How long will my money last in retirement? It can be feasible to retire at forty five years of age, but it will rely upon a spread of things. If you’ve got $500,000 in financial savings, according to the 4% rule, you may have get entry to to kind of $20,000 for 30 years.

Ways to make your savings remaining longer

A calculator just like the one above may be a useful manual.

-

But it’s hardly the very last word on how far your savings can stretch, mainly if you’re willing to modify your spending to fit a few commonplace retirement withdrawal strategies.

-

Below are some smart policies of thumb on a way to withdraw your retirement financial savings in a way that offers you the pleasant danger of having your cash last as long as you want it to, no matter what the world sends your way.

The four% rule

The four% rule is based on studies via William Been, posted in 1994, that determined that if you invested as a minimum 50% of your cash in shares and the rest in bonds.

You’d have a sturdy chance of being able to withdraw an inflation-adjusted 4% of your nest egg every 12 months for 30 years (and in all likelihood longer, depending on your funding return over that time).

The technique is straightforward:

-

You take out 4% from your financial savings the primary year, and each successive 12 months you’re taking out that equal dollar amount plus an inflation adjustment.

-

Been examined his principle throughout a number of the worst financial markets in U.S.

-

History, along with the Great Depression, and 4% become the safe withdrawal fee.

-

The 4% rule is easy, and the chance of achievement is strong, as long as your retirement financial savings are invested as a minimum 50% in stocks. Here’s a way to approach investing in shares.

Dynamic withdrawals

The 4% rule is pretty inflexible:

-

The amount you withdraw each year is adjusted by way of inflation and not anything else.

-

finance specialists have provide you with some methods to your odds of fulfillment, particularly in case you’re searching out your money to ultimate plenty longer than 30 years.

-

These strategies are referred to as “dynamic withdrawal techniques

-

Generally, all meaning is you alter in reaction to investment returns.

-

Decreasing withdrawals in years when funding returns aren’t as high as predicted, and oh, glad day pulling extra cash out when marketplace returns allow it.

-

There are many dynamic withdrawal strategies, with varying levels of complexity.

-

You might want help from a financial marketing consultant to set one up. (Here’s the way to find the best financial consultant for you.)

The earnings ground method

This method facilitates you hold your savings for the long haul by using making sure you don’t ought to sell shares while the market is down.

Here’s how it works:

Figure out the full greenback amount you need for vital fees, like housing and meals, and ensure you’ve were given the ones expenses included with the aid of assured earnings, together with Social Security, plus a bond ladder or an annuity.

A phrase approximately annuities

-

While a few are overpriced and risky, using the right annuity can be an effective retirement-profits tool you fork over a lump sum in return for guaranteed bills for life.

-

In the right instances, even a opposite mortgage would possibly work to shore up your earnings floor.

-

That manner, you usually realize your fundamentals are covered. Then, permit your invested financial savings be liable for your discretionary expenses.

For instance, you’d settle for a mastication whilst the stock market’s tanking. Which increases the query: Do you still call it a mastication whilst you’re retired?

Not quite equipped to retire?

When you’re on the threshold of retirement, you’re bound to marvel how a ways your existing savings will take you.

But in case you’re nonetheless some years faraway from leaving the group of workers.

The usage of a retirement calculator is a remarkable manner to gauge how modifications to your financial savings price will affect how much you’ll have while you retire.

If you can use help with your monetary plan, see our best economic advisors listing.

Cumulative savings at retirement

Enter how a great deal you have got stored to-date for retirement. Then upload to this variety how much you can realistically save between now and your retirement date.

Finally, upload in any predicted net after-tax greenbacks you assume to receive from the sale of real property, a enterprise, or any item of value at or close to your retirement date.

Do no longer matter expected inheritances or return on investments. Use latest values, now not expected destiny values.

Amount you want to spend yearly in retirement

How lots money you want to spend annually in retirement together with payment of taxes. Use modern day greenbacks.

Subtract from this quantity annual any quantity from Old Age Security (OAS), Canada Pension Plan (CPP), other pensions, or different lifetime income resources.

Be cautious now not to underestimate living [charges and taxes. Doing so could purpose extreme coins-glide shortages in a while.

After tax rate of go back in retirement

This is the once a year rate of return you assume out of your investments after taxes. The real fee of go back is basically dependent on the type of investments you pick out.

For instance, the overall go back which include dividends of the S&P/TSX Composite Index for the ten year period from December 31, 2011 thru December 31, 2021 become 8.9% (source indices. Com).

Savings debts at a bank or credit union can also pay as little as 2% or much less.

It is vital to remember the fact that future fees of return can not be anticipated with certainty and that investments that pay higher costs of return are issue to better hazard and volatility.

The real fee of go back on investments can vary broadly over the years, specifically for lengthy-time period investments.

Summary

This includes the ability lack of important for your investment.When you take periodic distributions from an account or funding, the go back earned is often lower due to more conservative funding picks to help insure a regular go with the flow of earnings.

Expected inflation price

What you expect for the average long-time period inflation charge. This calculator increases your distribution quantity on the quit of each year by using the charge of inflation.

This starts devolved at quit of the primary 12 months of distributions. This allows illustrate the price of presenting a modern-day amount of buying strength throughout your distributions.

Amount of retirement

This is the extra quantity you may add for your retirement savings. Enter a negative quantity if that is a reduction or withdrawal on your retirement financial savings.

All deposits and/or withdrawals are assumed to occur at the beginning of the yr.

- Year to start

- First year of the extra amount.

- Year to give up

Last yr of the extra amount. If this is the same as the first yr, it’s going to impact your account as soon as.

Otherwise we anticipate that the additional amount is an annual deposit (or if poor a withdrawal).

You’ve spent your working lifestyles saving for retirement. Now it’s time to spend a number of that money. But how a whole lot? After all, you don’t want to outlive your retirement savings.

It’s safe to say we spend a lot extra time figuring out how we’re going to keep for retirement, than how we’re going to withdraw the ones savings. Here are a few tips which can assist.

The 4% rule

In the Nineteen Nineties, monetary planner William Been used historical facts to decide that, most often of thumb.

For the general public, taking flight four% in their retirement nest-egg every yr could permit them to enjoy a regular income for 25 to 30 years.

However, there are a few matters to consider about the 4% rule:

-

You’ll nevertheless have to pay income taxes from this annual amount.

-

You might also need to alter for the annual inflation rate (how a whole lot items and offerings growth in price every 12 months)

-

It doesn’t don’t forget investment returns for your closing retirement financial savings

-

For many people, the 4% rule might be greater like a tenet. Some years they will withdraw greater, some years much less, depending on their plans and lifestyle.

Estimating your own retirement profits desires

It’s difficult to calculate precisely how long your cash will final in retirement. However, you may estimate the use of those steps:

-

Add up all your retirement savings including registered retirement financial savings plans (Rasps), tax-unfastened financial savings debts (TFSAs) and non-registered debts.

-

Your retirement financial savings may also include the sale of a business. Divide your savings with the aid of the range of years you anticipate to live in retirement to get an envisioned annual income quantity from your savings.

-

Add up all of your assets of month-to-month retirement profits from organist pension plans, authorities advantages along with Canada Pension Plan (CPP) or Quebec Pension Plan (QPP), Old Age Security and Guaranteed Income Supplement (GIS). Multiply this amount with the aid of 12 to get an annual quantity.

-

Add the two annual amounts together from steps 1 and a pair of to get your approximate annual retirement income quantity.

-

Next, upload up all of your annual expenses in retirement. Include loan, car or lease payments, fitness care fees, food, insurance, utilities, gifts, journey, and so forth. And be sure to treat yourself on occasion.

-

Compare your annual retirement profits together with your annual prices. If your annual profits is better than your annual fees, you’re in appropriate form. If not, you could need to lessen your fees or do not forget operating longer and saving more.

Remember, this estimate doesn’t recall a person residing off dividends or a comparable constant income stream.

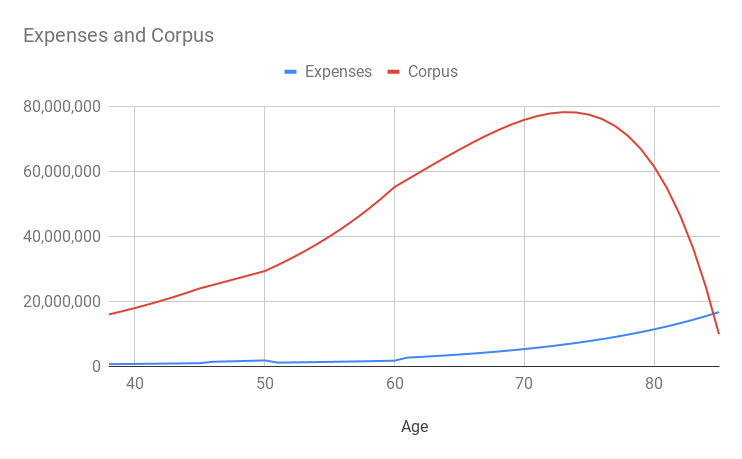

This chart presents some examples and indicates the significance of maintaining your retirement financial savings invested.

The duration of your retirement subjects

While the common Canadian retires at age sixty three.Five according to Stats Canada, a few people pick to work longer.

If you continue to work till you’re 70, that’s 6.5 fewer years of retirement you need to keep for, or more money you can spend yearly during retirement.

That said, in case you need to retire at age 60 or even 55, you could need to plan for 35 years of retirement or more.

That may mean you need to store greater for retirement or spend extra frugally.

Retirement Advantages

Now which you realize more about how lengthy your money can also remaining in retirement, you may need to contact your guide to:

-

Create a retirement spending plan to calculate your expenses

-

Determine how a great deal retirement income you may anticipate from the authorities

-

Calculate your total retirement financial savings

-

Learn about alternatives for drawing an earnings out of your retirement savings which could help you not outlive your money

A sustainable withdrawal rate

The sustainable withdrawal fee is the envisioned percentage of savings you’re able to withdraw every yr during retirement with out jogging out of money.

We did the mathematics looking at history and simulating many capability effects and landed on this:

-

For a high diploma of self assurance that you may cover a regular amount of fees in retirement (i.E., it should work 90% of the time).

-

Aim to withdraw no greater than 4% to 5% of your financial savings inside the first 12 months of retirement, after which adjust the amount every 12 months for inflation.

-

Of course, your state of affairs can be exceptional. For example, you may want to withdraw more inside the early years of retirement whilst you plan to travel drastically, and less in the later years.

-

But this 4%-to-5% estimate gives a on hand guiding principle for making plans.

-

Let’s have a look at a hypothetical instance. John retires at age 67 with $500,000 in retirement money owed.

-

He comes to a decision to withdraw 4%, or $20,000, every year for fees.

-

Since John plans on chickening out an equivalent inflation-adjusted quantity from savings at some stage in his retirement, this $20,000 serves as his baseline for the years in advance.

-

Each year, he increases that amount through the rate of inflationirrespective of what takes place to the market and the price of his investments.

A appearance lower back at records

Of route, your actual sustainable withdrawal fee will vary based on many things, including some you can not manipulate like how lengthy you live, inflation.

The long-time period danger and go back of the markets and others over which you may have some manipulate like your retirement age and the investments you choose.

History indicates that the winning marketplace surroundings on the time of your retirement can be specially essential:

-

As a susceptible market early in retirement can extensively lessen your nest egg, specially in case you don’t dial down your withdrawals with the declining markets.

-

On the other hand, a robust inventory market early in retirement can placed the wind at your again financially speak for decades.

-

Unfortunately, it’s impossible to understand what the stock marketplace can be like whilst you retire.

-

That’s one cause Fidelity indicates the usage of assured profits sources for critical fees in retirement.

-

That way your requirements are taken care of, irrespective of what the marketplace does.

-

Consider the chart under, which illustrates a ancient examine how a great deal an investor may want to have withdrawn from savings with out strolling out of cash over a 28-12 months retirement, depending on the date of retirement.

-

As you can see, actual sustainable withdrawal fees numerous extensively,2 from simply under 10% in case you retired in 1982.

-

At the beginning of a roaring bull marketplace, versus greater than 4% if you retired in 1937, throughout the Great Depression.

-

This analysis is based on a 90% hazard that the portfolio might not run out of money within a given retirement horizon.

-

The ninety% self assurance stage displays the “robust plan” framework utilized in Fidelity’s retirement planning tools.

-

Of course, four% to five% is only a starting point.

-

Our studies and the interactive device below show how things you could manage like your retirement age and funding mix can play a position in identifying the proper wide variety for you.

Take your timeline into consideration

One of the most important factors that impacts how tons you could withdraw is what number of years of retirement you propose to fund from your retirement financial savings.

Say you propose on a retirement of 30 years, you put money into a balanced portfolio, and want a excessive stage of confidence that you might not run out of money.

Now here describe some points such as:

-

Our studies shows that a 4.5% withdrawal charge would had been sustainable ninety% of the time (see graph under).

-

But in case you paintings longer say you expect to retire at age 70 or if you have fitness troubles that compromise your life expectancy, you can want to plot on a shorter retirement duration say, 25 years.

-

The historical evaluation suggests that, over a 25-year retirement duration, a 4.Nine% withdrawal price has worked 90% of the time.

-

On the opposite hand, in case you are retiring at age 60 or have a own family records of longevity, you could need to plan for a 35-yr retirement.

-

In that case, four.3% turned into the maximum you can withdraw for a plan that worked in 90% of the ancient intervals.

-

These may also sound like small differences, but they could equate to heaps of bucks in annual retirement profits.

-

The precise news is that even with the marketplace’s historical united state sand downs, these withdrawal amounts labored maximum of the time assuming that traders caught to this balanced funding plan.

-

The takeaway from this analysis is that the longer your retirement lasts, the lower the sustainable withdrawal fee.

How you invest may be critical too

The mix of investments you pick out is some other key to how a great deal you could withdraw with out jogging out of money.

Portfolios with extra stocks have historically provided more over the long term however have additionally experienced larger fee swings.

Another vital issue in determining the right asset blend for you:

-

The diploma of self belief you need that your cash will ultimate your lifetime.

-

As the chart beneath illustrates, in approximately half of the hypothetical scenarios we examined, a increase portfolio (70% shares, 25% bonds, and 5% cash).

-

Might have allowed you to withdraw greater than 7% every 12 months over 25 years of retirement over 25% more than a conservative portfolio (20% stocks, 50% bonds, and 30% coins) with a sustainable withdrawal charge of 5.7%.4

-

If you want a much better diploma of self assurance, the evaluation suggests that increasing equity publicity doesn’t enhance the sustainable withdrawal charge, and in fact becomes counterproductive.

-

At a ninety% self assurance degree, the sustainable withdrawal charge for the conservative portfolio is four.8%, as opposed to 4.5% for the portfolio.

-

For a ninety nine% self belief, the analysis shows you can withdraw 4.1% from the conservative portfolio, versus handiest 3% from the portfolio.

Summary

In the Nineteen Nineties, monetary planner William Been used historical facts to decide that, most often of thumb, for the general public, taking flight four% in their retirement nest-egg every yr could permit them to enjoy a regular income for 25 to 30 years.

Frequently Asked Questions

How lengthy does $500000 ultimate in retirement?

How lengthy does $500000 ultimate in retirement?

It may be feasible to retire at 45 years of age, but it will depend upon a ramification of factors. If you have $500,000 in financial savings, according to the four% rule, you may have get admission to to roughly $20,000 for 30 years.

Is $1 million enough for a secure retirement?

Is $1 million enough for a secure retirement?

No, count number how you slice it, it truly is quite a few cash! For a long term, a $1 million nest egg become the degree of retirement making plans success. It became taken into consideration enough to enjoy a dream retirement and depart an impressive legacy behind.

Can I retire with 600000?

Can I retire with 600000?

You can retire readily on a sum like $600,000 in case you take the right steps (and do not confuse “relaxed” with “costly”). With the proper monetary selections, a $six hundred,000 nest egg is probably enough for an correctly funded retirement with out depleting your financial savings at a risky fee.

What is a good monthly retirement income?

What is a good monthly retirement income?

In widespread, unmarried people depend more heavily on Social Security assessments than do married humans. In 2021, the average monthly retirement earnings from Social Security turned into $1,543. In 2022, the common monthly retirement earnings from Social Security is expected to be $1,657.

Can I retire at sixty two with 400k?

Can I retire at sixty two with 400k?

Yes, you may retire at 62 with four hundred thousand bucks. At age sixty two, an annuity will provide a guaranteed degree profits of $21,000 annually beginning at once, for the rest of the insured’s lifetime.

How a lot money do you need to retire with $one hundred thousand a yr income?

How a lot money do you need to retire with $one hundred thousand a yr income?

With that during thoughts, you ought to anticipate to want about 80% of your pre-eminent earnings to cowl your fee of dwelling in retirement. In other phrases, if you make $100,000 now, you’ll need about $80,000 according to 12 months (in modern-day dollars) when you retire, in keeping with this principle.

How long will million bucks remaining in retirement?

How long will million bucks remaining in retirement?

A latest examine decided that a $1 million retirement nest egg will last approximately 19 years on average. Based in this, in case you retire at age sixty five and stay till you switch 84, $1 million may be sufficient retirement financial savings for you. However, this average varies substantially based totally on a number of different factors.

How lengthy will 2m ultimate in retirement?

How lengthy will 2m ultimate in retirement?

Yes, you may retire at 45 with 2 million bucks. At age forty five, an immediate annuity will offer a assured degree earnings of $seventy three,259.04 annually for a existence-only payout, $seventy three,half.Eighty yearly for a lifestyles with a 10-year period positive payout, and $seventy two,345.Forty eight annually for a life with a 20-12 months period certain payout.

Will Social Security run out?

Will Social Security run out?

Current workers will still receive Social Security benefits after the trust fund’s reserves grow to be depleted in 2034, however it is feasible that future retirees will simplest get hold of seventy eight% of their complete blessings unless Congress acts.

How plenty does average character have at retirement?

How plenty does average character have at retirement?

According to this survey through the American Center for Retirement Studies, the median retirement savings by age inside the U.S. Is: Americans of their 20s: $16,000. Americans of their 30s: $forty five,000. Americans in their 40s: $sixty three,000.

Conclusion

At the end of this article hopefully you will like reading this article. This is our great research on this topic. If you will like reading this this article please share this articles to all your friends and others.