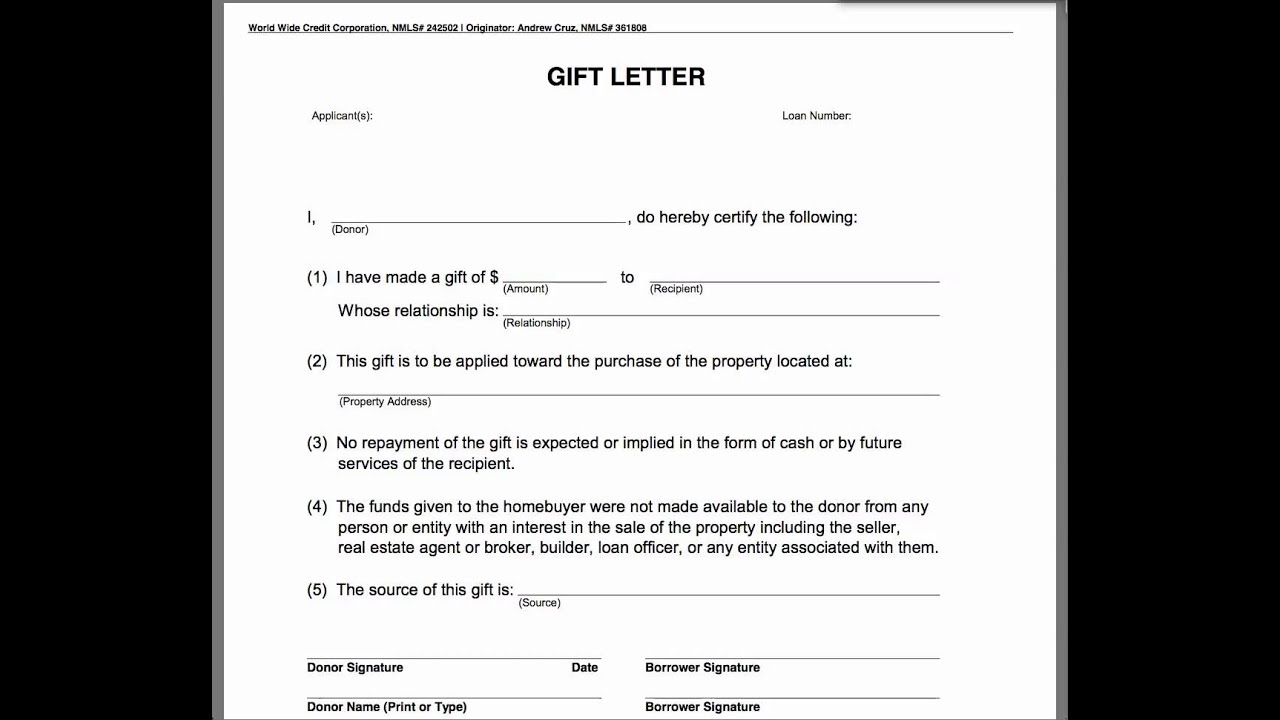

A mortgage gift letter is a statement in written form that ensures that the funds that come to the borrower’s account are a gift and not of loan. The sender must have signed and personal information on the letter.

What is the stock gift letter?

The stock gift is a kind of letter gift letter where the donate addressee with a gift that could have been purchased. Thank you for having seen the letter.

Mortgage Gift Letter Overview

- The exact dollar of amount for the gift.

- The donor has signed a statement that no repayment is expected.

- The property is associated with the down payment.

- Savings or investment.

Steps to Hand Over The Mortgage

- Supply the borrower's lender with verification of funds. The lender must be infallible, and you have sufficient money to provide.

- Oppugn as to how much the borrower's lender charges to buy down the claim rate. A lower rate impacts a more down monthly payment to the borrower.

- Sign and date a letter and fix the details gift.

Mortgage Gifts Loan Type

| Conventional Loans | FHA Loans |

|---|---|

| The buyer’s spouse’s | Immediate family |

| Children or dependents | Close friends |

| Blood relatives | Employers |

| Legal relatives | Labor unions |

| Domestic partners | Charity organizations |

Information on the gift letter

- Donor’s name and contact.

- Relationships between donor and recipient information.

- Vehicles gift money provided by the donor

- Confirm that the beneficiary has no obligation to repay the money.

How do you write the mortgage loan template for free?

With the down payment or other closing costs for the mortgage, your lender requires the donor to submit a donation letter. The gift letter ensures that the money you are providing is a gift, not a loan you need to pay back.

Steps to Give Up House

- Setting a price. Set your home's price at or near a fixed price.

- Establishing Down Payment Amount.

- Determining Gift Equity Yes.

- Considering Possible Tax Consequences.

- Drafting a Gift Letter.

- Reporting Your Gift.

Summary

It is summarized that The lender requires the donor to submit a donation letter when submitting a down payment or other closing costs. By writing a gift letter, you guarantee the money you are giving is not a loan. You can also hand over the mortgage to anyone according to your preferences.

Frequently Asked Questions ( FAQs)

1- How many letters do you send money to write?

Write these letters to the head of your company or organization. Include the date, title, company name, and address of the person who sent the gift. Start writing "Dear Mr. or Ms. Possess the person's name in the title.

2- What gift should the letter contain?

This message often displays the relationship between the sender and the recipient. Gifts can be a generous sale, exchange, or transferring something from one thing to another. Common gifts contain cash, checks, or other substantial items.

3- Why do you need a mortgage gift letter form?

A mortgage gift letter is a form provided by your donor saying funds for your down payment are a donation and you're not required to pay the money back. In fact, most first-time home buyers have received some help from their families to buy their first home.

4- Who can give money as a mortgage down payment?

Money must come from family members, e.g., parents, grandparents, or siblings. Accepting a gift from your spouse, common-in-law, or another important person is usually acceptable. However, you're engaged in getting married. How much you ' are authorized to accept as a down payment gift depends on the species mortgage you By interest.

5- How much mortgage security can be used as a gift?

The amount of money that can be given depends on the loan receiver. If a gift is for you at least 20 percent, Many lenders require you to obtain at least the value of the house at 5 percent. Restore your deposit from your wealth.

6- Can family members guarantee you gifts?

Generally, you can deposit any gift that a meaningful person accepts. Donors can only be close relatives, spouses, or common-law partners if you plan to use these gifts to pay for payments or mortgages. This rule is strictly about paying Fannie Mae.

7- How do you write examples for gift money letters?

In a donation letter, you must state the giver's name, address, contact information, relationship to you, amount, and source. Furthermore, the loan amount must be clearly stated in the mortgage donation letter.

8- Do you need a gift letter to borrow?

For some lenders, a free deposit means you don't need to disclose your savings, and you don't need to settle into the real estate market. The approving trick is to use a donation letter template, which will receive an ATM proof that the money can't be returned to your parents.

9: What can you do with money gift letters?

A money gift letter is a letter that indicates you gave money to someone. At the time of purchase, a Mattis needs a bow. Advantages of positioning your money.

10- When do you need to send a receipt?

From a technical point of view, donors will need to provide personal information in any location before submitting a tax annual income gift. It has been taken away. There are other ways to confirm a gift. Yes, a written gift Donor’s confirmation is sent either by e-mail or post.

Conclusion

We want to conclude that the mortgage gift letter is a written statement confirming that the funds coming into a borrower’s account are gifts rather than loans. Letters must be signed and contain the sender’s personal information. Donors must provide personal details before submitting a tax annual income gift. It has been taken away.