officers and enlisted, and their families. The firm ranks No. 100 in the 2018 Fortune 500 ranking of the top United States companies by total revenue.

What are USAA’s Pay Dates?

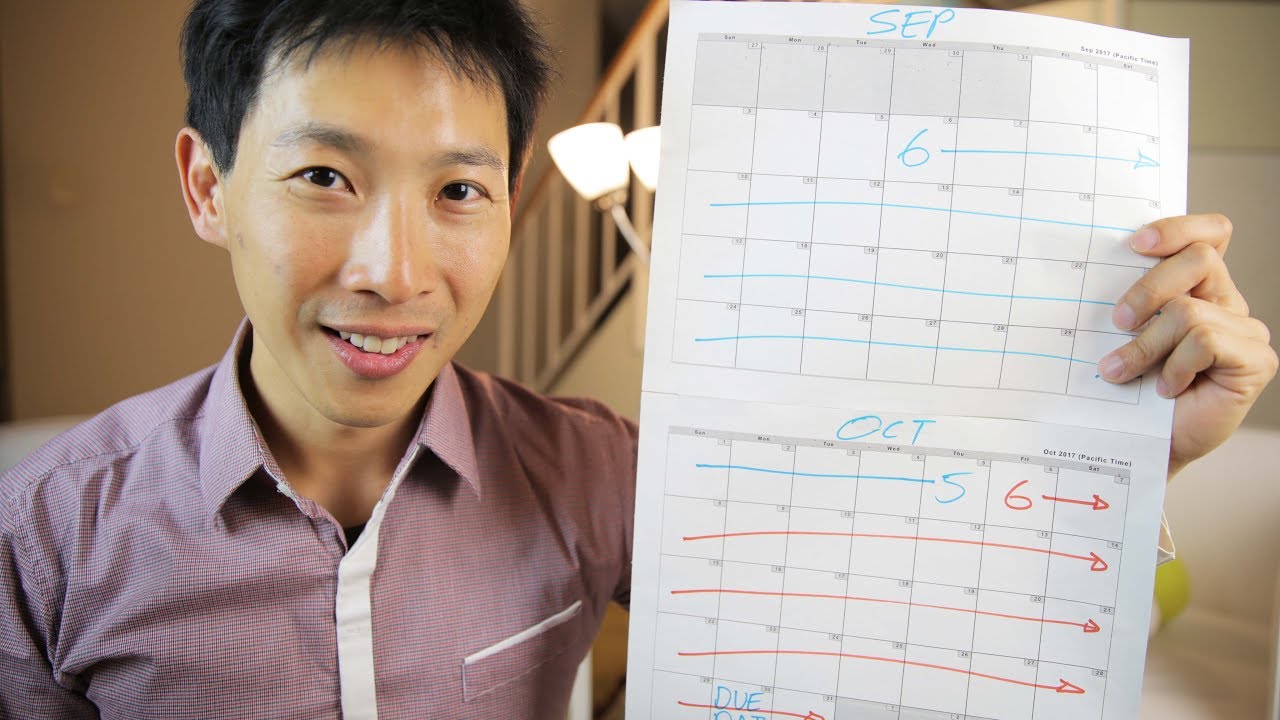

Knowing when you are paid is vital. You already know that you will be paid on the 1st and 15th of every month. On the other hand, weekends and holidays might cause the actual payday to fall outside of this window.

In addition to that, if you bank with USAA, you do get paid early. You will get your money a business day before your normal payday. This implies that occasionally you will get your salary on a Friday, whereas the typical military payday is Monday.

2022 Military Pay Dates for Active-Duty Paychecks

Predicting how much money you’ll earn and when you’ll receive it is an important first step in constructing a budget.

In general, military pay dates are simple to remember: You normally get paid on the first and 15th of each month.

There are exceptions when certain dates occur on a weekend or holiday. You’d get paid on the business day before the weekend or holiday in these situations. So if your pay day was on Sunday the 15th, you would actually get your salary on Friday the 13th. (I suppose occasionally Friday the 13th may be fortunate!)

2022 Military Pay Dates

It’s easy to see in the accompanying chart when you’ll get your military pay in 2022, as well as when you’ll be able to access your LES and NPA via myPay.

Pay Periods: You get compensated for the preceding period of time that you were employed. Your 15th-of-the-month pay is for the period from the 1st to the 15th of the current month. Your end-of-month pay, which you get on the 1st of the following month, is for pay due from the 16th through the end of the month.

All arms of the military, including the Air Force, the Air National Guard, the Army, the Army National Guard, the Marine Corps, the Navy, the Space Force, the Coast Guard, and the Public Health Service, are covered by these pay dates.

The LES may be accessible on various dates for reserve members, but their pay dates are the same.

Can You Tell Me When I Can Expect to Get My Military Salary?

Your military payment will generally be accessible on your payday. Your banking institution determines when you will get access to your money. It’s possible that cash won’t be accessible for a few days if you’re dealing with a bank or credit union.

Armed forces deposit accounts may be accessed as early as two days prior to the actual pay day at certain military-friendly financial institutions. Navy Federal Credit Union (if you use the Active-Duty Checking Account) is one financial institution that does this often.

The following is a list of the finest credit unions and banks for military personnel. Consider banking with one of these financial institutions if getting your income sooner is crucial to you.

How Much Do I Get Paid as a Military Member?

Military base pay is dependent on your rank and total years of service. No matter what branch of service you’re in or what position you’re in, your starting salary is the same. Here are the 2022 military pay tables.

Military members are also eligible for benefits such as a food allowance called basic allowance for subsistence (BAS), basic allowance for housing (BAH), and sometimes other forms of incentive pay, cost-of-living adjustments based on your location, per diem and travel pay, and other types of compensation.

For a variety of reasons, your compensation may fluctuate from month to month if you get these various sorts of allowances.

Earnings and Benefits

When it comes to keeping track of their salary and benefits, military personnel have two options: Leave The military offers service personnel two documents to monitor and understand their pay and benefits: Leave and Earnings Statements (LES) and Net Pay Advice (NPA). If you have a myPay account, you may access and download all of the necessary forms. An extra copy of these documents might help you double-check your compensation and perks.

The following details may be found in these documents:

LES: You should discover all you need to know about your salary and perks on your LES. On the last day of the month, you’ll get a summary of your earnings, including your gross pay and net pay for the month, state and federal taxes you’ve paid, other wages and benefits (such as BAH, FSA Pay, Hazardous Duty Incentives Pay, bonuses, and so on), days of leave, and so on.

In the middle of each month, the National Payroll Association (NPA) publishes data on employee compensation.

What about half months?

Pay and benefits for partial months of service are easy to calculate since the military views a month as being 30 days long. So each day’s salary is worth 1/30th of your monthly income and perks.

If you just worked half of a pay period, you would earn 1/30th of your typical salary and benefits for this time. This is crucial to know for those times when you PCS, are gone on a lengthy TDY or deployment, or when you separate or resign from the service.

In which regions are this year’s lengthier pay periods concentrated?

Since holidays and weekends alter the military pay dates slightly over the 2022 year, there are usually a few pay periods that are longer than others. When you factor in early pay, the length of some of these pay periods may grow even more.

-

March 12–31 (NFCU) is a pay period of 19 days.

-

May 12–31 (USAA) is a pay period of 19 days.

-

The pay period for the USAA and NFCU runs from the 12th to the 31st of August.

-

October 13–October 31 (USAA) is a pay period of 18 days.

-

November 11–November 30 (NFCU) is a pay period of 19 days.

This is vital information for military families to take notice. If you plan and budget for 15–16-day pay periods, you may need to prepare a different strategy for the months that have longer pay periods.

The lengthier pay periods that occur during spring break and Thanksgiving should be noted by NFCU members. If you don’t plan ahead and keep an eye on your budget, these two pay periods with extended pay periods might have an influence on your holiday travel and food preparation plans.

Pay particular attention to the lengthier pay periods that come between the Memorial Day holiday and Halloween. If you regularly plan getaways or parties, this may affect your budget if you don’t prepare ahead of time.

During the second part of August, when you’re likely to be wrapping up your back-to-school shopping, USAA and NFCU members will have more time in between paychecks. It is important to check your finances ahead of time to make sure that you have accounted for this lengthier pay period as you move towards the start of the school year.

18-19 day military pay periods in 2022!

You are aware that it will be longer between pay checks on certain days, but what can you do? A smart suggestion is to prepare to save on the shorter pay intervals.

Many make the mistake of assuming that since a pay period was just 12–14 days long, they had additional money. Instead, save the excess away for these extended gaps in income.

A savings account may help you prepare for the longer pay intervals. Speak with a helpful representative at USAA or Navy Federal Credit Union about starting one and how you can save during the shorter gaps between paychecks.

If you aren’t presently a member of Navy Federal Credit Union or USAA, you may be losing out on perks like early pay. Take a look at the advantages of becoming a member now!

When are LES statements available for the pay periods?

Leave and Earning Statements (LES) are normally accessible 7 days before the pay day.

In terms of the pay date for December 1, the only thing that could be different this year is the LES statement due on November 24th. This year’s Thanksgiving occurs on the 24th of November. Therefore, the LES’s availability date may be somewhat altered.

The DFAS MyPay System is what it sounds like.

For military members, the DFAS MyPay system makes it possible to see pay and tax statements, sign up for the Thrift Savings Plan, amend or cancel TSP contributions, and get travel advice updates. You may also read and print your tax statements and travel vouchers, update your bank details and adjust your tax withholdings.

The DFAS MyPay login is accessible at the DFAS MyPay official website. For MyPay, dial 888-332-7411 and choose option 5.

U.S. Armed Forces: Army, Navy, Air Force, Coast Guard, and Space Force all get their monthly paychecks these days.

When can I expect to get my bank transfer?

If your employer contacts us at minimum multiple business days ahead of time* of the expected pay date, it is USAA’s typical practise to make your payment available to you one working day prior to the actual pay day. This is subject to the condition that the actual pay day falls on a business day.

Paydays that fall on official holidays might cause his pay to be postponed if the employer does not transmit your automatic payments to USAA on time. This is more likely if the holiday or weekend falls on a payday.

Make sure that you have a notification system in place so that you are aware of the arrival of your direct deposit as soon as it occurs. You might get a notification through email or text message as soon as it is available.

Reasons for requesting a direct deposit

Direct deposits from any payroll provider into your USAA account are free of charge and are not subject to any holds. This service is provided by USAA.

Identity theft is less likely with this type of payment (You can’t lose or steal it since there is no physical check).

Occasionally, you’ll be paid earlier than expected. As the company that employs you is still in business notifies us at least, in advance, 2 business days , we’ve always made direct deposit money accessible one business day before the actual pay day.

How to Set up?

This form or these actions may get you started with direct deposit, but your employer will do it for you:

-

Firstly, logging on to USAA

-

Press “Account Features”

-

Then, enter on “Set Up My Direct Deposit.”

-

Follow the instructions step by step.

USAA mismanaged payday disputes, established illegal accounts: CFPB

According to the Consumer Financial Protection Bureau, Federal banks USAA overlooked stop-payment orders and reopened deposit accounts without consumers’ authorization, and as a result, the bank will pay over $15 million in restitution and penalties.

The CFPB’s settlement order, published Thursday, stated the bank declined to investigate when clients reported that monies had been deducted in erroneously. The bank’s response to contested payday loan transfers was singled out by the government as a source of USAA’s questionable practises.

The CFPB claimed USAA also engaged in unfair acts or practises from 2011 to 2016 by reopening closed customer bank accounts in some cases without giving sufficient notification.

Customers were charged over $270,000 in fees when USAA established 16,980 closed accounts without getting their permission or knowledge, according to the court decision. In July 2017, USAA paid those clients’ costs plus interest.

For violating the Electronic Fund Transfer Act, Regulation E and the Consumer Financial Protection Act of 2010, the $82.2 billion San Antonio bank agreed to pay a $3.5 million fine and $12 million in restitution to 66,000 of its members, according to the CFPB.

N26 declined to suspend or rectify payments on payday loans when consumers reported potential mistakes in electronic cash transfers that they believed were wrong, unlawful, or beyond the authority provided by the client, according to the 39-page consent order.

USAA offers no-interest payroll advance loans

If the government shutdown impacts military pay on February 1, USAA is giving aid to its members, including a no-interest loan.

When the federal government shut down on Friday night, one of the first worries in San Antonio was how it would effect the troops. Members of the military were paid on January 15, with the next planned payday arriving on February 1.

If the government shutdown affects military pay on February 1st, USAA says they’ll provide no-interest payroll advance loans to service members.

As well as these options, USAA is proposing special payment arrangements to members who are experiencing financial hardship as a result of the federal government’s payment interruption.

If a funding deal is not reached and an interruption in military pay looks inevitable, USAA will contact eligible members with information about how to sign up.

Summary

2018 Fortune 500 places the company at No. 100. Certain military-friendly banking institutions provide early access to military deposit accounts as early as two days before the actual pay day.

Frequently Asked Questions

People usually ask many questions about USAA pay dates. A few of them are discussed below:

1. What time is the first direct deposit?

Employees may expect their wages to arrive in their bank accounts on payday if their employers start the ACH transfer process early enough. For many workers, the day before their pay day, they may anticipate their payroll direct deposit to appear in their account at midnight.

2. How come direct deposit hasn’t arrived yet?

When processing payroll, you could have entered the erroneous date. If you utilise a payroll processing provider and the check date is inaccurate, contact your payroll processor for assistance. In certain cases, the check date may be adjusted to allow for genuine same-day processing if discovered early enough; nevertheless,

3. Why is my direct deposit late?

One of the primary reasons direct deposits take so long is because the banks are attempting to guarantee that the payments are not fraudulent. Many financial institutions abide by the “Three Days Good Funds Model” which indicates that deposits may be kept up to three days to check that it is real.

4. How much US Army Pay Depository (USAAPD) Deposit Hours?

Any time throughout the day, USAA pay deposits may be credited to a customer’s account. The early hours of the morning tend to be given credit, although this isn’t always accurate. Depending on the information received from the pay agency, USAA credits military pay one business day prior to the actual payday.

5. How much banks cease processing payments at a certain a day.?

Business days for banks are normally Monday through Friday from 9 a.m. to 5 p.m., excluding government holidays. Transactions received outside of these hours are normally reported on the following working day.

6. Can banks see pending deposits?

You may check your pending deposits by entering into your online account. When you look at your deposit or purchase history, you’ll often see them at the very top. Banks can also see your pending deposits, so you may call them at the customer care number to enquire about them.

7. How can I find out whether my direct deposit has been received?

Contact the organisation that is intended to manage your direct deposits, such as your employer’s payroll department. Request that the agent make a call to the business that handles your institution’s electronic transactions and direct deposits. Request a direct deposit tracking number from the processing firm.

8. Is there a pay day coming up for the troops?

Friday, May 13th, 2022, is the next scheduled regular military pay day. Military personnel will be paid that day, unless they utilise a bank or credit union that allows early crediting of military pay as a bonus to its members.

9. Can a bank keep money for a long time?

Regulation CC authorises banks to store certain sorts of deposits for a “reasonable amount of time,” which often means: On-us checks might take up to two working days to clear the bureau (meaning checks drawn against an account at the same bank) Up to five extra business days (totaling seven) for local checks.

10. What time do members of the armed forces get their paychecks?

Active duty, National Guard, and reserve personnel of the armed forces get their DFAS paychecks on the first and fifteenth of each month, unless the date occurs on a holiday or weekend. Pay is provided on the day before the first and the fifteenth of the month after the end of the previous working day.

Conclusion

In 1922, U.S. Army officers established the United Services Automobile Association (USAA). By the year 2020, USAA expects to have over 13 million members.

Related Articles

Dda Debit

Will Usaa Replace An Old Roof

Why Didn T Usaa Pay Today

Zelle maximum transfer