How much will I get back from unemployment taxes? During a difficult financial time, unemployment benefits can be a lifeline that helps you and your family get by. You shouldn’t have to worry about submitting your tax return on top of everything else you have to worry about during tax season.

Do you pay income tax on unemployment? How and when?

One way taxes are deducted from a worker’s paycheck is through wage withholdings. Your employer will withhold different amounts from your salary depending on the information you provide on your W-4 form. Thus, you’re gradually settling your tax liability with each paycheck.

So, what can you do if you didn’t arrange withholding in the first place?

-

To begin withholding taxes from your unemployment benefits, fill out Form W-4V and send it to your state’s unemployment office.

-

Payment of anticipated taxes will help you get back on track if you’re behind. These installments can be paid quarterly, allowing you more flexibility in meeting your yearly tax obligations.

Summary

Unemployment compensation is another income from which tax withholding can be elected to be withheld. The standard rate for federal tax withholding is 10%. It’s possible it won’t be enough to satisfy your tax bill, but at least you’ll contribute to it each time you collect unemployment.

IRS to Recalculate Taxes on Unemployment Benefits; Refunds to Start in May

In light of the recent changes brought about by the American Rescue Plan, the Internal Revenue Service has indicated that it will be taking measures to automatically refund money to taxpayers this spring and summer.

The law, enacted on March 11th, permits taxpayers with less than $150,000 in modified adjusted gross income to subtract unemployment benefits of up to $20,400 for married taxpayers filing jointly and $10,200 for all other taxpayers who qualify. The new law will not tax only unemployment payments received in 2020.

The Internal Revenue Service (IRS) will take action this spring and summer to amend the returns of anyone affected by the change who filed their taxes after the change went into effect. It is anticipated that reimbursements will begin being issued in May and continue through the summer.

The Internal Revenue Service will determine the appropriate taxable amount of unemployment compensation for those taxpayers who have previously filed and calculate their tax based on the entire unemployment benefit amount. Any overpayment of tax that results from this will be repaid to you or applied to any other taxes that are still owing.

Individuals who have already filed taxes should expect the IRS to recalculate their returns in two stages, with the first phase focusing on those who are qualified for the up to $10,200 exclusion. The Internal Revenue Service will make necessary adjustments to returns for married people and filing jointly entitled to up to $20,400 exclusion and those with more complicated returns.

Unless the computations result in the taxpayer being entitled to additional federal credits and deductions that were not included on the initial tax return, an updated > return is not required.

Summary

Because the exclusion altered the taxpayer’s income level, the IRS can revise returns for people who previously claimed the Earned Income Tax Credit (EITC) and may now be entitled to a higher EITC amount, resulting in a greater refund. However, if a taxpayer’s income has changed and they are now eligible for the EITC or other credits but did not claim them on their previous return, they will need to file an updated return.

How do I pay my unemployment taxes?

You can settle your federal unemployment tax obligations in one of three ways. You may find it more convenient to pay the whole amount of tax you owe at once if you don’t anticipate your benefits to increase that amount by too much. By choosing one of the following strategies, you may reduce the likelihood of owing a substantial sum of money at tax time.

Make sure federal taxes are being withheld by contacting your state’s employment agency. If you choose to have taxes withheld from your unemployment benefits, the government will take 10% of each check and use that money to cover your federal tax liability.

When applying for unemployment benefits, you will often have the option of having taxes deducted. To have taxes automatically deducted from your unemployment compensation, fill out a Form W-4V, Voluntary Withholding Request, and submit it to the organization handling your payments. Form W-4V, Voluntary Withholding Request, is available from the IRS or the unemployment office upon request. Use the form created specifically for your organization if one exists.

When certifying your benefits, you may be able to adjust your withholding amount every two weeks (online or by mail), depending on the laws in your state. If you live in a state that allows you to modify your withholding schedule on a periodic or biweekly basis, you can withhold money at some periods of the year and not at others.

Find out tax deductions

Find out what kind of tax deductions you qualify for by contacting the unemployment office in your state. It’s important to remember that some states have been unable to implement federal withholding on emergency unemployment compensation authorized by Congress, although perhaps doing so for normal state payments.

Use the Estimated Tax Payments Calculator to ensure that you are paying the correct amount of tax from your unemployment benefits. If your taxes are not withheld at a sufficient rate, you may need to make anticipated tax payments every quarter to avoid an underpayment penalty.

Remit estimated tax payments every three months.

Making anticipated quarterly payments to the U.S. Treasury can help you avoid a big tax bill at year’s end. You can also pay your taxes monthly, weekly, or quarterly using estimated payments. You’ll need to send the money in yourself instead of having it automatically deducted.

If your total tax withholding does not cover enough of the income taxes you would owe, you may choose to make estimated quarterly payments and withhold your taxes from unemployment benefits and other sources of income.

Estimated tax payments may be calculated using the Estimated Payments Calculator. Following that link will take you to details on how to make these payments in whichever method is most practical.

Revenue from Preparation of Quarterly Tax Estimates For the first three months of the year, payments are due on the first, fifteenth, and first of the next calendar year.

Step 3: Make a complete tax payment. When the time comes for you to pay your taxes, you can do it in one lump sum if you require the whole amount of your unemployment benefits for your costs and cannot make quarterly projected payments.

Utilize Taxslayer’s Refund Estimator to determine your approximate tax liability.

Provided you can’t afford to pay your taxes as they are due, the Internal Revenue Service may be willing to waive the penalty if you meet one of the following conditions:

You retired (after reaching age 62) or became disabled during the tax year or in the preceding tax year for which you should have made estimated payments, and the underpayment was due to reasonable cause and not willful neglect; or You failed to make a required payment due to a casualty event, disaster, or other unusual circumstance and it would be inequitable to impose the penalty.

State and local unemployment tax payments

If you owe taxes to your state or local government, you may have a few alternatives for making your payments, depending on where you call home. Contact your state, county, or local unemployment office to learn about tax payment choices. Possible choices are:

Asking that your state and/or city taxes be withheld. The procedures for requesting federal tax withholding differ from those for requesting state and local tax withholding.

Putting forth a certain sum every three months. Unlike federal payments, state and local governments often set their deadlines for expected payments.

Note: Making a complete tax payment. If you expect to use the full amount of your unemployment benefits and cannot make the projected payments required by the IRS, you can make a lump-sum payment to satisfy your tax liability. You may be subject to an underpayment penalty if you do not pay sufficient taxes during the year.

FAQs

1 - When do I expect my unemployment check to arrive?

Suppose you have already filed your tax return and reported unemployment compensation. In that case, the Internal Revenue Service (IRS) may immediately refund you or apply the funds to any outstanding tax liabilities or other debts you owe. Please go to IRS Operations Status for further information.

2 - What counts as “earned money” when you’re out of work?

Self-employment profits are considered earned income as well. Pensions and annuities, government assistance, unemployment pay, worker’s comp, and social security are not considered earned income.

3 - How much taxes do you pay on unemployment in California?

For state income tax reasons, unemployment benefits are excluded. Adjust the Unemployment Insurance Payment Amount in column B of the California Adjustments - Residents (Schedule CA 540) by subtracting the amount shown there. Visit CA Schedule 540 Instructions for further details.

4 - Can I expect to pay taxes on unemployment benefits from the IRS?

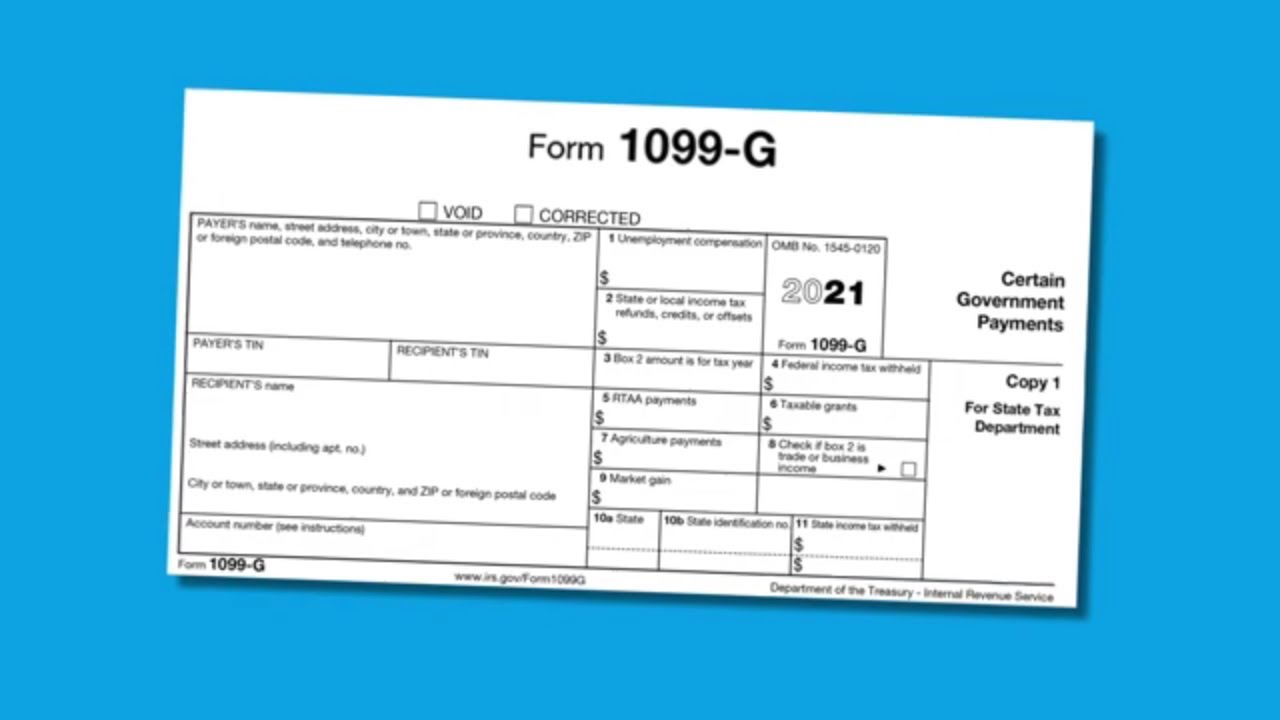

All unemployment benefits are generally taxable in the calendar year they are received. Box 1 of your Form 1099-G should reflect the entire amount of unemployment benefits you received. How to File includes information on free filing choices, including IRS Free File and tax software.

5 - Is there a repercussion if no taxes are taken out of unemployment checks?

Given that the IRS considers unemployment benefits to be taxable income, those who did not have taxes withheld from their unemployment payments in 2021 (or who did not have enough taxes withheld) may owe money to the IRS or receive a lesser tax refund than expected.

Conclusion

There has been a dramatic increase in the number of people applying for unemployment benefits due to the coronavirus epidemic, which has profoundly affected the economy. We recognize your anxiety in exploring uncharted territory, such as applying for unemployment benefits for the first time. Regarding state taxation, it is conditional.

Unemployment benefits are not subject to state taxes in places where individual income taxes are not levied. Unemployment compensation is handled differently by each state that imposes an income tax. The state of Michigan taxes unemployment benefits, whereas the state of California does not.

Related Articles

1. When does the $300 unemployment start